This is the 3rd AGB write-up of 2025. Ecolab was tricky because there are many buzzwords and generalizations that are used to describe the company, but ultimately I think we did a decent job distilling what’s important about the business. Ecolab should be a beneficiary with the rising need for fresh water, given the investments into data centers and fabs around the world. And pricing power + growth in digital should continue to lead to margin improvement.

As with all new write-ups, the financial model is attached at the end of this post. Feel free to change your assumptions and inputs to get your own estimate of fair value.

The Update write-ups on TransDigm and HEICO are still in the pipeline. I may write-up another water related company before that. Stay tuned.

Thank you for your support!

Ecolab

Ecolab is the leading provider of chemical equipment and solutions for 40 different end markets and industries. The company’s products ensure food safety, are critical for sanitization, prevent infections and optimize water use for its customers. Ecolab services over 3M customer locations in over 170 countries in key markets like Food Service, Hospitality, Healthcare, Pest Control, Data Centers, Dairy, Food & Beverage, Refineries, Paper and others.

Customers typically sign multi-year contracts with Ecolab where they receive the hardware at minimal cost but are required to use the company’s consumables. Included in the contract are minimum usage amounts that the customer draws against over time. Effectively Ecolab’s business is 90%-95% recurring revenues due to this razor/razor blade revenue model, with the remaining 5%-10% in service contracts and hardware. The company has a team of over 25k experts within the various end-markets that work with customers to analyze how they run operations. These experts then recommend a set of solutions that help customers operate more efficiently.

After winning new customers, Ecolab typically gains responsibility for more of their processes over time. As an example with a hotel customer, the company usually starts with the dish machine in the restaurant and later expands to laundry service. Then after working with housekeeping for some time, the customer will select Ecolab to manage the AC sanitation, water management, pest elimination and eventually the overall food safety program at the hotel.

