Subscribe to AGB - One analysis of a good business every two weeks.

Floor & Decor

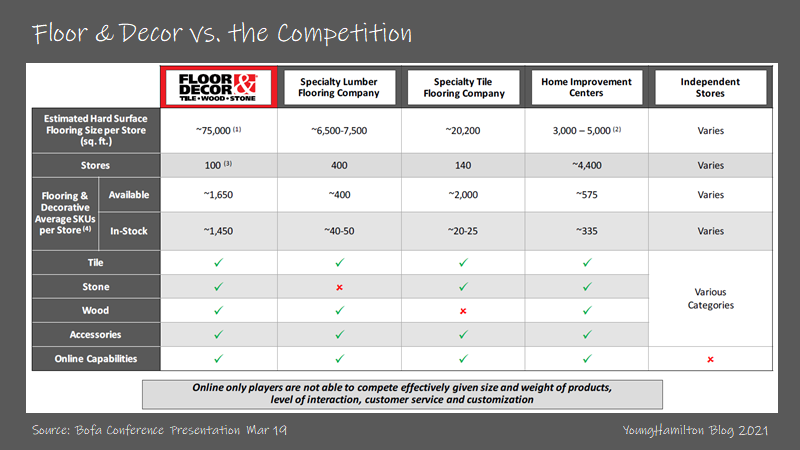

Floor & Decor is the leading specialty retailer in the U.S. focused on hard surface flooring products. The company’s large warehouse like stores are unique to the industry. At an average size of 78k sq ft (this number has moved higher in recent years), Floor & Decor’s stores are large enough to keep most of its 4.1k SKUs in stock for customers to take home that day. Most stores also have a dedicated design center where customers can meet with designers for a free consultation on their repair or renovation flooring project.

Floor & Decor has expanded its footprint across the U.S. at a 20+% store count growth rate since 2012 (earliest store count data available) as the company has reinvested most of the excess capital generated back into the business. As of the third quarter of 2021, the company operates 153 stores in 33 states, still leaving ample room for expansion for many years. Since there is so much white space available the company does get asked about increasing the unit growth above 20%, but the company is focused on maintaining its 20% growth rate given the complexities around opening these large warehouse locations and the supply chain investments that need to go along with store expansion.

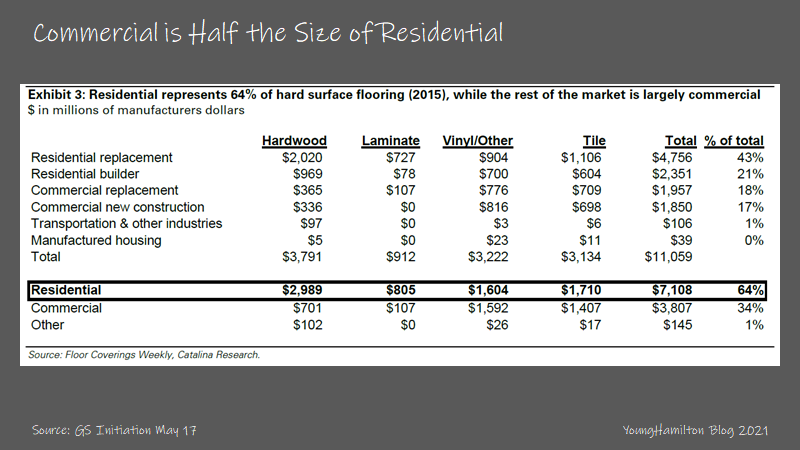

The company competes in the ~$29B hard surface flooring market of which $16B is residential and $13B is commercial. From 2015 to 2019, the market grew 6% annualized, then in 2020 shrank by 2%-3%, and is projected to grow 4%-6% from 2021 to 2025. Long-term trends that benefit this market are: the aging housing stock in the U.S., first time home purchases by millennials, rising home equity values, and a secular shift of consumer preference from carpet to hard surface. In 2002, just 39% of the flooring market was hard surface and that’s increased to 55% by 2020.

Floor & Decor commands 9% market share, the large home improvement retailers like Home Depot and Lowe’s command 25%-30% and the rest of the market is comprised of independent stores, distributors and regional players. Other smaller public competitors, Lumber Liquidators and The Tile Shop command 3.5% and 1% market shares, respectively.

