This is the second issue of AGB in 2025. Sticking to our theme of travel stocks, this write-up is on Booking Holdings. It may be easy to make assumptions about the future of the OTA industry due to the recent advancements in AI because almost everyone has used an OTA for trip planning. But Booking’s business model may be more resilient to potential changes to consumer behavior due to the company’s strength across both its supply and demand sides of its networks. And the recent data suggest that Booking’s position is improving over time.

The financial model attached at the last section of the write-up includes a lot of this data in the Segments tab.

The next post will be an update on Alimentation Couche-Tard (initial write-up here), which will likely be published towards the end of this month. Thanks for reading and supporting this publication!

Booking Holdings

“Winning a traveler's business is never easy because of the high level of competition in our industry. But we are pleased to see that by providing a better way to do it, less friction, better value, a broader selection and great customer service, we are building a customer base that is more likely to choose us.” - CEO Glenn Fogel on the Q1 2024 earnings call.

Booking Holdings is the leading online travel agency (OTA) with over 1.1B room nights, 83M rental car days and 49M airline tickets transacted through their various travel platforms in 2024. The company started off as a Priceline.com in 1997 mainly offering customers a way to purchase airline tickets online. Throughout its early history, Priceline was known for its “name your own price” feature, which matched customer bids to unsold inventory for their airline, hotel and rental car partners. Priceline eventually removed this feature in the late 2010s, as customer behavior changed and partners were less willing to offer this type of inventory. The company would later acquire Booking in 2005, Agoda in 2007, Kayak in 2013 and OpenTable in 2014. Because most of Booking’s revenues and operating profits were from Booking.com, the company changed its name to Booking Holdings in 2018.

Through its online travel marketplaces, Booking.com, Priceline.com and Agoda.com, the company offers customers accommodation, flight, ground transportation, cruise and activity inventory from their travel partners. Booking gets a percentage of the payment from the travel partner and the take rate varies depend on the type of booking. Customers typically transact directly on the platform, oftentimes completing the payment in advance and other times reserving a booking with the service provider. The company partners with most major airlines (although Southwest is a notable example of not using Booking) and offers over 31M accommodation listings (23M traditional hotels and 8.1M alternative accommodations) across its travel sites.

Booking also generates advertising revenues from its other two travel sites, Kayak and OpenTable. Kayak allows customers to search across many OTAs and travel sites. Booking gets commissions from their travel partners for customer referrals to their sites. OpenTable offers restaurant reservations to diners and subscription services to restaurants on their platform.

Across its product suite, Booking (and other OTAs) mostly makes money from accommodation bookings. This largely has to due with the fact that hotels (and with certain alternative accommodations) have a fixed amount of capacity and their profitability varies significantly with changes in occupancy. This means hotels have high fixed costs while the incremental cost to service a customer is minimal. So, hotels can afford to pay a decent sized commission to increase occupancy, as long as the demand is incremental. This is in contrast to airline tickets, where supply is somewhat more variable depending on the number of flights, size of the plane, etc. for a specific route. Furthermore, the power dynamic between the hotels and the OTAs is much weaker as compared to the the major airlines.

Booking’s value-add to its accommodation partners is the ability to drive incremental demand. If a customer does the research, finds the hotel’s website and books a stay directly, this customer would obviously provide the highest margins for the hotel. But even after paying commissions, having a customer come from an OTA partner is a close second. This is because the demand is almost all incremental with just low single digit % overlap between these two customer types. The company has done a few studies on this to prove out to hotel partners that there is very little overlap between Booking’s customers and those that book direct. Here is VP Carlo Olejniczak at the Skift Global Forum in November 2024:

“The travelers or the users that will book on our platform are not usually the loyal customer of a brand. And we have some data there, for instance, we have done an analysis with one of the largest European hotel chains, where we have looked at their booker data, and we have looked at our booker data. And we've done that through a third-party agency to make sure that it's fully neutral. And we try to measure the overlap. And the overlap between our respective bookers' data is only 3%. And I've made another analysis which is to understand, what is the percentage of bookers that will book on Booking.com more than once in the same property... The bookers that book more than once the same property on Booking is 2%.”

The data suggest that customers are relying on Booking as part of their discovery and research when booking a trip. Customers that know where to stay because they’ve already been to a certain region or hotel will likely book directly. But customers that are looking for the widest selection and accruing the benefits of combining flights, rental cars and activities will likely use Booking’s platform.

It’s logical to think that growth in the accommodations business is the main driver of value for the company. On the hotel side, initially it was about increasing the number of accommodations that were available on Booking’s network. And increasing supply means that over time the company was able to drive more demand for specific regions that have more supply. Eventually as the company was able to add enough supply within each region, the highest driver of value shifted to increasing demand to Booking’s sites as well as improving conversion rates.

