Subscribe to AGB - One analysis of a good business every two weeks.

HEICO

HEICO is a leading aerospace parts manufacturer and distributor that has a very unique angle on aftermarket parts and repairs. Over half of its business (51% of revenues in FY20) is categorized under the Flight Support Group (FSG), the main part of which consists of selling FAA approved functional equivalent parts that are otherwise sold by OEMs (original equipment manufacturers). These parts are categorized as PMA (Parts Manufacturer Approvals) and typically are priced below that of the OEMs. You can almost think of PMA as generic versions of branded pharmaceuticals, without the IP protection of the formulary.

Customers (airlines and defense contractors) like that there is a second source for many of these highly priced aftermarket parts, which keeps prices in check, and OEMs live with it because HEICO aims to only take 30% market share with its PMA products. HEICO claims to have saved its customers over $2B since 2002 by using its parts and repairs and is currently saving 50 customers over a $1M annually. The company is projecting to save over $1.3B for its customers in the next 3-5 years. Sometimes due to regulatory reasons, OEMs are required to have a second supplier to their aftermarket parts to engender some price competition and PMA suppliers can fit that need easily.

If you’ve studied the aerospace value chain, you’d know that the high margin dollars are in aftermarket parts, which many OEMs view as the majority of their profit pool. These OEMs spend billions of dollars on R&D to create the next generation of engines, avionics and instruments. And while the finished products are sold at a high price, the margins tend to be low due to the upfront costs. Aftermarket for certain products, which can last years or even decades, tend to be very high margin as customers are almost forced to take on highly priced parts to keep their aircrafts in line with maintenance regulations.

HEICO develops new PMAs through methodical reverse engineering, which takes a significant amount of R&D dollars and effort but not nearly as much as what the OEMs invest. Typically, these engine and avionics parts are not patent protected, allowing HEICO to get FAA approval as long as it’s up to their safety and quality standards. This “investment hurdle” allows the company to stay ahead of other PMA upstarts. It’s estimated that HEICO commands more than half of the PMA dollars in the aerospace market.

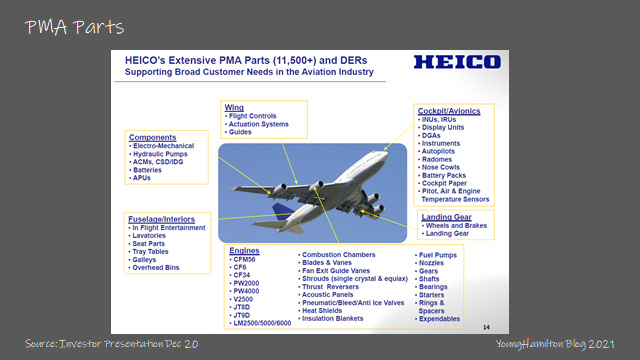

The company has produced over 11,500 PMAs for their customers and develops 350-400 PMAs per year. HEICO typically works closely with customers before starting a new PMA project, ensuring that there is ample demand for the product and the company typically gets order commitments pending approval. Lufthansa was one of the earliest customers that partnered with HEICO on their PMA journey and currently owns 20% of HEICO Aerospace Holdings Corp, which is the PMA division within FSG.

HEICO Flight Support Corp. (other segment under FSG) handles parts distribution and repairs for domestic and foreign airlines and defense contractors. Having a large distribution and repair operation helps HEICO to push their high margin PMA products to their customers.

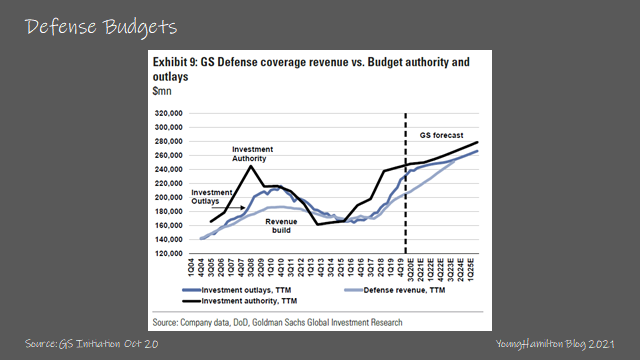

HEICO’s other segment (49% of revenues in FY20) is the Electronic Technologies Group (ETG), which consists of many smaller independently run subsidiaries that manufacture electronic, data, microwave and electro-optical products. The ETG segment’s main customer is the defense industry (66% of revs in FY20), which allows for much more predictable revenues and backlog.