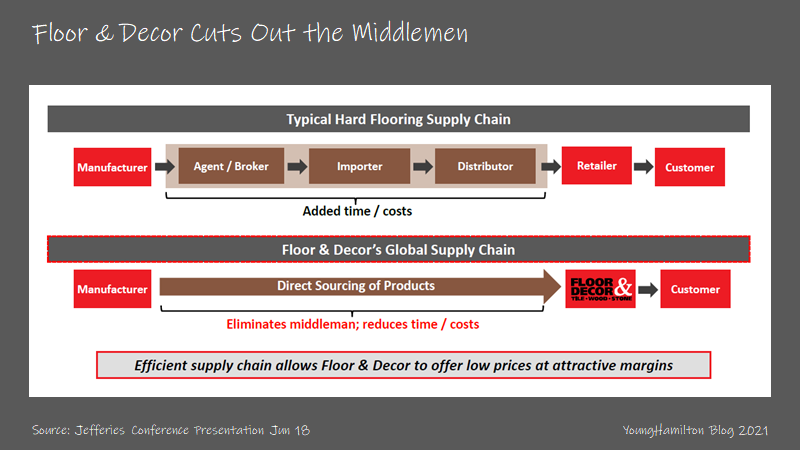

Floor & Decor effectively competes against these competitors through its direct sourcing model and the company’s superior selection, availability and design offerings. The company has direct relationships with over 220 vendors in over 24 countries. Cutting out the middlemen such as agents/brokers, importers and distributors takes costs out of the value chain and reduces the time to acquire inventory from these suppliers.

Floor & Decor's larger selection and same day availability set the company apart against the large home improvement retailers. Home Depot and Lowe’s only average ~600-800 SKUs in store and have only 5k-7k of sq ft dedicated to flooring in their stores. Against the smaller competitors, same day availability and value pricing help the company to take market share.

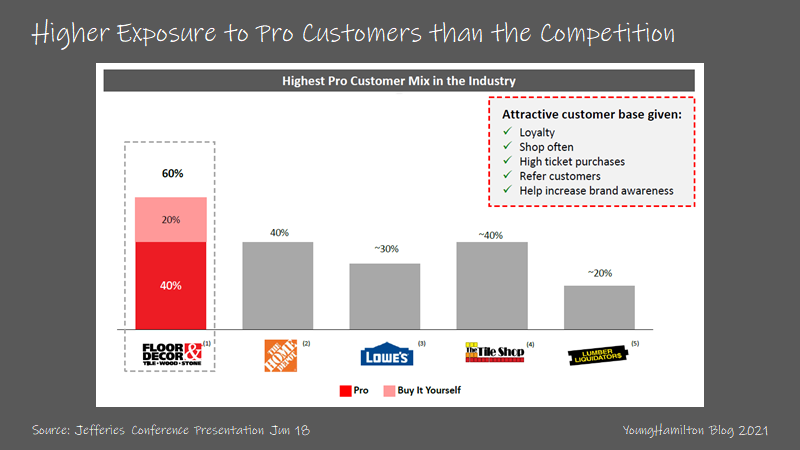

Customers of Floor & Decor skew more towards Pro vs. DIY than the competition, because most flooring repair and renovation jobs are done through a contractor and to these Pros product availability and selection are important. The company estimates that 60% of sales are to homeowners and 40% to Pros but that over 85% of installs involve a Pro. These homeowners are generally higher income ($100k-$125k) and are looking to renovate their existing home or a new home purchase.

The company’s growth strategy is based around its five pillars, which are opening new stores at +20% annual unit growth, improving comp stores sales, expanding the connected consumer experience including eCommerce, increased penetration of the commercial opportunity and providing design services to prospective customers. We’ll go over the first four in more detail later on.

On the design front, the company had tested its design offerings in a few locations a few years back and found that it led to impressive sales results. Customers that go through a design consultation lead to 3x higher average ticket at a much higher close rate. The designer sells the entire improvement project to the customer, which usually results in them buying additional materials required for installation and decorative pieces that go with the design.

Why is it a good business?

Floor & Decor benefits from scale advantages and intangible assets (brand recognition) as the company grows in size and reach. The company is able to direct source most of its supply instead of relying on third party distributors or wholesalers. Because of these direct relationships, Floor & Decor is able to reduce the time to get inventory to the stores. And the company is able to work with suppliers to create unbranded products specifically for Floor & Decor (83% of sales). It helps that flooring has very little brand recognition from the end consumer.

