Subscribe to AGB - One analysis of a good business in each issue.

Lululemon

“So, the product innovation that I've been sharing with you really is underpinned by really one of the most important facets of our work, and that is our raw materials. Raw materials sit at the heart of how we enable our guests to feel and perform their best. There is a science to why Align pants feel like butter and our Fast and Free feel cool to the touch. We apply years and years of rigorous testing and worked with our partners globally to be able to deliver and unlock new sensations to our guests through fabric innovation to solve their unmet needs. We're constantly innovating new ways to enhance the guest experience by iterating our current raw materials, creating new ones.” – Former Chief Product Officer, Sun Choe, at Lululemon’s 2022 Analyst Day

Lululemon is a leading designer and retailer of athleisure and sports apparel. The company’s first store was opened in 1998 in Vancouver, Canada. With the initial success of its Luon fabric for its women’s yoga leggings and the company’s subsequent product and fabric innovations, Lululemon has grown into a global brand. As of 2023, the company had 758 store locations (the main geographies are U.S., China, Canada, Australia and the U.K.) and generated $9.6B in revenues servicing over 20M members.

Lululemon’s initial core product was women’s yoga apparel. There were a few reasons for the company’s early success. First, women’s yoga apparel was a market that was under-served, especially for products made with innovative fabrics. The Luon fabric was important in that it was breathable and soft yet supportive. And while price points were high, the quality and innovation on the fabric side allowed for the company to successfully position its products in the premium tier.

Second, Lululemon was smart to leverage community based marketing tactics to popularize the brand and its products within local markets. Customers were offered yoga and other fitness classes in its stores to get an introduction to the brand. Later Lululemon introduced its brand ambassador program, in which the company partnered with local fitness instructors to help promote the brand in exchange for small perks like early access to new products, a contributing voice in product direction and a yearly allotment of free products. Today, the company has over 2k brand ambassadors, 50 of which are global ambassadors. Lululemon also sponsors community events like 5k and 10k races.