The current management team and large ownership group took over the company in 1990. Since then, HEICO has been one of the best performing stocks over the past 30 years. What’s amazing is that HEICO is a family run business, by managers who didn’t have prior experience in the aerospace industry. Laurans, the father, is the CEO and the sons, Eric and Victor, each run FSG and ETG, respectively. You can read the history of the Mendelson family and HEICO in this Forbes article from January 2020 here.

As you can imagine, the high margin PMA business tends to throw off a lot of cash and the management team of the company have been great capital allocators. HEICO has spent most of its capital acquiring smaller independent companies, most of which are categorized under ETG, for reasonable multiples. The sellers of these companies typically remain on board and retain a portion of the ownership with incentives in place to see their companies grow. Margins of the acquired companies are typically high, which allow for HEICO to reinvest into more acquisitions.

The margin profile of the ETG segment has been much higher (10-12%) than that of the FSG group, which makes sense because FSG has the lower margin maintenance and repair division as well as the specialty products division. If you account for the extra amortization costs from acquisitions, the ETG segment’s margins are 7-9% higher than that of FSG.

Why is it a good business?

The FSG segment is perceived to be a good business due to the regulatory complexities in acquiring a new PMA from the FAA. HEICO has dominated this business (commanding more than half of the PMA dollars) due to its advantages in intangible assets and scale economies. First, HEICO has the knowledge and experience in the reverse engineering of critical aftermarket parts and the company has the relationships with the large airlines and defense contractors to ensure that demand will be there after the PMA is approved. Second, HEICO has a history of success with the getting approval from the FAA in a timely fashion, which is important to its airline customers.

With a successful PMA, HEICO can then leverage its scale and distribution capabilities to sell the part to its customers. HEICO is careful to keep market shares near 30% for certain parts to not upset the OEMs and still satisfy the end customers. With its distribution and repair centers, HEICO can determine which parts (mainly HEICO PMAs) will be pushed to service maintenance and repairs.

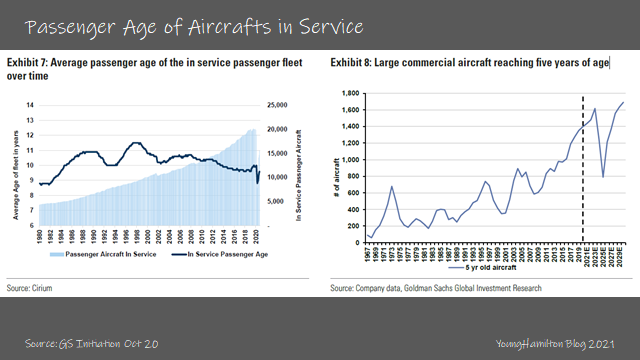

We also have to remember that the demand for many of these aftermarket parts are not discretionary. Due to strict repair and maintenance regulations, parts need to be repaired or replaced after a certain number of flights and miles flown. So as long as planes continue to fly (which had been a detriment to demand in FY20 due to the pandemic), HEICO should see continued steady demand for its products.

For the ETG segment, HECIO has methodically acquired highly complex components and parts manufacturers within electronic, data, microwave and electro-optical products. As a generalist, this segment is more difficult to wrap our heads around, but we’ve concluded that the ETG segment is just the result of very good capital allocation.

HEICO has assembled a group of independently run businesses within highly technical niches at reasonable prices. Because the owners of subsidiaries still maintain an ownership stake, they tend treat the business like their own. An example of this is the annual capex budget for HEICO. The consolidated capex typically comes in below budget because HEICO’s subsidiaries choose to save on costs. The ETG segment is also heavily exposed to the defense sector, which allows for steady demand and high margins.

Returns on capital?

Over the past 10 years, HEICO has spent 73% of its capital on acquisitions, 18% on R&D and 9% on capex. It makes sense that R&D is a larger capital outlay than capex due to the highly technical nature of both the PMA and the ETG segments. Because the distribution, repair and maintenance and specialty products segments of FSG don’t require much R&D, the R&D spend as a percentage of revenues is much lower (difference of 3% of revenues) in FSG than it is in ETG. Capex for both segments are roughly the same.

On the acquisition front, the company has made 82 acquisitions since 1990. Looking at the past 5 years of acquisitions (roughly 24), 80% of the acquisitions have been for the ETG segment. HEICO also discloses how much of each company is acquired and while there were some deals where HEICO acquired the entire entity, on average, HEICO only acquired 85% of the entity and the existing owners continued to own the remaining 15%.