As Floor & Decor gets larger with coverage in most regions, the company should benefit from the economic advantages of national advertising campaigns. This usually results in much lower customer acquisition costs as we’ve written about in our reports on Five Below, Tractor Supply and O’Reilly Automotive.

In terms of brand recognition, there is still room for improvement. The company estimates that 80% of Pros are aware of Floor & Decor while only 10% of DIY customers recognize the brand unaided. But as the company has grown, Floor & Decor has seen some benefits to increased awareness. Specifically in regions where Floor & Decor already has an established presence, the first-year sales from a new store are higher than in new regions.

This, however, does have a dampening effect on same store sales (we discuss this more in a later section) as the natural ramp up to full productivity starts from a higher base. And because Floor & Decor is opening new stores at such a high rate, this does have a significant impact (20+% unit growth implies that ~52% of stores have only been open for four years).

Similar to other segments of home improvement, flooring is less subject to disruption from pure play eCommerce. The size and weight of flooring products don’t make it economical to offer last mile delivery (at least for free) and so the companies that have benefited the most from growth in eCommerce are the omnichannel players. Plus, specific to flooring and a few other segments of home improvement, the purchase cycle tends to be long (given that it’s usually a one time, large and permanent purchase), so the customer wants to touch and see the product in person.

Floor & Decor’s omnichannel effort has seen good results so far. eCommerce represented 19% of sales in 2020, up from 10% in 2019. Most online orders (over 80%) are for instore pickup, which benefits the company because the items are held in store anyway and customers can easily pick up installation materials and accessories while visiting the store. During the pandemic related lockdowns, this allowed the company to continue to generate revenues even as customers were not allowed inside the warehouse. Store employees put the items directly into the customers’ trunks or flatbeds of their trucks.

Specific to Floor & Decor, the company’s skew towards the Pro customer is an advantage. Of all the home improvement related retail companies, Floor & Decor generates the highest percentage of revenues from its Pro customers. And the company has been making strides to further incent these Pros to shop at Floor & Decor. The company offers a credit card, has a ProZone (an designated area in each store that caters to Pro customers) and a loyalty program called Pro Premier Rewards (PPR). This program was started in late 2018 and the company ended that year with 50k members. That number has grown to 178k by the end of 2020 and 230k by Q2 2020. Pros that participate in the PPR program accounted for 81% of total Pro revenues, and these customers spend 2.5x more and shop 2x more frequently than Pros not enrolled in the program.

Returns on incremental capital?

