This is the first AGB post of 2025. Airbnb may be a little controversial since the company hasn’t yet fully evolved into what it will ultimately become. But Airbnb is a special case because the pandemic accelerated its maturity curve, going from running on breakeven financials and experimenting with many different investments to a more focused company that now generates almost $4.5B in annual free cash flow.

Airbnb still has lofty aspirations to be more than just a short-term rentals company and will likely see some growing pains with those new ventures. But Airbnb’s unique position in its core homes business will likely give it a better shot at achieving scale in more than one vertical of travel and/or much better monetization than the company currently achieves.

Just as a reminder, the financial model is attached to the last section of the write-up.

The next post will be either the second AGB post in 2025 on Booking Holdings or an Update on Alimentation Couche-Tard (initial post here). This will be published sometime in the first two weeks of June. Thanks for reading everyone!

Airbnb

“We're going to have one app, one brand, the Airbnb app. And we want the Airbnb app kind of similar to Amazon to be one place to go for all of your traveling and living needs. A place to stay is just really, frankly, a very small part of the overall equation. Every new business we launch, we'd like to be strong, and I think it's standalone, but it makes the core business stronger. I think that each business could take three to five years to scale. A great business could get to $1 billion of revenue. It doesn't mean all of them will. And you should be able to expect like one or a couple of businesses to launch every single year for the next five years.” – CEO Brian Chesky on the Q4 2024 earnings call.

Airbnb is the leading online marketplace for alternative accommodation stays. Through its website and mobile app, the company facilitates transactions between hosts that have housing assets to offer and guests looking to rent for both short-term and long-term stays. Since its founding in 2008, Airbnb has grown to have over 5M hosts in over 100k towns and cities offering over 8M active listings on the platform, resulting in over 2B cumulative guest stays. The company also recently announced expansion into select services and experiences during its Summer 2025 release.

A marketplace for short-term home rentals wasn’t a new concept when Airbnb was founded (HomeAway was founded in 2005, Agoda in 2005, Flipkey in 2007, onefinestay in 2010, etc.) but the company improved upon the concept in two main ways. First, Airbnb increased the level of trust on the platform by requiring identification and profiles of most guests and hosts. In 2024, Airbnb had over 200M verified identities and 2M listings across five countries with the verified badge. Furthermore, reviews are two-sided meaning that good behavior is encouraged from both hosts and guests. Over time, the company added protections for hosts and guests to prevent as many unsatisfactory stays as possible. The higher level of trust on the platform meant that the positive Airbnb experience would encourage repeat usage of the service.

Here is CEO Brian Chesky summing it up nicely on the Q3 2023 earnings call:

“So on most travel companies, you can book as a guest and they don't even have account information. And you can sign up with an account, but you can also check out as a guest and they don't have the same robust account information that we do. On Airbnb, 100% of the bookers and 100% of the Hosts have to have a verified ID associated to their account. They have robust profiles. About 70% of people on the guest and host side leave reviews to the other people. So this really does demonstrate how Airbnb's a little bit of a different community. We think that if we continue to invest in the profile and we can continue to invest in our system of trust, then as we learn more about guests and Hosts, we can then match them for more types of offerings on Airbnb.”

The second improvement was the unlocking of new supply in the home rentals market. Most of the supply that came onto Airbnb was for short-term stays and the most hosts were individuals that listed only a single property. This meant that many hosts were doing this part-time to earn some extra cash by renting out the home that they lived in when it wasn’t being used. Shared house or spare room stays can only be achieved with the higher level of trust that came with Airbnb.

Initially, a big part of the platform’s value proposition was lower cost stays. For guests, you either get a low cost stay if it’s a room stay or you get more space for a full house stay. And in many cities in the U.S., there were very few fees attached to the stays. Airbnb only started collecting occupancy taxes in 2014 in a few select cities as the company began working with local governments to legitimize short-term stays as the platform increased in size. Cleaning fees were implemented in the early 2010s and many hosts didn’t implement them until the company released pricing tools for hosts in 2012.

For many hosts, even if their stays were priced lower vs. hotels or other platforms, it wasn’t as relevant because they were starting from zero utilization. The average host made less than $10k per year on the platform (~$15k in 2025) and hosts would often view the income earned on Airbnb as incremental. Given that the asset was not at all productive before listing on Airbnb, most hosts had plenty of latent supply, so pricing their homes lower usually resulted in incremental revenues. And many hosts were building their stay history and accumulating reviews from guests, so undercharging was an “investment” for future price increases and value capture.