HEICO value proposition to sellers of businesses can be viewed similarly to that of Berkshire Hathaway.

HEICO intends to buy and hold forever,

subsidiaries are given almost complete autonomy to grow their businesses (with some guidance from corporate),

capital gets allocated from corporate to the highest returning subsidiaries, and

the managers are incented with their continued ownership stake to focus on the long-term and make high return on capital decisions.

Because of this value proposition to sellers, HEICO can pay lower multiples to earnings than other buyers.

Of the four largest deals in HEICO’s recent history, ranging from $133M to $333M in size, the company has paid on average 3.5x revenues and 32x P/E. The company has repeatedly said that they aren’t willing to pay high valuation in the 12x-14x EBITDA range for acquisitions and even though overall industry multiples have gone up in the past few years, the company still manages to acquire 5-7 companies per year. HEICO’s M&A strategy requires that the operating margins for the acquired businesses must be similar to that of the rest of HEICO, so even when paying 44x earnings (Reinhold Industries in FY13) there is likely a path to increasing margins significantly after the deal close.

Over the past 10 years, we estimate that HEICO generated a 17%-20% return on its capital spent. It’s interesting to note that large acquisitions don’t really swing the return profile that much because the company is constantly doing much smaller deals to make up for years when large deals just aren’t available.

Reinvestment potential?

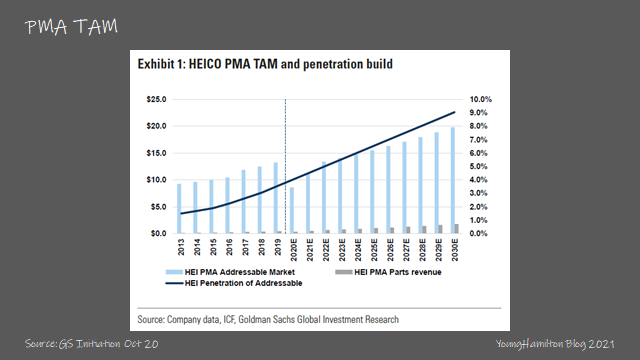

For the FSG segment, Goldman estimates that the PMA market was roughly $13B in 2019. This is assuming that the global market size for aftermarkets components and parts is $50B and that a quarter of that market is addressable with PMAs (lower priced, smaller market parts are likely not as economically feasible to be impacted by PMA players). Under this assumption, HEICO’s penetration of the market is low at just 4% using 2019 numbers.

TransDigm, which is an OEM for many aerospace aftermarkets parts, has come out and estimated that third party PMA penetration in their aftermarket parts business is 2%- 3%. If you’re interested, you can read more about TransDigm in our 4th Issue of AGB from 2020 here.

As for the ETG segment, it’s difficult to size the market due to the many different subsidiaries. One way of estimating TAM for ETG would be to size the defense market by revenues or by government defense budgets, but that’s beyond our knowledge of this sector.

But rather than viewing the ETG segment as a business that is increasing its penetration into a set of end markets, it’s easier to view ETG as the result of HEICO’s high returning M&A strategy. While both the FSG and ETG segments have shown organic growth over the past 10 years (except for FY15 and FY20), the ETG segment is much steadier than the FSG segment and has much higher margins.

Looking at the inorganic growth rates by segment over the past 10 years, it’s easy to see that HEICO prefers to redeploy its capital into the ETG segment. This also shows in the higher level of amortization of the segment vs. the FSG segment. Amortization expense as a % of revenues for ETG has averaged 4.6% from FY13 to FY20, while FSG has averaged only 1.7%. This is because many of HEICO’s acquisitions result in increased amortization of intangible assets such as customer relationships, intellectual property and licenses/patents.

We estimate that HEICO has reinvested between 60%-70% of its capital back into its business over the past 5 years. The large acquisition years tend to lead towards much higher reinvestment rates but that is normalizing as HEICO becomes a larger entity. Assuming 17%-20% returns on capital, we estimate that the company has increased its intrinsic value between 12%-14% over the past 5 years.

What else is important?

Covid impact

Similar to other aerospace parts suppliers, Covid-19 had a big impact on HEICO’s commercial aerospace business (mostly FSG). Going month by month in FY20, May was the bottom for orders and things started to rebound nicely in June and July. The FSG segment was prepared for a 50%-60% drop, which implied a 70%-80% drop in the aftermarkets parts business at the existing expense rate.

