AGB 2025.4 - Badger Meter (BMI)

Software Growth on top of Hardware Base

Subscribe to AGB - One analysis of a good business in each issue.

Badger Meter

Badger Meter is the leading provider of water management solutions for municipalities, utilities and commercial customers. The company’s primary product offerings are water meters, which is used to measure the flow the water, so that the municipalities know how much to charge their customers for water usage. Badger Meter has also recently acquired other products that handle quality monitoring, pressure measurement and leak detection. The company reported $827M in revenues and $190M in EBITDA for 2024.

Badger Meter’s business model is a relatively simple one. The company sources key materials, produces metering and other water management equipment and sells them through its own salesforce and distribution partners (the company relies on distribution partners more for certain product lines than others). Badger Meter’s customer base is very sticky as most municipalities like to standardize its water metering technology on one company’s products. As long as these metering products provide a certain level of accuracy and reliability, there is little incentive for change. Badger Meter (and others in the industry) provide up to 20 year warranties on their products.

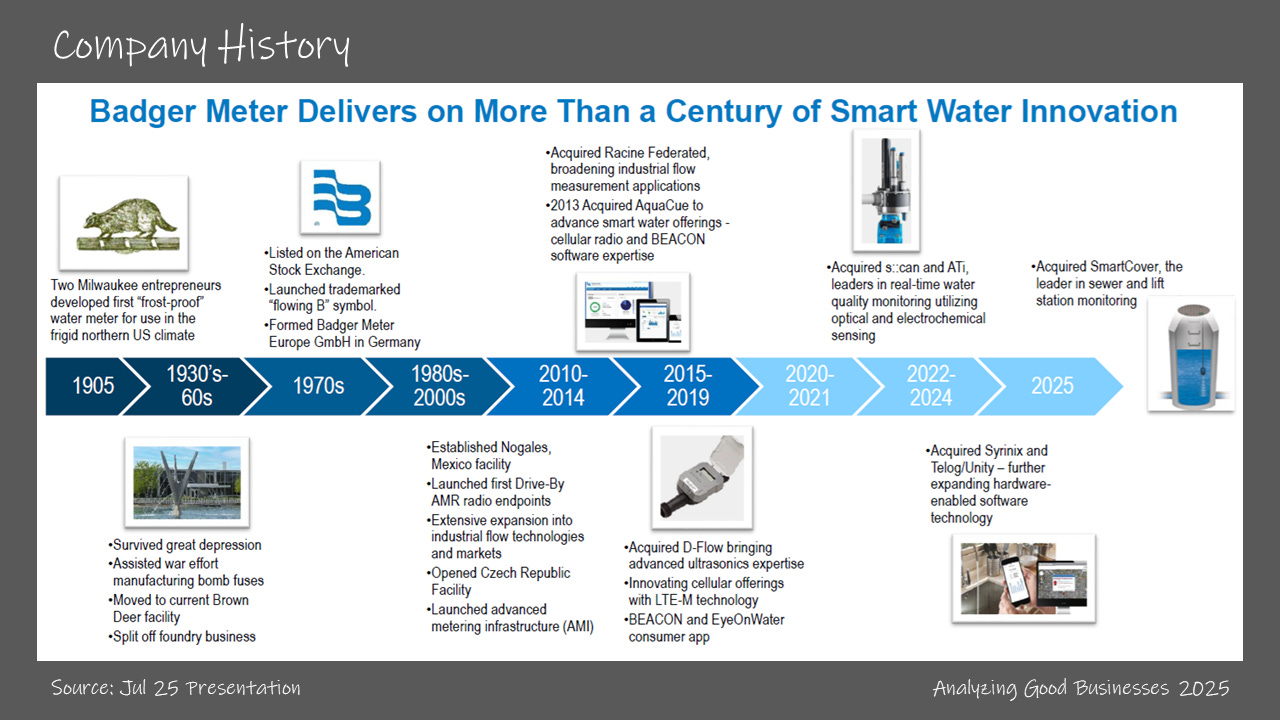

As a leader in the industry, Badger Meter has a long history of innovation, incrementally improving its offerings for its customers over time. The company pioneered many of the metering advancements in the industry including frost proof meters, rotary multi-jet meters, and ultra sonic meters to name a few. Incremental innovations tend to lead to replacement cycles, but given that most of the company’s customers are municipalities, replacement rates are low.

