Subscribe to AGB - One analysis of a good business in each issue.

Alimentation Couche-Tard

Here is a quick recap of Couche-Tard’s business. You can read the initial write-up for a full overview of the business.

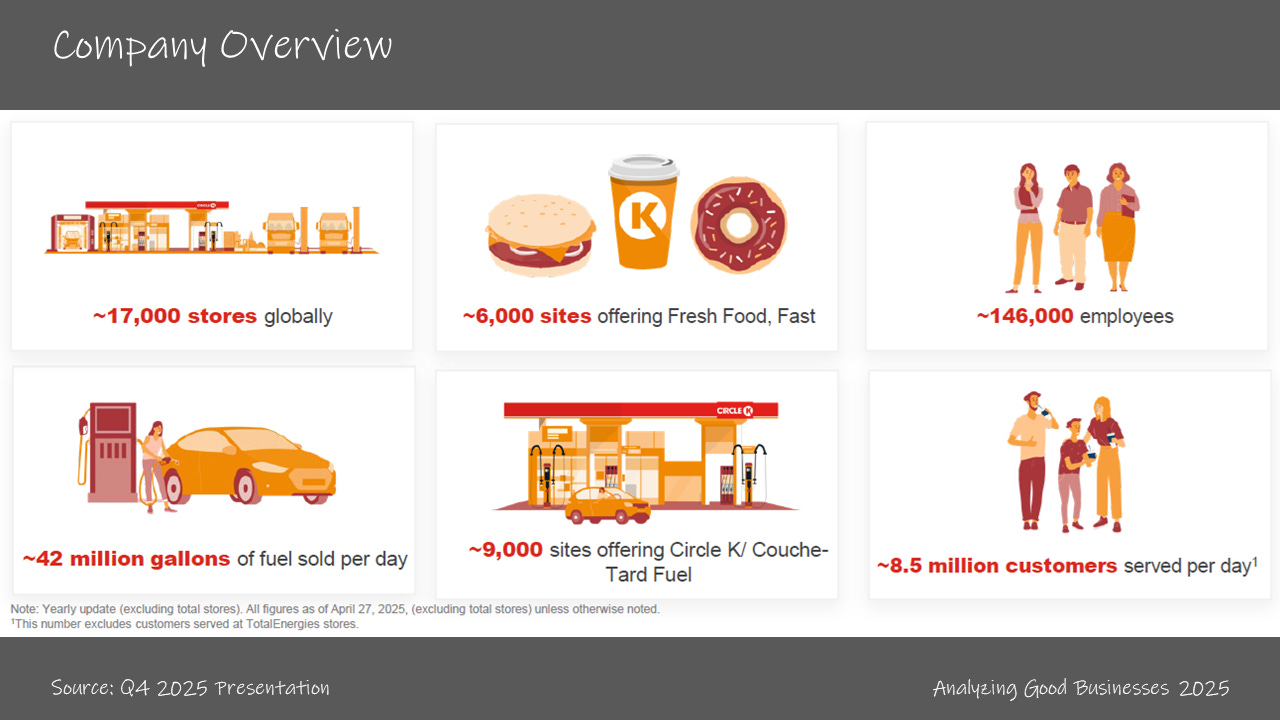

Couche-Tard is one the largest global convenience store operators (top 5 globally and #2 in the U.S. in 2024) with almost 17k total locations, of which 7k+ is in the U.S. The company services 8.5M customers daily and has 10M customers enrolled in their Inner Circle membership program. Couche-Tard offers prepared food at 6k stores and offers Circle K branded fuel at 9k locations. The company also operates car washes at 3.5k of its locations.

Couche-Tard has historically been very active in M&A, acquiring both large and small c-store operations around the world. Some of the more notable acquisitions are Total Energies (2023), CST Brands (2017), Holiday (2017), Pantry (2015) and and Statoil Fuel (2012). The company made an offer to acquire Seven & i Holdings (the owners of 7-Eleven an…