As we know, airline customers weren’t flying as many routes and passengers, which led to a dramatic slowdown in orders of aftermarket parts. Repairs and maintenance were also delayed and many airline customers elected to drawdown on existing inventory before purchasing new replacement parts. As we know, trends are improving for the industry and demand for parts should pick up as travel is expected to resume sometime in 2021. The FSG segment ended the year much better than originally anticipated with -29% organic revenue decline.

The ETG segment was less affected and ended the year down -1% in organic revenues. ETG has a much higher exposure to defense, which has a much more predictable order cadence and longer backlog. The company continued to be aggressive with its acquisition strategy during Covid, closing 5 deals in FY20, 4 for ETG and 1 for FSG.

HEICO vs. TransDigm

When considering investing in the industrials sector, there likely aren’t two better companies than HEICO and TransDigm. While they both service commercial and defense customers within aerospace, there are many differences. HEICO’s FSG segment is mainly PMAs while TransDigm is an OEM of aftermarket parts. Customers tend to view HEICO as a helping mechanism to lower total costs for aftermarket parts while many customers may view TransDigm as being too aggressive on price, especially within its sole source, proprietary aftermarket parts business. HEICO also has a large distribution and repair business that allows them to work with airlines to secure aftermarket PMAs.

On the ETG side, there could be more overlap because it’s mainly acquisition driven. Here, HEICO is viewed as a benevolent buyer, allowing sellers to retain partial ownership and also leaving them to run their businesses. While TransDigm also has a decentralized approach to management, they tend to be much more hands on after an acquisition is made. TransDigm typically right sizes the cost structure under the leadership of TransDigm executives and undergoes price optimization for the newly acquired product lines. HEICO goes after much smaller M&A targets, even when adjusting for relative size, but makes many more acquisitions per year. TransDigm on the other hand, goes for larger targets but does fewer acquisitions every year.

The return on incremental capital tends to be higher at HEICO, but the reinvestment rate is a bit lower. Now, it can be argued that HEICO’s conservative balance sheet has caused the company to miss out on maximizing value, but the management team would argue that running the business this way allows for more optionality and less stress during a downturn. TransDigm is known for having a lot of leverage and its business model is likely one that can withstand that much leverage due to its resilience even in the worst macro environments. The leverage at TransDigm is likely too high to go any higher but with its strong cash generation and tactful M&A strategy, the company could lower its leverage in the near future for future acquisitions.

HEI vs. HEI-A

HEICO has two shares of common stock, HEI and HEI-A. The A shares were issued in 1998 with 1/10 the voting rights of the common stock. The rumor is that the company issued the shares for a large acquisition that never materialized. Currently there are roughly 50% more A shares than there are common shares.

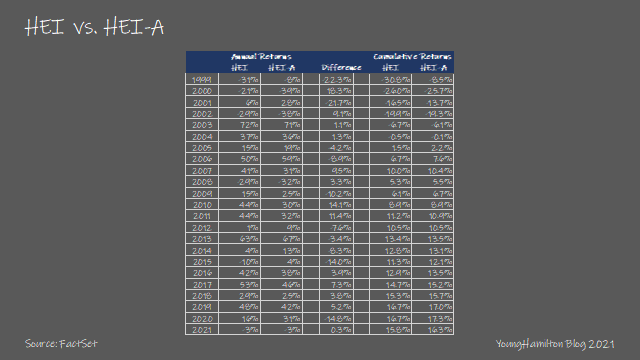

With the main difference between the two share classes being voting rights, which shouldn’t really matter that much with the outstanding job that the management team done, you would think that the shares trade in-line with each other. However, the returns for the different share classes actually differ materially, depending on the year. There have been two years where the difference between the common and A shares were more than 20% (1999, 2001) and five years where the difference was more than 10% (2009, 2010, 2011, 2015, 2020).

The good news is that looking longer-term, the performance does even out. While there may be a pair trading strategy there somewhere (please let me know if you find a successful back test), if you follow the cumulative performance of each share class over the 21 years, the difference is 60bps annualized. Since the end of 1998, the A shares have performed better.

Optionality

There isn’t some large untapped revenue line item within each of the business segments (like AWS) but HEICO does have the opportunity to expand its PMA business across geographies to increase its penetration among some of the airlines in frontier markets. For example, the company has mentioned many times that China has yet to really adopt PMAs for their aircraft programs.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!

Good stuff, thanks

Is the 30% market share cap figure something that's provided by Heico management?