Subscribe to AGB - One analysis of a good business in each issue.

Electronic Arts

“A game is no longer a six-week experience. It's a six year experience. And we're trying to design games that allow people to go deep into things that they love and play them for a very long period of time. And by the way, for $60 you're going to get entertained for the next two years or three years, that's a pretty good deal. I can think of no entertainment medium, like if you go to a movie today, you're going to probably spend $20 to $40 before you buy the popcorn. And that's a short experience compared to the type of experience you're seeing in the games.” – Former CFO, Blake Jorgensen at the Credit Suisse Global TMT Conference Nov 2017

Electronic Arts (EA) is one of the largest developers and publishers of video games. The company owns or licenses some of the largest brands in the industry including Apex Legends, Battlefield, The Sims, EA Sports (Madden NFL, Sports FC, Formula 1, UFC, etc.), Star Wars, Mass Effect, Need for Speed and others. Players access EA’s games on all platforms including console (60% of revenues), PC (23%) and mobile (17%).

The business model for video games has evolved over time, but for the most part it still remains the same at its core. A company hires a team of developers to create a video game in one of the many popular genres like sports, racing, first person shooter, action, platform, role-playing, simulation, fighting, puzzle, adventure, strategy, etc. Then they partner with a publisher to help with marketing and distribution (and sometimes financing) of the game on the various platforms. This was the only viable method for distribution when players could only access games through the purchase of physical disks/cartridges at retailers.

Over the past decade+, the shift to digital has had a significant impact to the industry. First, the distribution model found another avenue to get the game to the player. Whether on the PC or console, players could now download copies of the game directly without having to get the physical copy of the game from a retailer. This was made possible due to improving download speeds and cheaper costs for storage. Digital distribution also allowed for the developer to extend the life of a game by providing additional content after a game’s initial release. Downloadable content or DLC was great for both developers and players because developers could earn more money for little incremental development costs and players could access more content for a game they already liked to play.

Second, digital also allowed for smaller developers to release games that weren’t AAA titles that required large budgets. On any of the online platforms (Xbox Games Store, PlayStation Store, Steam, Epic Games Store, etc.), there are many games for sale that don’t retail at the $60 or $70 price point, and it’s usually made by lesser-known studios. In the past, this was difficult because you had to charge AAA title prices to make a profit due to the distribution model.

Third, digital resulted in much better economics for the developers. Over the past 15 years, the margin profiles for many of the large studios have improved dramatically. This is because retailers have been removed from the value chain and physical copies (and packaging) don’t need to manufactured. It’s estimated that publishers make $7-$10 more in gross profit for each full game download vs. a physical sale. There is usually a platform fee associated with a digital download but you don’t have the retailer, packaging, sales allowances (physical copies usually go on sale quicker due to inventory management) and royalties paid to the console makers. Downloadable content has even better margins than full game downloads because development costs are much lower. It’s estimated that DLC purchases result in operating margins of 60% vs. 20%-45% for full games.

The broader market for video games is fragmented and competitive. This is even more the case when including mobile games. While there has been some industry consolidation in recent years, (Microsoft acquiring Activision, TakeTwo acquiring Zynga, Microsoft acquiring ZeniMax, etc.), the top 10 publishers command just over 30% of the market. Not only do video game developers have to make a good game that players want to play, they also have to compete with other successful game launches and existing games that have long lasting loyal fan bases.

Some might consider the hit driven nature of developing individual titles unappetizing, but this is less pronounced among the larger publishers. This is because existing IP and an established fan base can result in very predictable revenue streams each year, especially ones that come with an annual release schedule like sports. The key is to own a collection of development teams or studios that can produce both the next hit from a popular series of games and create new IP that can add to the developers’ collection. EA owns well renowned studios in the gaming industry such as BioWare (Mass Effect, Dragon Age), Criterion Games (Battlefield, Need for Speed), DICE (Battlefield, Star Wars), Maxis (Sims), Respawn (Titanfall and Apex Legends), and Codemasters (Formula 1). And the company has over 700M registered players (half of which is for EA sports) within their network of games that subscribe to a service.

