Subscribe to AGB - One analysis of a good business every two weeks.

Spotify

Disclaimer: There are many other write-ups on Spotify that go into much more detail about the business and industry than we have here. The purpose of this write-up (and all the others on AGB) is to analyze whether the company has a sustainable competitive advantage, is generating high returns on incremental capital invested and has a long runway for reinvestment. Also, we won’t go into the nuances of music royalties and how much artists and labels make. If you’re interested, Sleepwell Capital wrote a wonderful piece covering this exact subject earlier this year.

Spotify is the leading audio streaming provider with over 70M tracks (including 2.9M podcasts) available on the platform in 178 markets. The company provides audio listening services to over 365m monthly active users (MAUs), including 165m premium users, on almost every connected device including smartphones, tablets, smart speakers, watches, TVs, videogame systems, cars, etc.

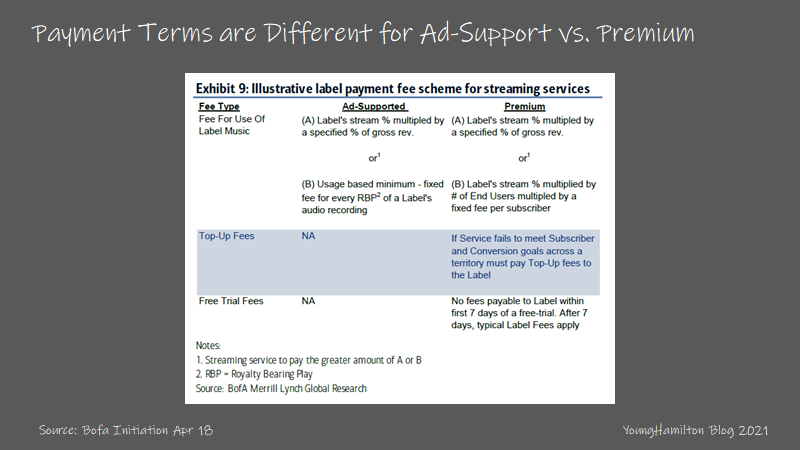

The core music streaming business mainly consists of providing free audio content to ad-support users and an ad-free listening experience to premium users who pay a monthly subscription fee. The ad-supported users are typically served a few minutes of ads per hour of listening. Spotify takes the ads fees as revenues and pays a royalty to the various music labels, aggregators and artists who have rights to the songs on a per stream basis with certain usage minimums.

For the ad-supported offering, there is a fine balance between providing enough ads to maintain a certain level of profitability without hindering the user experience. So far Spotify is playing the long-game, choosing to put user experience as a high priority. As the ad technology gets better over time and as Spotify decides to take more profits in this segment, there is a case to be made for the ad-supported segment to have margins similar to or higher than the subscription segment.

Spotify uses the ad-supported offering as a marketing funnel for the premium service. Over 60% of premium subscribers initially start with the ad-supported offering. From the company’s perspective, this makes sense as the subscription segment makes up more than 90% of revenues and commands higher margins than the ad-supported segment (10%-30% differential over each of the past 6 years). From the user’s perspective, it allows the user to appreciate the service prior to becoming a paid subscriber.

Premium subscribers typically start off using Spotify through a free trial but pay different monthly subscription fees after that depending on the plan. The company offers various plans including Individual, Duo (two accounts under one plan), Family (up to 6 accounts in one household), and Student (bundled with Hulu and Showtime). Premium subscribers also get to download songs onto their devices and can access content anywhere in the world. Spotify takes the subscription payments as revenues and pays a certain percentage of that to the rights holders, meaning that costs for the premium side are mostly variable in nature.

While there are many parallels between audio and video streaming, it’s important to recognize the key differences before jumping to the conclusion that Spotify will have a similar business trajectory to Netflix. The first key difference is that with music, consumers generally don’t want to subscribe to multiple services. The expectation is that the entire music catalog will be available for any service a customer pays for. The result of this is that the big three labels, Universal, Warner and Sony, have more negotiating power when structuring licensing deals. These three command over 80% of the global music rights and if you add Merlin (digital rights distributor for independent artists) that number becomes 85%.

The second difference is that there is just more audio to choose from and so discovery becomes much more important. Spotify stands out from the competition, with its more than 4 billion shareable playlists on the platform. These playlists can be created by the user but the company also creates playlists to recommend new music to users based on their preferences. The playlist offerings have improved and evolved over time going from Discover Weekly to Daily Mix to Your Daily Drive to Group Session.