Two of the recent innovations that are currently acting as tailwinds for Badger Meter are the ultrasonic meter and radio technology that allows remote reading. The benefits of the ultrasonic meter (vs. the mechanical meter) is that the high level of accuracy lasts much longer since there are no moving parts. Typically, mechanical meters fail over time and under report water usage, leading to customers to lose out on revenues. The EPA estimates that mechanical meters can fail to report up to 15% of water usage over time. And while the initial cost of the ultrasonic meter is higher than mechanical, they make up for it on the back-end with better measurement. Warranties tend to be longer on ultrasonic meters vs. mechanical meters for this reason.

To make a point on how slow these cycles are, while Badger Meter has been selling ultrasonic meters for over 15+ years the company still mainly sell mechanical meters. At the Morgan Stanley conference in September 2021, CEO Kenneth Bockhorst discusses the slow-moving, risk averse nature of its customer base:

“So, we were the first to bring the ultrasonic static meter to our market roughly 13 years ago. And so, for us, we are more than happy to consult with our customers and sell them the solution that's best for them where some of our competitors consult with our customers and sell them the only offer that they have. So, for us, having that approach and selling the customers the best for their solution, even today after 13 years, 80% of our unit volume is still mechanical and 20% of that being ultrasonic. Now, a common question is where do you see that going in the future in terms of adoption? Well, let's break it into two parts. On the residential side where there's lower flow in all the different homes which is the primary amount of our volume, the best case scenario for adoption will probably be roughly about a 50/50 split over a long period of time, 10 years again. It took us 13 years to get to 20%. I would suspect it's going to take quite a while still to get to 50/50.”

For radio technology, the penetration rate is higher since (1) the process involves adding a communications device to an existing meter, instead of rip and replace and (2) AMR technology (discussed below) has been around since the late 1970s. The payback period for radio technology is even shorter for customers with the immediate reduction in required labor to manually read each meter. CFO Robert Wrocklage discusses the 75% penetration rate of smart meters in the U.S. at the Gabelli Pump Valve & Water Systems Symposium in February 2025.

“So we've been at the smart meter game, whether it was drive by [AMR] and then now AMI for call it 40 years. And so after 40 years of hard work in the North American market, about 75% of metered connections have some form of radio communication on it. And in large part, about half of those are AMI… So there's still 25% or roughly 25 million connections in North America that are manually read.”

As mentioned in the quote above, radio enabled meters can be separated into two groups, AMR (Automated Meter Reading) and AMI (Advanced Meter Infrastructure). AMR involves a truck that drives by to collect metering data for radio enabled endpoints. AMI doesn’t require this type of data collection (it’s fully remote) and provides customers with more frequent and additional data points. AMI technology allows municipalities to support time-based pricing, educate customers with real-time consumption data and even turn water service on and off.

Specially for Badger Meter, AMI adoption has a positive impact to the company’s financials due to the attachment rate for its s BEACON software. This software has a 100% attach rate to AMI enabled meters that the company sells, since customers can’t get the billing reads from the meter without it. Badger Meter sells its BEACON software in a subscription model, which is margin accretive, comes with better cash flows and has an extremely low churn rate. The AMI enabled meters are set to operate over 10+ years and the customer can’t cancel the software subscription if they want to continue to get reads on the meter.

Badger Meter’s SaaS revenues have grown from $16M in 2019 to over $54M in 2024 or a CAGR of +27.5%. This outpaced growth has meant that SaaS revenues went from just under 4% of total revenues to almost 10% by Q2 2025. This has contributed to the company’s margin improvement in recent years.

With respect to the radio technology itself, Badger Meter uses cellular radios that leverage existing networks to ensure quick deployment and reliability. In contrast, other providers (like Xylem) have opted to go with fixed networks, which establishes a direct connection with the end point devices through a proprietary network. The drawback to the cellular solution tends to be higher recurring costs due to reliance on cellular service, but the benefits of quicker deployment and lower complexity usually outweigh the costs.