On the alternative accommodations side, Booking is still in the increasing supply phase of building its network. The company’s alternative accommodations supply has increased from 6.3M listings in 2021 to 8.1M in Q1 2025 and alternative accommodations room nights have increased from 175M in 2021 to 401M in 2024 (+32% CAGR).

One of the reasons that Booking has been so successful in growing this business is its existing demand for hotel accommodations. Supply that’s a little more sophisticated and professionalized can list on Booking’s sites to get incremental demand for their listings. Remember that Airbnb (write-up here) has almost completely stopped using performance based marketing to drive demand, so Booking can easily show incremental traffic to potential alternative accommodations hosts. Prior to the pandemic, about 1 in 7 customers that searched on Booking.com would see an alternative accommodation. In 2024, that statistic improved to 1 in 3.

Booking’s strategy with alternative accommodations is different than that of Airbnb in certain ways.

When customers search for stay options, hotels are listed in conjunction with alternative listings and customers have the benefit of choosing to book either option.

The company isn’t as concerned with having unique supply on their sites but Booking is focused on improving the booking experience over time.

The supply on Booking’s sites tend to skew more towards professionals or semi-professionals but the company is starting to focus on individual hosts as well.

Booking has added Partner Liability Insurance protections for hosts (similar to AirCover) and has recently added features like request to book (as it is on Airbnb right now) for hosts that want more control over who’s staying at their rentals.

The other potential driver of value growth for the company is the Connected Trip. This is considered to be the “holy grail” of travel booking since the OTA that successfully can implement this will be able to benefit from (1) the incremental high take rates that come with activities and (2) the ability to be the touch point with the customer across most of their trip planning, thereby increasing conversion rates and eventually take more margin.

To achieve the company’s vision of a Connected Trip offering, Booking invested in two key areas even prior to the pandemic. The first was payments, which the company began pushing to their hotel partners in 2018. Under the merchant model, Booking takes the payment from the customer at the time of booking and is the point of contact for any issues that may arise. Booking’s pitch to their hotel partners was around simplifying the process by handling any currency translation or payment acceptance issues, especially with cross-border customers. The merchant model results in reduced cancellation rates and should reduce overall payment costs over time. Ultimately, the merchant model expands the number of potential customers for their hotel partners. This is in contrast to the agency model, where the hotel partner handles the payment either online or directly at the time of stay, and Booking is paid a commission on the transaction.

For these services, the company takes a cut of the transaction. The take rates across Booking’s merchant and agency models are fairly similar, averaging 13%-14% (this includes flights, rental cars, cruises, etc.). Similar to Airbnb, due to the seasonality of travel centered around the summer months and revenues being recognized at time of stay, the take rates vary from quarter to quarter with the lowest calculated take rate in Q1 and the highest in Q3. One thing that the merchant model allows Booking to do is be more flexible with the customer when handling refunds and discounts across many of their packaged offerings. And because of this when the pandemic first hit and customers were cancelling their travel plans due to government mandates, the company actually absorbed a lot of those costs.

Payments through Booking’s platform accounted for 15% all bookings in 2019 and reached 22% in 2020. The company created an internal fintech unit in 2021 to accelerate the product roadmap of its payment offerings. New features were quickly added in 2021, including customer e-wallets and integration with more payment options like buy now pay later. Booking’s platform accounted for 27% of payments in 2021 and accelerated to 39% in 2022.