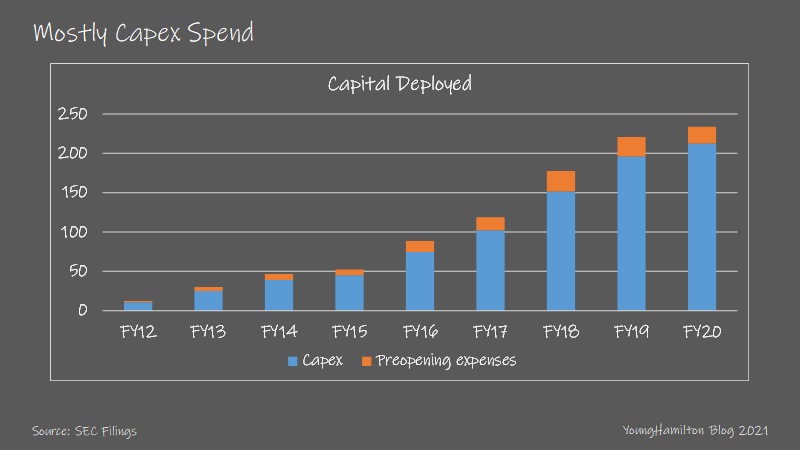

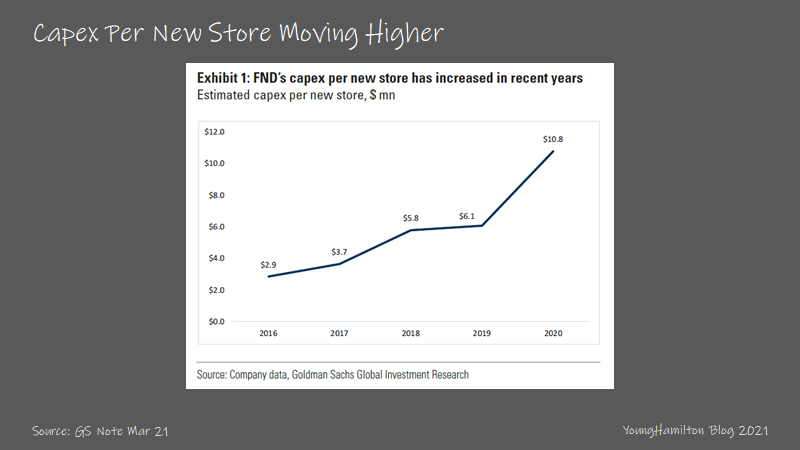

Over the past 9 years, Floor & Decor has spent over 87% of its capital on capex and 13% on preopening expenses. The company gives out capex plans for the year and based on those assumptions, the company has spent 55%-65% of capex on new store openings, 12%-30% of relocations, and 6%-15% on IT, infrastructure, eCommerce logistics and support centers. The company has gained leverage on its support related capex as the company has gotten larger but the new store capex has increased over the years.

Because Floor & Decor’s stores are large warehouse like formats, the builds are mostly from the ground up (vs. taking over an existing location) and the construction timelines are long. The company often spends capex for next year’s builds upfront. As Floor & Decor has gotten larger and more experienced in opening new stores, the company has elected to pay for more of the capex requirements and even have purchased the land that the store is built on. Currently, the company owns the land with two stores, one in Connecticut and one in Texas.

As a trade off for paying for more of the capex and self-developing its stores, the company is paying less in rent charges than it had in the past. Rent expense for new stores has come down in recent years from mid-teens % to single digits %s. It used to cost $4M-$5M of capex to open a new store ($5M-$6M in the expensive areas) but now new stores are averaging between $7M-$9M. Other benefits from taking control over the build process has led to higher building standards, more efficient permitting which results in faster openings and less maintenance capex required after open.

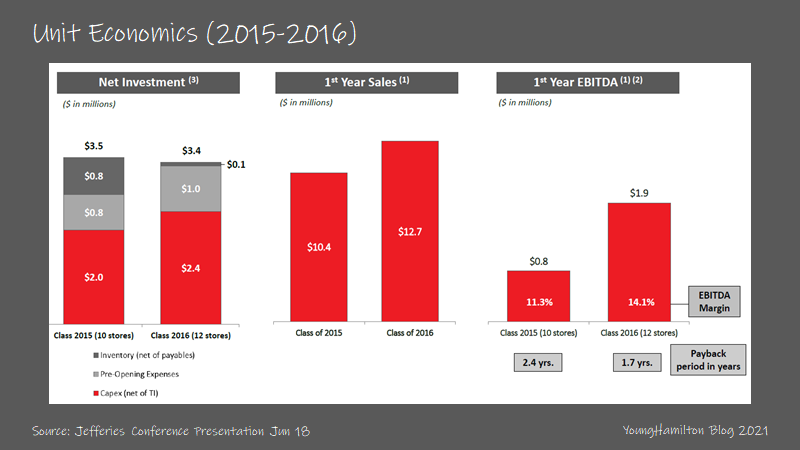

In terms of store level unit economics, the math has changed over the years, but the return numbers are very high across the board. As mentioned before, it costs $7M-$9M to open a new store and in 2020, first year revenues were between $12M-$15M with EBITDA of $2.5M before preopening expenses. This equates to a 2.5-3 year payback period. This implies a first year return on capital of 28%-36% and that number moves higher as sales ramp up to a mature level. With the bump from the recovery after the pandemic and the resulting high comp store sales growth, the numbers are now closer to $15M first year revenue and over $3M EBITDA, equating to first year ROC of 33%-43%.

After 5 years, stores reach steady state to generate over $26M in revenue and over 25% EBITDA margins. That number used to be $22M-$24M in revenue and close to 25% EBITDA margins just a year ago. Because of the recent improvement in performance of first year revenue, the comp store sales lift from new stores is less pronounced. This trend was occurring even before the pandemic. Just back in 2018, first year store revenues were lower at $10M-$13M.

In May 2021, Floor & Decor made the first acquisition in the company’s history of Spartan Surfaces for $90M ($85M cash and $5M stock). Spartan gives the company entry into the higher end commercial flooring market, in particular the Architecture and Design segment of the market. Spartan has 40+ account reps, each generating over $2M in annual revenues. The acquisition expands Floor & Decor’s TAM by $7B.

