Subscribe to AGB - One analysis of a good business every five weeks.

United Rentals

United Rentals is the largest equipment rental company in the world with a fleet of over 1M rental units in 4.6k different equipment classes offered at 1.5k locations. The company purchases construction and industrial equipment from its suppliers and rents the equipment to its customers for a fee. United maintains and services the equipment over its useful life cycle and then sells the equipment, usually to its customers, at the optimal time. Most of the company’s operations are in the U.S. and Canada (96% of locations), with a much smaller presence in Europe, Australia and New Zealand.

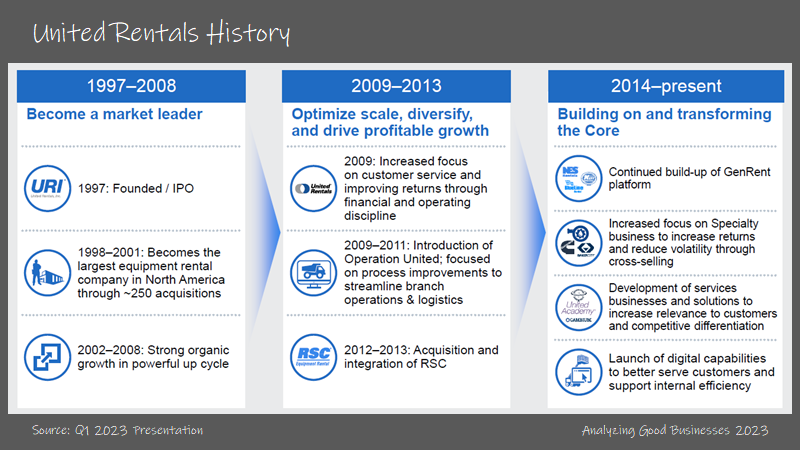

United has grown to be the industry leader through a series of acquisitions. The company was founded in 1997 and United quickly became the industry leader in just 13 months. Even as the industry has consolidated over time, the market still remains very fragmented. In 2010, United commanded 5% market share, followed by Sunb…