Subscribe to AGB - One analysis of a good business every two weeks.

Intercontinental Exchange

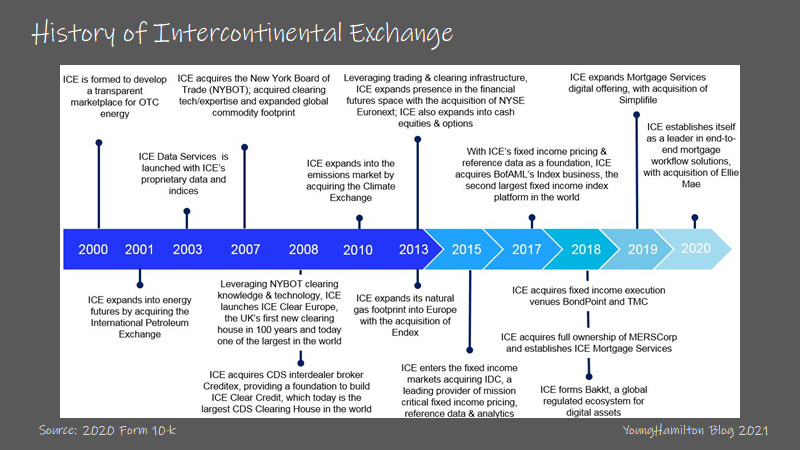

Intercontinental Exchange (or “ICE”) owns and operates 12 regulated financial exchanges and 6 clearing houses globally. The founder and current CEO, Jeff Sprecher, saw an opportunity to trade energy digitally and acquired a failing start-up to do so in 1997. After shoring up the technology to trade energy, ICE officially launched in 2000 with the backing of large financial and energy institutions. The company quickly thereafter expanded to offering energy derivatives, data services and clearing by acquiring more exchange assets.

ICE is a serial acquirer of assets in financial markets where there is still an ongoing conversion from analog to digital. Whether it’s cash equities, interest rates, fixed income securities or mortgages, the company is willing to make bold bets to gain a leadership position in a particular market. With better operating practices and leveraging the acquired assets to of…