We estimate that Floor & Decor has achieved returns on incremental capital between 45%-55% over the past 5 years. The company did benefit from the Tax Cut and Jobs Act starting in 2018, so the returns over the past 3 years are slightly better than prior years, even though total revenue growth has decelerated since 2017. The higher capex spend for new store construction hasn’t dampened returns because the new store performance is that much better with the increased investment and the ongoing rent expenses are lower.

Reinvestment potential?

Floor & Decor estimates that there is room for 400 stores in the U.S. and that has been the target ever since the company’s IPO is 2017. As the number of stores increases, the company is learning more about the capacity for stores in many different regions. Early on, the company worried about cannibalizing the revenues of existing stores when building out the 2nd or 3rd store within a region. However, the feedback from the Pro customer base has been good with respect to store density and Floor & Decor is learning more about store performance in tight clusters within regions. We have to remember that convenience is a key factor and value proposition for Pro customers. It wouldn’t be a surprise if the 400 store target gets revised higher in the future. It was estimated to be 315 back in 2012.

The growth strategy for Floor & Decor is well thought out. The company plans to grow its store base by 20% until the company reaches ~40 new openings per year. By that math, the company should reach that number by 2024. After that, the plan is to continue to open 40 stores per year until the company reaches 400 stores, which would happen in 2028.

Most of Floor & Decor’s stores are within close proximity to a Home Depot or Lowe’s. There are almost 2k Home Depot stores and over 1.7k Lowe’s stores in the U.S. And while these competitors’ stores address more subsegments within the home improvement category, it’s not an unreasonable assumption that Floor & Decor still has a long way to go from its current store count of 153.

On the commercial side, the TAM is $13B with the addition of Spartan Surfaces. Commercial jobs are not done out of the retail store front but rather through account managers that sell to larger commercial clients with jobs that are in the $10ks to $100ks range. The company has regional account managers (RAMs) that cover these commercial clients. RAMs on average produce $500k-$750k of revenues in their first year and ramp up to $2.5M-$3M by year 3. Floor & Decor has invested to increase the number of RAMs from 13 in 2019 to 22 in 2020 and the company plans to add another 15 in 2021.

The commercial margins are lower on the gross margin side because the purchase orders are larger and the customers have more power when negotiating pricing, whereas on the retail side, there is no discounting that goes on at the stores. But because there isn’t a retail location to maintain, though it can be argued that the commercial business doesn’t function as well without the retail store fronts and integrated supply chain, the SG&A costs are lower, which results in higher operating margins for the commercial side of the business.

Overall, the commercial business is still small generating $25.8M in revenues in the first half of 2021, but it’s growing faster than the retail business. The company stated that the goal was to get commercial to 5% of revenues, but this was before the Spartan acquisition.

With a reinvestment rate between 45%-65% and a return on incremental capital between 45%-55%, we estimate that Floor & Decor has increased its intrinsic value between 24%-29% over the past 5 years. Because the growth rate for new store units is so consistent and the company is gaining efficiencies related to working capital and new store openings, the returns and the reinvestment rates have been very consistent. It also helps (from a consistency perspective) that there has been very little M&A activity.

What else is important?

Comp store sales deceleration

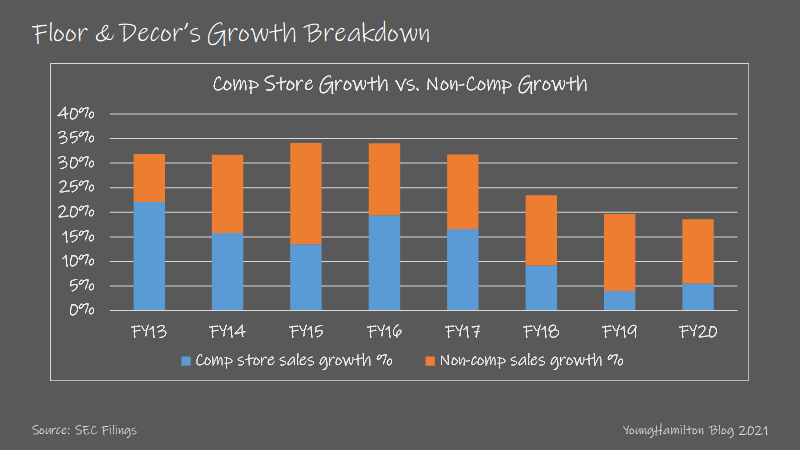

From 2013 to 2017, Floor & Decor posted double digit comp store sales growth. During this 5 year period, the company averaged +17.5% annual comp growth, which equated to +32.7% total annual revenue growth. Then in 2018, comp growth moderated to +9.2% and then +4% and +5.5% for 2019 and 2020.