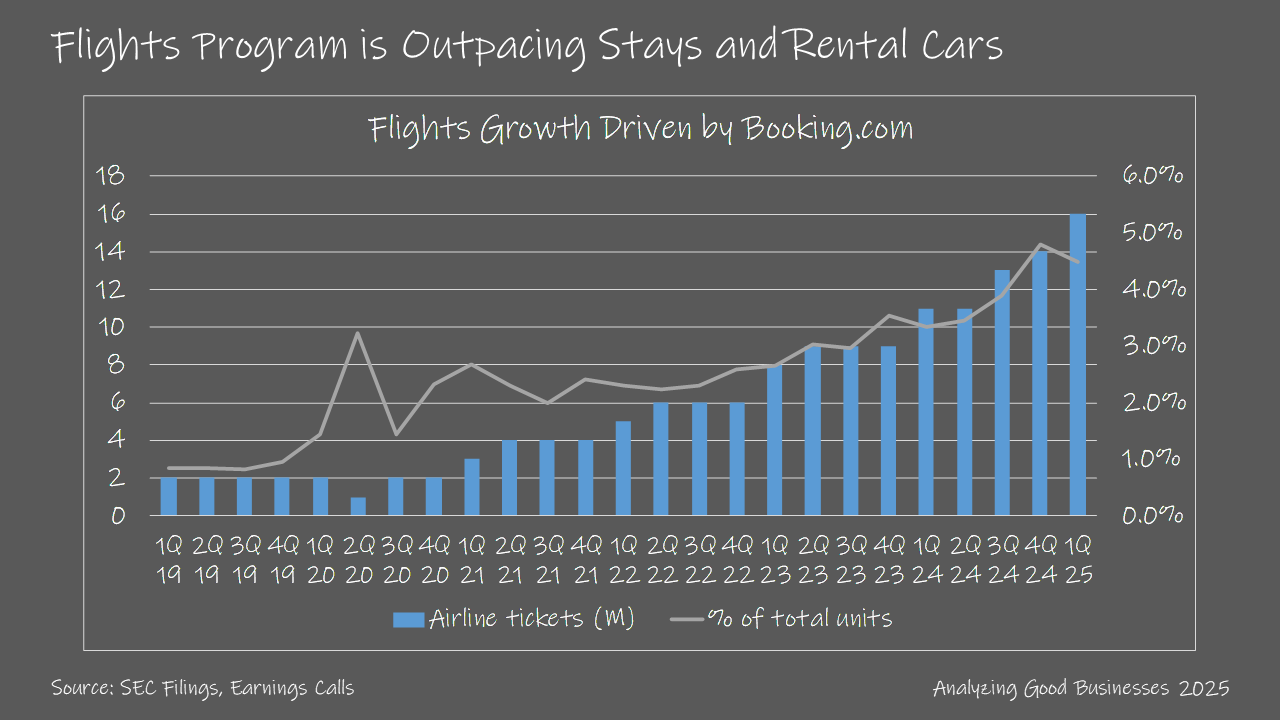

The second key area of investment was in the company’s flights offering. In 2019, booking.com started to offer flights in a few European markets and rolled-out flights to the U.S. in 2020. The company reached 34 countries by 2021 and 40 by 2022, which was more than 70% coverage of booking.com’s customer base. The idea behind flights were two-fold: (1) incremental customer demand that previously started their trip planning process elsewhere, and (2) synergies with cross-selling and being able to offer discounted Connected Trip packages.

Booking initially saw that 25% of flight bookers were new to the platform (this statistic was later reduced to 20% in 2022) and many customers were attaching an accommodation to their trips. Here is CEO Glenn Fogel discussing the impact of the flights offering on the company’s Q1 2022 earnings call:

“We have seen that in over 70% of our flight bookings on Booking.com, the flight was the first or only product that was booked. This helps confirm the value of flights as the starting point in many people people's booking journey and it is an anchor product that we can utilize to cross-sell accommodations and other products. A meaningful percentage of bookers who first book a flight then book an accommodation. We will continue our work to further optimize the cross-sell opportunity and build on the early positive signals that we are seeing so far.”

It's still early days for the Connected Trip vision to come to fruition. In 2024, connected transactions were a high single digit % of total bookings. Discounts can be offered to customers that select Connected Trips because Booking has room to play with the prices on the accommodations and activities (and to a lesser extent car rentals) potion of the trip.

On activities, the company has built out some of their own supply but also partnered with Musement in 2020 and Viator in 2021 to help fill out some of the supply for certain categories. By 2021, Booking had 50% coverage of its destinations, which was up significantly from 10% in 2020. The company is not as focused on activities as it is on shoring up supply for their alternative accommodations at the moment. And part of the reason is that activities are booked towards the end of the trip planning process. Here is CEO Glenn Fogel discussing activities on the Q2 2021 earnings call:

“Now, do I expect that to happen with something like activities? No, I'm not really thinking a lot of people are going to come for an activity first. Then they're going to buy a flight or then they're going to buy a hotel. That's going to be a lot more the other way and helping produce the loyalty and the repeat business that we talked about. And then it goes into all the things that I was talking about in terms of using a wallet so we can give credits and have different suppliers be able to promote different offerings in different ways to different customers. All of that spins together increasing that flywheel. And that's what we're trying to achieve and I think it's just so great to see it start happening right now even though it's very early.”

With all of these recent strategic investments and the rebound in travel coming out of the pandemic, Booking achieved record gross bookings, revenues and operating income in 2024. Margins however have still not recovered to 2019 levels as the company has been actively reinvesting in key areas to improve the consumer experience to drive conversion. To improve operational efficiency, in late 2024 the company announced its Transformation Program to cut $400M-$450M (or 2.5%-2.8% of its opex) from its annual operating budget. The company achieved savings of over $35M in 2024 and expects another $150M in 2025.