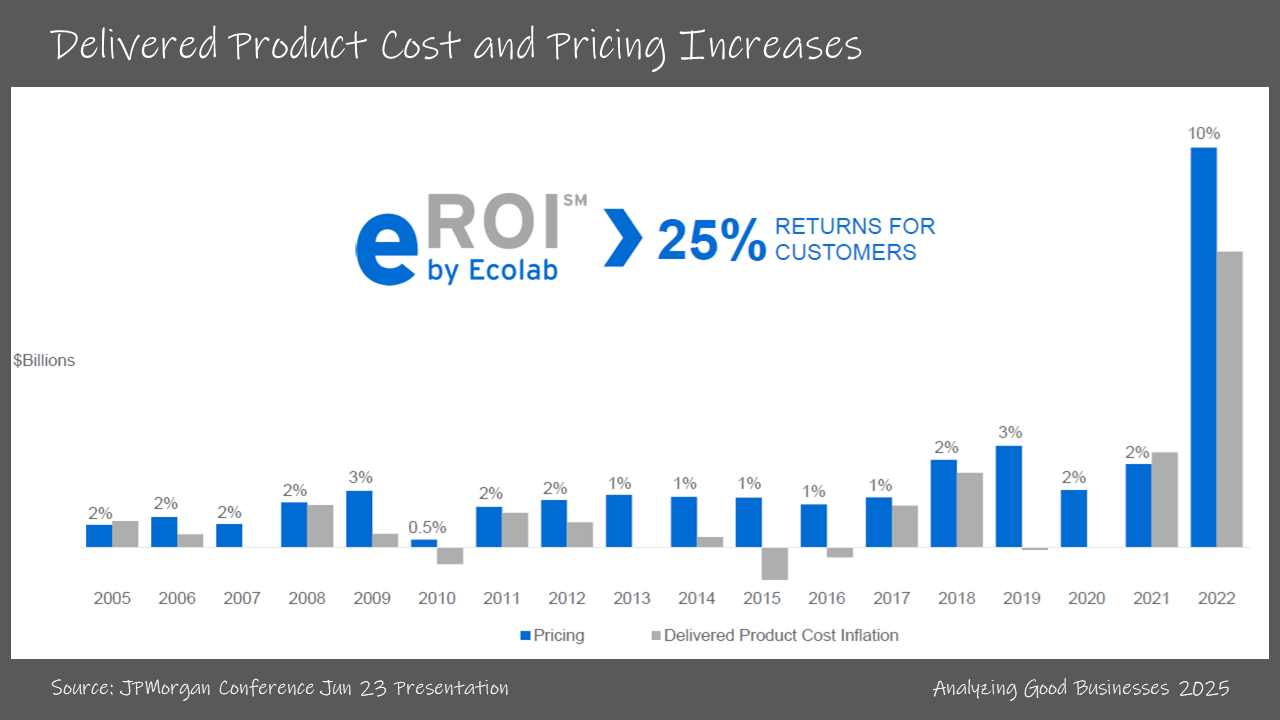

For customers, it’s not only the ease of use and the ability to outsource these needs to Ecolab that makes it worthwhile. The company also provides energy conservation and operational cost savings that are measurable. Ecolab calls this measurement eROI and aims to deliver at least 25% to its customers. Over the past 20 years, the company has been able to achieve this for customers while also raising prices above the cost of inflation, indicating the value that the company delivers. Here is CEO Christophe Beck explaining how Ecolab arrives at eROI for customers at the JPMorgan Conference in March 2025:

“The way we measure as well the value we're generating for our customers is called total value delivered, and it's in three pillars. It depends, obviously, on the industry that we're serving, but it's always, first, a business outcome. It can be an uptime in a data center. Second, it's the operational cost performance per hour, per data, per burger, whatever that is. And third is the environmental impact in water, energy, waste, especially that you can see on our website. Because it's in real time, that we know those numbers and we make sure that we always have the alignment with the customer that what we've saved is really aligned between the two parties. And we agree where do we want to go, and we get the share out of that value that we are delivering to our customers in value pricing, which is why pricing is a strong part of our top line proposition as a company.”

For Wyndham Hotels specifically, Ecolab helped conserve 160M gallons of water in 2020 and achieve $10M in operational cost savings due to energy savings. The laundry program resulted in fewer wash steps and better performance at lower temperatures. On a per hotel basis, Wyndham was able to save 600k gallons of water and 200kwH of energy from the laundry program. The company was also able to save 300k gallons of water and 200kwH from Ecolab’s dish machines.

While the company has a favorable position with its customers given its revenue model, there is still a fair amount of innovation required to maintain these contracts when they’re up for renewal. Ecolab spends ~$200M each year on R&D to make improvements to their product suite.

In 2025, Ecolab’s innovation pipeline is estimated to be $1.7B in revenues vs. $15.7B in total revenues in 2024. Cumulatively, this should be 2.5x-3x that amount or $4.25B -$5.1B in incremental revenues over the next 5 years, or 27%-32% of 2024 revenues. Historically, the company’s innovation pipeline has grown 2x the rate of organic revenues, which implies that newer products gain adoption at a high rate and are likely more impactful and efficient that existing products. Here is CEO Christophe Beck talking about this on the Q3 2024 earnings call:

“And the cannibalization, we don't really disclose that number, but it's a very high, especially on the innovation side, and most importantly, all new products and offering coming in the market are incremental at margins. And this is the number one objective that we have.”

The company has an internal KPI called the vitality index, which is the % of revenues of revenues that have come from products that have launched in the past 5 years. In 2024, the company’s vitality index was 30%.

Ecolab’s segments are Water (49% of Q1 2025 revenues), Institutional & Specialty (40%), Pest Elimination (7%) and Life Sciences (4%). The company’s segments were adjusted in early 2025, moving Pest Elimination to a stand alone business segment and part of Healthcare into Specialty. The two segments that really move the needle are Water and Institutional, which is mostly Food Service and Hospitality.

In the Water segment, Ecolab provides treatment products and programs for managing water usage, performing cooling and purifying wastewater. Two of the fastest growing industries within the Water segment are data centers and microelectronics. For the data center market, Ecolab helps with water management, cooling and humidification. A single data center can use as much water as 50k people. In 2023, the data center segment within Water grew north of +30%. And for the microelectronics market, purity of water is necessary for production and yields. Certain processes are water intensive and many of these fabs are better off purifying and reusing the water with the help of Ecolab. Ecolab has sized these markets to be a $5B+ opportunity for the company by 2030.

In the Institutional & Specialty segment, Ecolab provides cleaning and sanitizing programs for the various service industries. Food Service and Hospitality are the large verticals within this segment. The company aims to keep the cleaning process as efficient and effective as possible, resulting in cost savings for its customers. Large customers that have contractual agreements with Ecolab in this segment include Marriott, Wyndham Hotels, McDonald’s, Burger King, Wendy’s, Shake Shack, etc.