For the company’s core homes business, Airbnb charges an average of ~3% to the host and ~10-11% to the guest. Both of these fees are explicitly broken out for both hosts and guests at the time of booking. There are certain instances where Airbnb will take lower fees like when guests book long-term stays past 2 months and higher fees when guests opt to pay half at the time of booking/half prior to their stay. But overall, these fees have stayed fairly consistent over time. Airbnb also has host-only fees to certain professional listings and will charge higher fees to hosts with strict cancellation policies.

When backing into the implied take rate for Airbnb as the company explains it in its quarterly shareholder letters (Take rate = Revenues / Gross Bookings), it tends to fluctuate due to seasonality between 8.5% to 18.5%. This is because there is a lag between bookings and stays, which is when Airbnb can recognize revenues. And there is this natural fluctuation because of how people book stays throughout the year with more stays occurring in the summer months.

You can normalize for seasonality by calculating billings like a software company (Billings = Revenues + Change in Unearned Revenues). This is possible because Airbnb mostly collects cash upfront at the time of booking and the unrecognized revenues are on the balance sheet. As a % of billings, Airbnb’s take rate each quarter is much more consistent, ranging between 13% and 14%.

Airbnb’s founding story is relatively well known so we won’t go over the early history here. But below we highlight the some of the recent improvements to the core homes business over time:

2012: AirCover for Hosts – $1M to cover any property damage

2014: Superhost Program – Recognition for top hosts who provide excellent service

2021: Flexible Dates, Matching and Destinations – Includes listings in search results that are just outside of parameters for guests that have flexibility in their bookings

2021: AirCover for Hosts Upgrade – Up to $3M for guest property damage protection per stay and up to $1M for third-party claims of personal injury or property damage

2022: Categories – Curation of stays by category, allowing for discovery

2022: Split Stays – Option to combine two separate stays in one trip

2022: AirCover for Guests – Support for guests during stay including host cancellations, check-in issues, inaccurate listings, etc.

2022: All-in Pricing – Shows full rate with fees included in search results, resulting in cleaning fees coming down and 40% of active listings not charging a cleaning fee at all

2022: Airbnb Setup – Easier start-up method for hosts to list new homes

2023: Similar Listings – Allows hosts to compare pricing of other listings in the area to reach better price discovery

2024: Co-Host Network – Enables hosts to find experienced (and highly rated) co-hosts to manage their listings

2025: Services and Experiences – Users can book verified services and experiences through the app

Even with these many improvements for the host and guest experience, the company hasn’t increased take rates. Most of the surplus value has accrued to the hosts on the platform. When building a global two-sided marketplace (40%-50% of nights booked are still cross-border), it’s difficult and more important to grow supply, especially unique supply. And this is reflected in the breakdown of take-rates between the hosts and guests. A 3% charge to hosts is one of the lowest across all online marketplace companies and this barely covers the cost of payment processing by Airbnb. And while it’s important to also keep guests happy and provide a consumer surplus, it’s much easier to generate incremental demand on the guest side with marketing and/or price concessions than it is to grow supply in short order.

In 2020, the pandemic accelerated the evolution of the company, both operationally and financially. The initial reaction to the lockdowns was a steep drop in demand, with 80% of bookings drying up in just eight weeks. Bookings in March and April were a net negative with all the cancellations on the platform. Airbnb had always operated like other silicon valley start-ups, investing for growth and barely breaking even (or burning cash). The company had to cut all marketing, even performance based marketing that drives traffic to the site. Airbnb also rightsized its organization, laying off 25% of all employees by May. The company was worried of a cash crunch if travel demand remained low for an extended period of time and raised $2B in a couple of private rounds of equity and debt.

However, travel quickly rebounded in late 2020, early 2021 as people were looking to get away from their homes after being in lockdown for months. And Airbnb, kept its new lean organizational structure. Performance based marketing was also largely left behind as the company found that 90% of traffic to the site was organic anyway. Instead Airbnb spent its marketing dollars on brand advertising to build awareness. The company also reinvested more in product development, increasing its product releases to 2x per year. The result was a much more profitable company, with free cash flow increasing from $47M in 2019 to $2.2B by 2021 and $4.5B in 2024. And while share based compensation is still high (12.7% of revenues in 2024), the net share count has been coming down in recent years since Airbnb does plenty of buybacks funded by its internal cash generation.