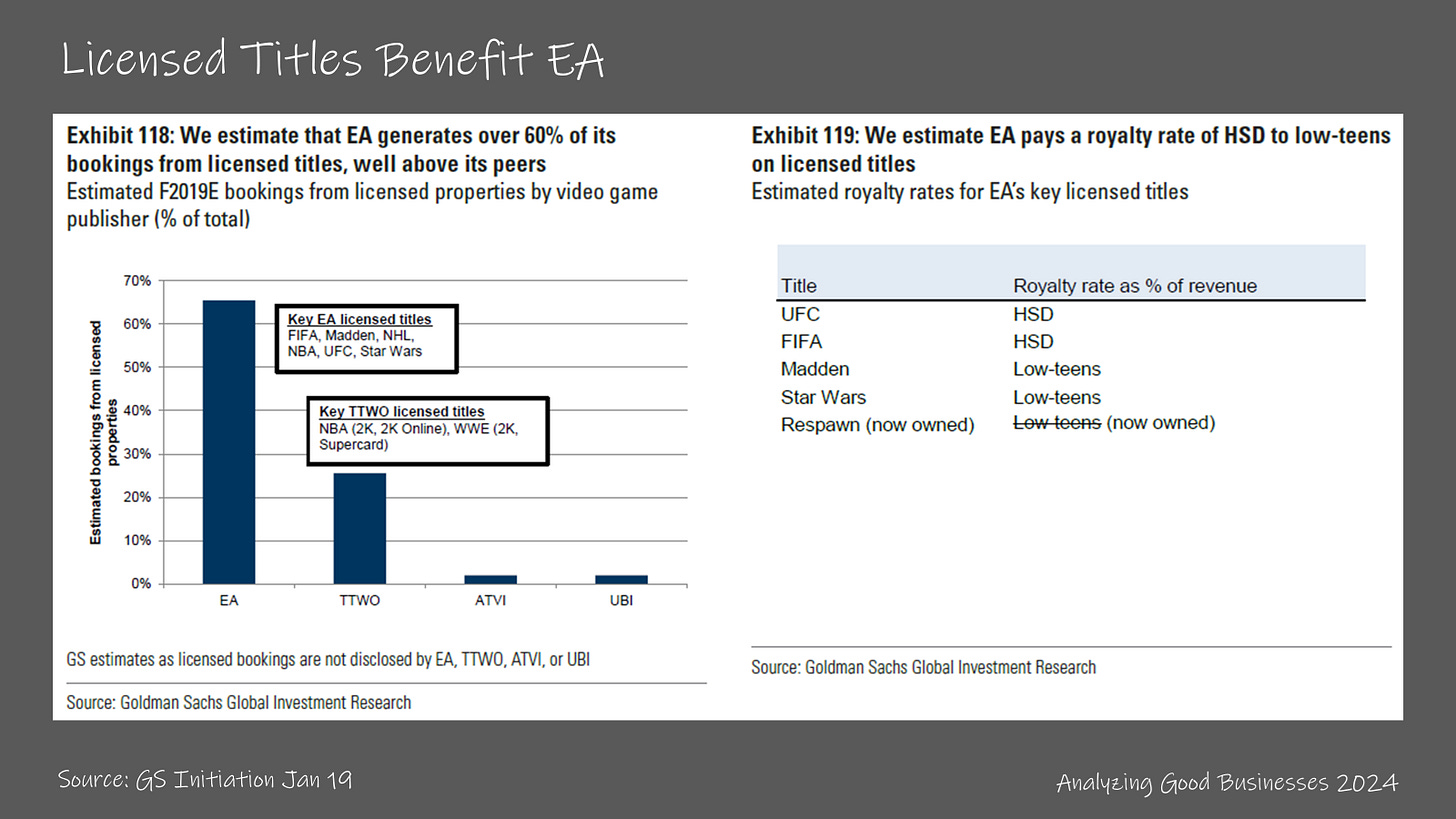

There are two subtle differences between EA and other large game publishers. The first is that EA focuses more on licensing than other publishers, which allows the company to have the largest sports franchise in the video game industry with Sports FC (formerly FIFA), Madden NFL, UFC, Formula 1, NHL and PGA Tour and Star Wars. Among the top 10 earning PC and console games released in 2023, EA’s games accounted for 3 of them, #5 EA Sports FC 24, #6 Madden NFL 24 and #8 Star Wars Jedi: Survivor. All three are based on licensed IP.

The second difference is that more of EAs annual bookings come from the sports genre, which are released on an annual schedule. While this may go against the idea of digital extending the life cycle of games, EA’s sports titles can almost be considered annual installments to existing games with a few minor upgrades. Usually players pay for the next year’s release to get new features to the games as well as team and roster changes for the game to match what’s actually happened in the sport in the real world. EA has over 400 licenses for its sports franchises.

Sports FC and Madden NFL are the two largest titles in the sports portfolio for EA. The company decided to not renew their license with FIFA in 2023. Instead, EA signed over 300 individual partnerships and licenses across 30 leagues and federations for the game starting with Sports FC 24. Players can access content related to the UEFA Champions League, CONMEBOL Libertadores, the Premier League, Bundesliga, Serie A, LaLiga, and the MLS. The initial response to the game was strong, leading to 14.5M players in the first 4 weeks of its release. Sports FC makes up most of Ultimate Team subscriptions, the live service that provides online multiplayer game play.

Apex Legends is a popular live service game for EA with almost 200M registered players, of which more than 18M are monthly active users. The battle royale themed shooter launched in 2019 in a free to play model. The company monetizes the game through optional characters and items that players can purchase to improve their playing experience. Apex Legends operates in a seasonal model, with each season lasting about 3 months. Each new season provides updated features and new playable characters. The Sims is also a longstanding live service franchise for EA. Sims 4 has over 70M players, which collectively engaged with the game for 1.8B hours in 2023, which was a 30% increase from 2022.

While EA and other North American AAA publishers have established positions within the PC and console end markets, mobile has quickly become the largest end market with other publishers leading the way. The large North American large publishers have recently increased their mobile exposure with Activision’s acquisition of King (maker of Candy Crush) in 2015, TakeTwo’s acquisition of Zynga in 2022, and EA’s acquisitions of Glu Mobile and Playdemic in 2021. Mobile accounts for 17% of revenues for EA. Prior to these acquisitions, the company’s mobile strategy had revolved around releasing mobile versions of its popular franchises like with Apex Mobile and Battlefield Mobile.