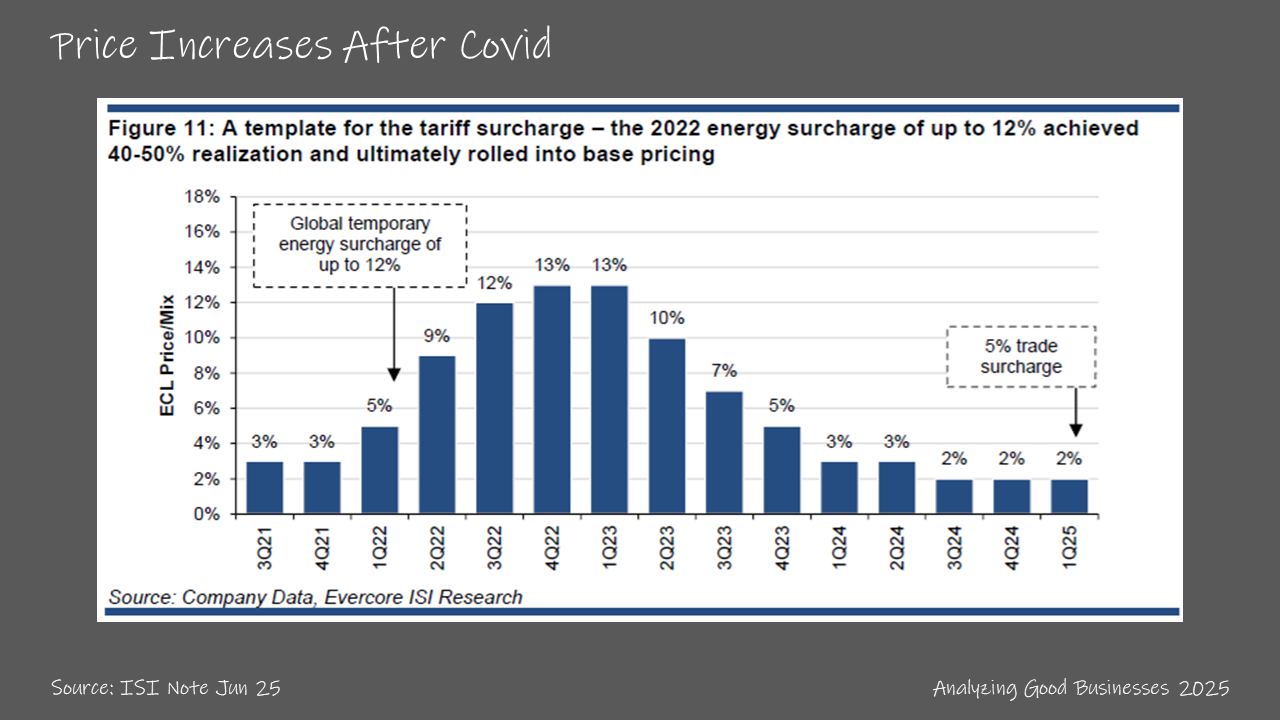

Over the past 5 years, the biggest impact to the business has been the inflationary environment coming out of Covid. Similar to other chemical companies, Ecolab has experienced significant cost pressure in raw materials. Over 75% of the inflation pressure in 2021 was in the Industrial segment. Starting in 2022, the company elected to institute a company-wide surcharge related to the spike in energy costs, which was placed on top of any pricing related to other cost increases. The surcharge range was between 8%-12%, depending on the price of oil.

Typically during an inflationary environment, it takes Ecolab about two years to recover on margins because pricing takes time to get implemented across the company, depending on contract terms within the various segments. But with the energy surcharge, price increases were almost immediate. In 2022, pricing increased +10% and almost +9% in 2023. With energy prices coming back down in 2024, the surcharge was removed and pricing went back closer to the normal range at +2.5% in 2024. This is still above the company’s 1%-1.5% range for the prior 10 years before the Covid inflationary period.

The interesting aspect of pricing for Ecolab is that (similar to other companies where the price elasticity is very low), even when energy prices went down, the company didn’t have to give any of that back. In the company’s long history, there really hasn’t been a period where pricing has reversed. Here is CEO Christophe Beck explaining the company’s pricing history on the Q3 2021 earnings call:

“But generally, if you look at just the last 10 years, Ecolab never went backwards in pricing. You have years with higher pricing and some with lower pricing and in average you get to 1%-plus, something like that, which is a good indication of the fact that pricing is something that we hold going forward. And why that is, because we always link the pricing that we're asking with the value that we're creating for our customers, how much dollar value we've helped them create by reducing the usage of natural resources, their improved productivity, reduced waste and so on. That doesn't go away when the raw materials go down ultimately, which is on one hand the reason why pricing is always going to go up and second, that the margins ultimately for the company gets better because you get lower input costs for a price that keeps going up as well. And last point is innovation as well, which is always brought in the market with higher margin. That helps as well improving the leverage in a much more natural way.”