In 2021, as more people started to book long-term stays on the site and as hosts raised prices to account for increased demand, inflation and the focus on sanitation and cleaning, average daily rates (ADRs) increased from $116/night in 2019 to $166/night in 2024, or a 43% increase. The big jump was in 2021 by 26% and has grown in the low single digit range since then.

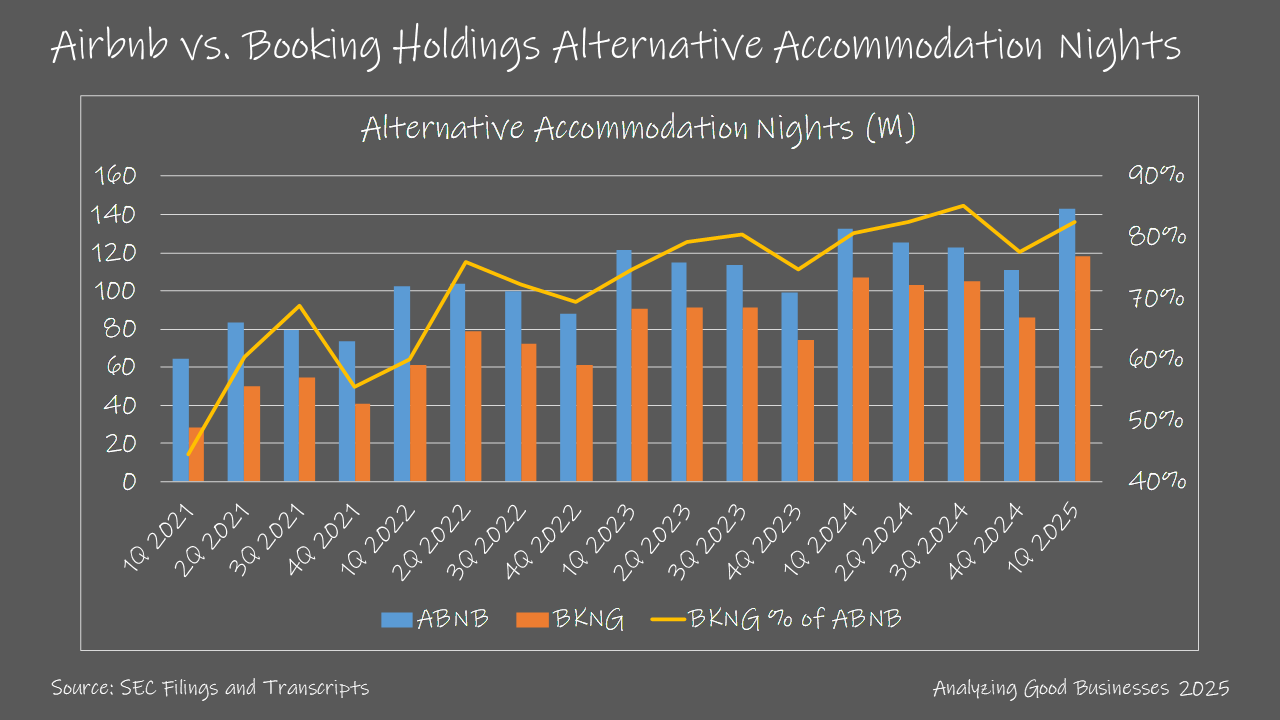

Airbnb competes for hosts on other online marketplaces that specifically list non-hotel stays like Booking Holdings and Vrbo (owned by Expedia). Booking Holdings leverages its strong base of users for its hotel/flights/vacation packages offering and its heavy investments in performance based marketing to grow its alternative accommodations business. This segment has outpaced the growth of the company’s core business and that of Airbnb over the past few years to reach 401M room nights in 2024. By comparison, Airbnb had 492M nights and experiences booked in 2024. Booking Holdings generally has more professional hosts and offers fewer protections and guarantees for both its hosts and guests compared to Airbnb.

Vrbo has much fewer active listings than both Booking Holdings and Airbnb, and generally has hosts that want to list their vacation homes on their platform. The average stay tends to be longer and skews more towards non-urban areas. There is more flexibility in the take rate for hosts where they can either pay a subscription or choose to pay a % of the booking. Airbnb commands 40+% of the alternative accommodations market, followed by Booking Holdings at mid-30s% and Vrbo at 10+%.