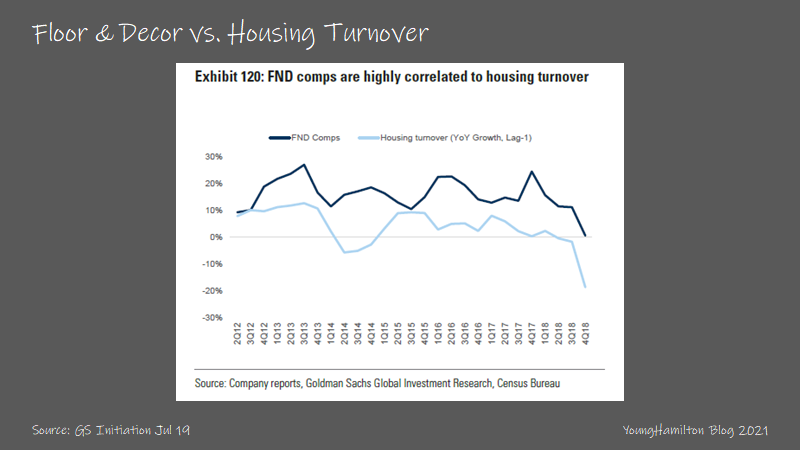

The macro environment does explain some of the deceleration. From 2013 to 2017, there were was a good amount of housing turnover and growth in home equity, which resulted in a nice tailwind for the flooring industry. As we know, 2018 was a weak market for housing, which impacted revenue growth. We’ve also seen the opposite effect of that over the past year and the resulting rebound in same store sales growth.

There are also two other company specific factors to consider that explains the comp store sales growth deceleration. First is that Floor & Decor has been opening more of its new stores in existing markets. The company aims to maintain a 50%/50% split when it comes to opening stores in new markets vs. existing markets, but that hasn’t been the case for the past three years. In 2017, only 35% of its new stores were in existing market, which led to less cannibalization. But that number jumped to 60% in 2019 and 2020. It’s a similar story in 2021 with the company planning to open 65% of its new stores in existing markets.

The second factor is that the new stores built in recent years are starting off at a higher revenue base in the first year. In the past, first year revenues were in the range of $10M-$13M. Starting in 2019, that range increased to $12M-$15M. And now new stores are generating more than $15M in the first year. And because a large portion of Floor & Decor’s stores are four years or newer, the increasing first year revenues for new stores does dampen the natural ramp for comp store sales.

Covid impact

Floor & Decor did close some of its stores in March of 2020 but reopened in May of that year for in-store shopping. Prior to that, the customers were able to buy online and pick up at the store without getting out of their cars. Employees would place the purchased items in the customers’ trunks or flatbeds.

Similar to other home improvement related companies, after the slowdown in the March quarter, there was a sharp rebound in revenues. Because flooring tends to be a long sales cycle and home prices have continued to grind higher (encouraging homeowners to put some of that equity back into their homes), the growth rates have remained above normalized levels for the past 5 quarters. Same store sales growth has increased +18.4% in 3Q and +21.6% in 4Q of 2020. That was followed by +31.1% in 1Q, +68.4% in 2Q and +10.9% in 3Q of 2021.

There are some supply chain hiccups but given that the company has many direct sourcing relationships, it may end up that Floor & Decor gains market share during this time against its smaller competitors. Remember that many of the smaller independent shops don’t carry much onsite inventory, and may have trouble fulfilling demand if there are delays along the supply chain. The company had also diversified its sourcing away from China back in 2017, when there were tariff implications. China accounted for 50% of revenues in 2018 but accounts for less than 30% as of 2021.

Optionality

Floor & Decor is one of those unique growth stories that doesn’t need a second act just yet. The company is doing the right things in commercial and expanding in that area faster than the core business.

Aside from additional M&A (which may not be necessary at all for a while) the upside to future growth should come from international markets. Similar to Home Depot and Lowe’s, the company can expand into Canada and Mexico to run a similar playbook as in the U.S. Floor & Decor can leverage the infrastructure that’s been built to support the U.S. market in those adjacent geographies.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the newsletter and share with anyone that would find it valuable. Thank you for your support!

Great analysis as always! May I ask you how do you calculate the reinvestment rate?