Ecolab estimates that the company generated $2-$3B in revenue from pricing from 2022-2023, but also saved its customers by more than double that amount during the period. And given that pricing was strong and the company more than delivered on its eROI targets, Ecolab has changed its stance on the +1%-1.5% annual pricing range, increasing it to +2%-3% going forward. The company does need to be careful with raising prices too much (as seen with other companies that have price inelastic products), because there is always the risk of backlash from customers and/or regulators that feel like the company is taking advantage of customers. So far retention rates have remained steady, so Ecolab has been doing a good job flexing its value but not to the detriment of future business.

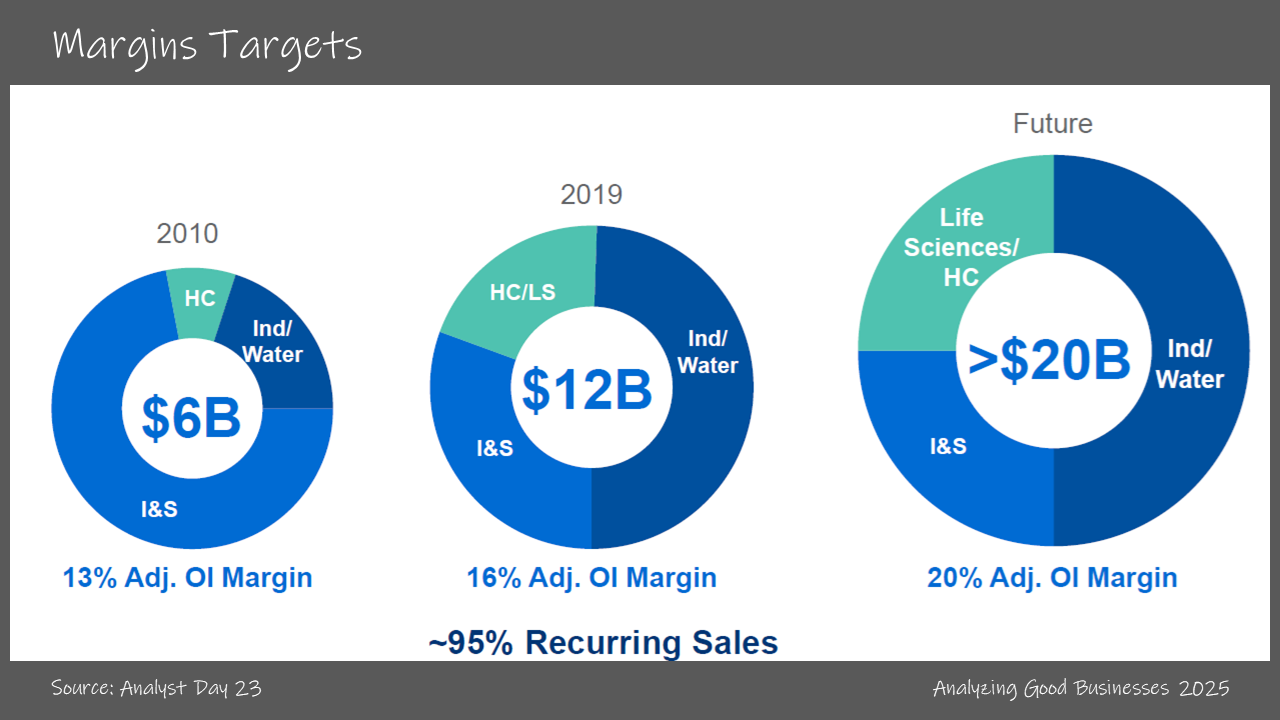

With pricing holding up and the pipeline of innovation coming down the pike, the company is estimating that it will reach 20% operating margins in the near future. To help reach that target, Ecolab has also instituted cost savings programs, particularly on the SG&A expense line. Ecolab targeted $120M in savings in 2021 and another $140M in 2024 as part of the restructuring related to its One Ecolab initiative.