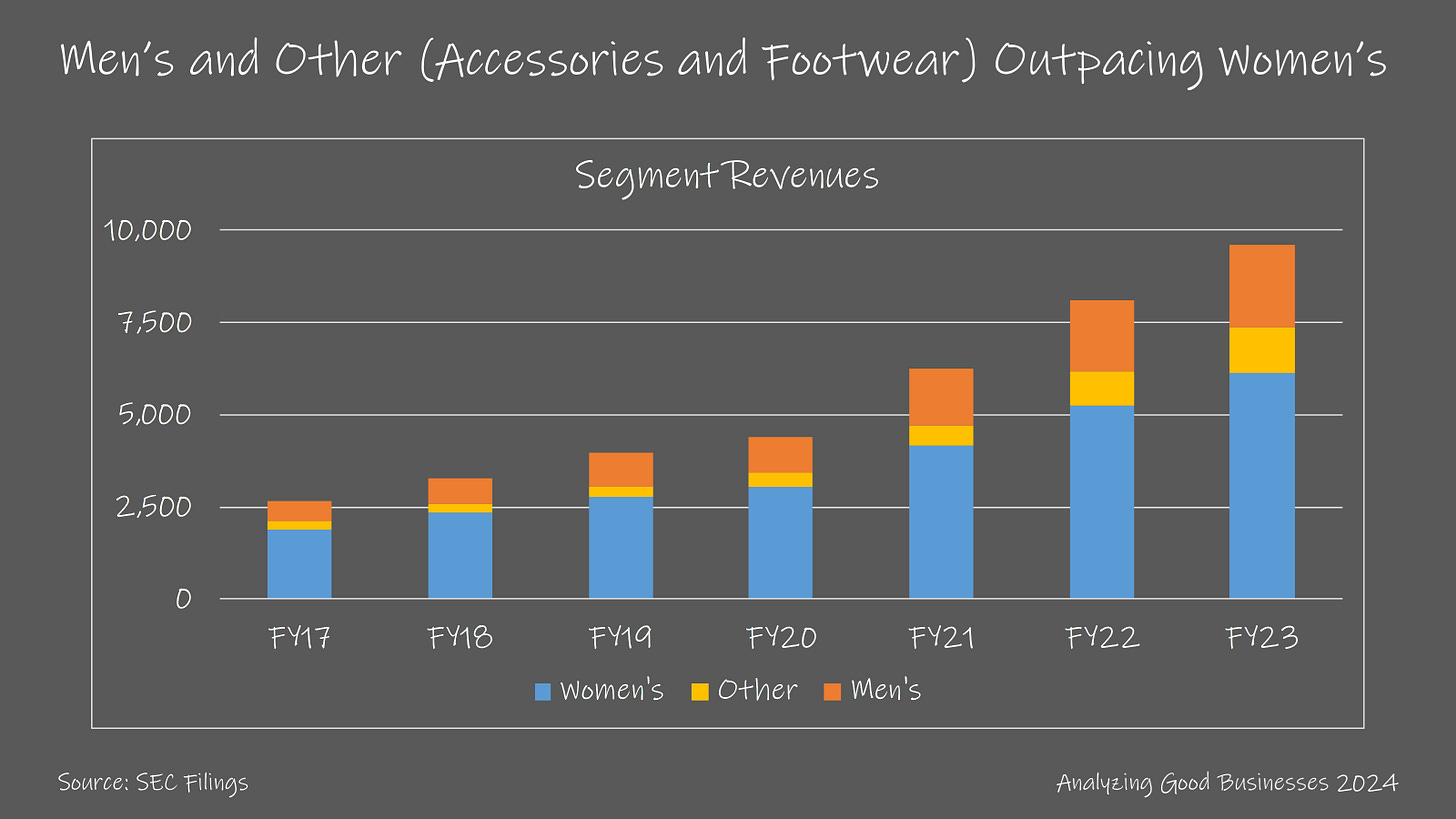

As the brand grew, Lululemon expanded its product line-up to include men’s and accessories. Since the company started disclosing the breakdown between segments in 2017, the men’s segment has outpaced the women’s segment at a 27.4% vs. 21.7% CAGR. Women’s is now a $6B segment, while men’s is over $2.2B. Lululemon also expanded to offer apparel targeting other fitness hobbies like running, golf, tennis and weight training.

The company has continued to innovate on fabrics, some of which are used for specific collections under Lululemon brand. Women’s has the sub-brands of Align ($1B franchise as of 2022), Scuba, Define, and Softstreme and men’s has the ABC collection and License to Train. Some of Lululemon’s newer fabric innovations include:

Everlux, which is meant for hot exercise environments,

Nulu, which is essentially a lighter version of Luon,

Nulux, which are similar to Nulu but for high sweat exercises, and

Silverscent, which helps neutralize odor by combating bacteria.

Similar to other apparel retailers, Lululemon designs its products and contracts out the manufacturing to third parties, mostly located in Asia. This allows the company to be more capital light, benefit on margins, and have flexibility on ramping up and down production. This doesn’t come without risks. The three main risks are that the company is less in control of its supply that could lead inventory stock outs, subject to varying levels of quality in materials and have the potential for knockoffs.

Once the company secures the products from its manufacturing partners, Lululemon distributes its products through its own network of physical stores and its eCommerce business. The stores are important because they provide the connection with the fitness community and brand ambassadors in a local region. They also facilitate many of the omnichannel features offered to customers like buy online/pick up in store, return in store, ship to store, etc.

Lululemon heavily invests in its distribution network and was able to take full advantage of the pull-forward of eCommerce from off-line shopping during the Covid pandemic. The company’s revenues from its eCommerce business surpassed its stores in 2022 and they each commanded more than $4B of revenues in 2023. The eCommerce business was only introduced in 2009, accounting for just 4% of revenues that year. Operating margins for the eCommerce business is also much higher at 42% in 2023 vs. 27% for the stores.

The company once also had a kid’s line of products under the ivivva brand that was launched in 2009. It was mostly dance-inspired apparel for girls. Lululemon even built out individual stores for this sub-brand, reaching 55 locations within the U.S. and Canada by 2016. The stores weren’t as productive as the core Lululemon stores, almost reaching $1,000/sq ft (as compared to $1,600/sq ft). The company closed almost all of these stores by 2017.

Lululemon gave updated 5 year growth and margin targets at its 2022 analyst day. The company exceeded the prior 5 year target given at its 2019 analyst day, even including the impact from Covid. The latest growth targets call for a doubling of revenues by 2027, from (1) low double digit % growth in women’s and a 2x in men’s, (2) low double digit % growth in the core North America region and a 4x in international, or (3) a mid teens growth in stores and a 2x in eCommerce.