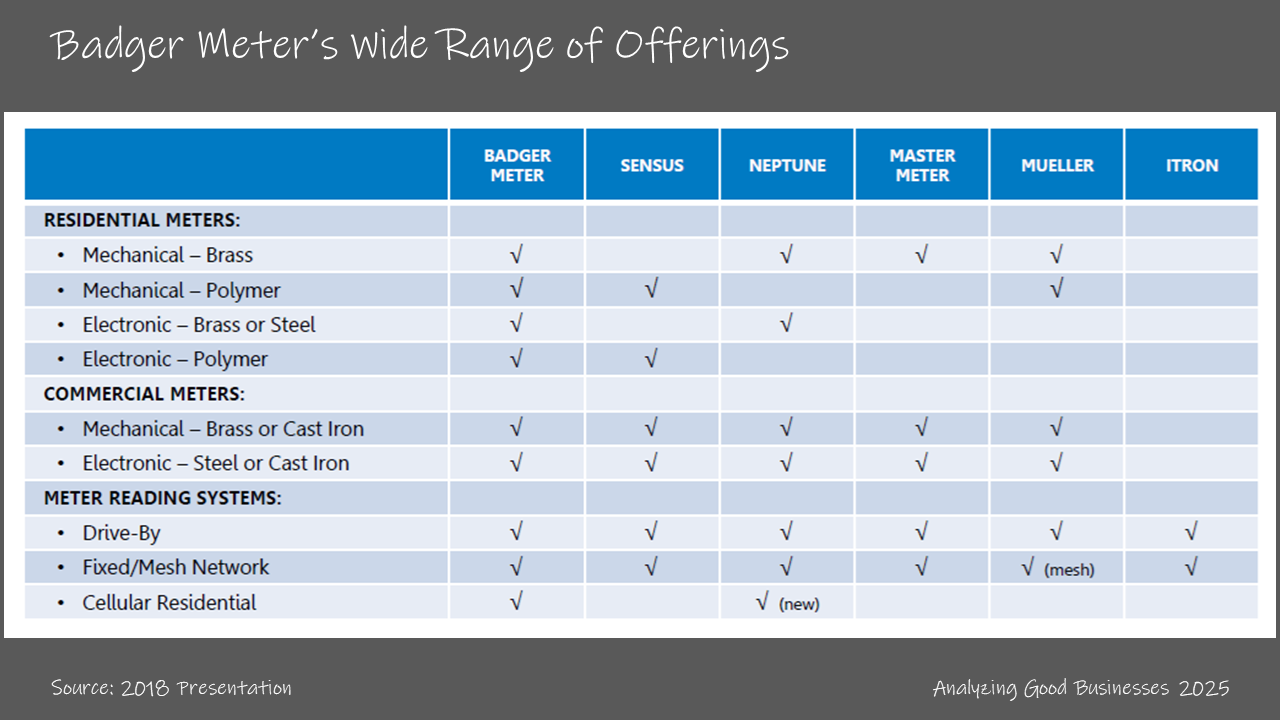

Badger Meter’s advantage when competing for RFPs is its innovative solutions, breadth of product lines and its direct salesforce. The company calls this concept “Choice Matters” when attributing the high win-rates to its broad portfolio of solutions. Badger Meter competes against the other large water meter providers like Xylem (owns Sensus) and Neptune (owned by Roper). These three companies command somewhere in the range of 80%-90% of the water meter market. And because their customer base is so slow to act, the market shares are relatively consistent, even though Badger Meter has been taking some share in recent years. Here is CEO Kenneth Bockhorst discussing how difficult it would be for new entrants to take significant share.

“So having said that the differences and why we still feel very good about our competitive position in the US is, you start first with the oligopoly of three really strong players who've existed for over 100 years in us, Neptune and Sensus. You have very risk-averse, slow moving, sticky customers that you've held for decades and decades. They don't just leave, especially to go to a new entrant with a new technology that they haven't dealt with before. The ability to build a channel through 50,000 utilities that have all those aspects I just talked about. The fact that we've been on the innovator and on the front side, we feel very strong and frankly, in a pandemic, generally I think if you check the history, the strong only gets stronger, so I can't imagine those smaller people trying to come in here with only a partial product line without a channel.”

Historically, the company has estimated that its incremental margins are in the 20%-25% range assuming that gross margins are steady in the 38%-40% range. However in recent years, incremental margins have inched higher towards 30%. And we can see that EBITDA has been increasing from the low 20%s to 23% in 2024. Higher mix of SaaS revenues, pricing actions the company has taken in recent years due to cost inflation coming out of Covid and better management of input costs have contributed to this recent uptick.