Spotify competes against many larger tech companies that have a music offering and smaller stand alone streaming service companies. Each of these companies competes to reach new subscribers and take away subscribers from other streaming services. For the large tech companies like Apple, Google and Amazon, it’s usually a combination of marketing to existing users of their hardware (smartphones and smart speakers) and/or bundling with the companies’ widely used services (like Prime). For the smaller companies, it’s a tough slog.

To effectively compete in this type of environment, Spotify continues to innovate on top of the core streaming offering. The two business extensions that standout today are (1) The two sided marketplace (Spotify for Artists and Sponsored Recommendations specifically) and (2) the company’s push into exclusive podcast content.

Spotify’s scale means that user data and access to the users’ playlists have become valuable for artists and labels to leverage when promoting their music. Spotify for Artists allows artists and labels to analyze user data to their advantage (for example if an artist wants to see if there are new countries or regions to put on their tour schedule), create shareable social media assets for their fans, and pitch music to gain entry into certain playlists. Sponsored Recommendations are just that, marketing dollars that results in recommendations made to users that have an affinity for that type of music.

On the podcasting front, the company has been very active over the past three years, acquiring podcasting technology and content companies as well as signing celebrities and podcasters with large followings to exclusive licensing deals. These exclusive deals were made with the hope to bring more users to the platform and lower churn rates.

Podcasts are mainly monetized through advertising and there is a lot of room for improvement. Currently, the most popular ad formats are still ones that are read by the podcaster and there is very little ad targeting applied to the listeners.

Subscriptions for podcasts are relatively new. Luminary charges $3/month and Stitcher Premium is $5/month. Apple has announced Apple Podcasts Subscriptions for creators to offer a subscription offering starting this May. Apple takes a 30% cut of the subscription revenues in the first year, followed by 15% in following years. Spotify followed suit and recently announced a Paid Subscriptions option for U.S. podcast creators. Similar to Apple, the creators set the pricing. Spotify has elected to forego taking a percentage of revenues until 2023, when the company will start to collect 5%.

From Spotify’s perspective, podcasting is a medium that allows the company to have unique content to offer its users, something that the company can’t do with recorded music streaming. The podcasting segment on its own has the potential to achieve higher margins at scale because it’s mainly a fixed cost business. In addition, podcasting can have a positive effect on the core music streaming business and so far the anecdotal results have been just that. The number of podcasts on the Spotify platform has increased from 185k in FY18 to 2.2M in FY20. Listening hours were up over 200% in FY19 and over 100% in FY20. And the portion of MAUs that engaged with podcasts increased to 25% by FY20.

Spotify is still years away from reaching maturity but has laid out its long-term targets at its latest Analyst Day in February 2021.

Revenue growth of 20+% (was 25%-30% at the IPO)

Gross margin of 30%-40% (moved up from 30-35%)

Operating margin of 10+% (no formal guide given prior)

Advertising revenue contribution as much as 20%

Why is it a good business?

Spotify benefits from scale advantages and network effects. The mains scale advantage is Spotify’s ability to negotiate with the labels on music rights. It’s almost taken as a given that Spotify and other streaming services don’t have much power in these negotiations because of the dominant market shares of the large music labels. But it can be argued that scale actually does help Spotify more than is appreciated.

Spotify’s licensing agreements are short (averaging two years) and the company says that’s by design. Changes happen quickly with respect to consumer behavior, the breadth of content offered and the technology with respect to advertising so it makes sense to review terms frequently. And because of Spotify’s increasing scale, the company becomes more important each year to the labels for income.

We have to remember that Spotify has been able to negotiate much more favorable terms with the labels in the past. In 2017, prior to the IPO, the company was able to negotiate much better terms so that gross margins on both the premium and ad-supported side increased materially. In FY16, the premium segment had gross margins of 13.6% and by FY18, margins were 25.7% for this segment. Similarly, the ad-supported segment had gross margins of -11.9% which moved higher to 10.8% in the same time period.

Spotify’s former CFO doesn’t think that future negotiations will result in much more favorable terms for the company, but that’s a good public stance to take.

“And so, the last round of label negotiations was about elevating the margins to a point where at least the business was self-sustaining and it was in economic self-interest of the record label partners who allow the margin to increase because after all streaming has been the single source of renewed revenue growth for labels. So what was good for Spotify is good for the labels and that's why the margins increased. Now, on a go-forward basis, is that going to happen again? No. That's not going to happen again. It's not in their economic interests to allow it to happen again.” - Barry W. McCarthy, former Chief Financial Officer, at the Morgan Stanley Technology Conference February 2019

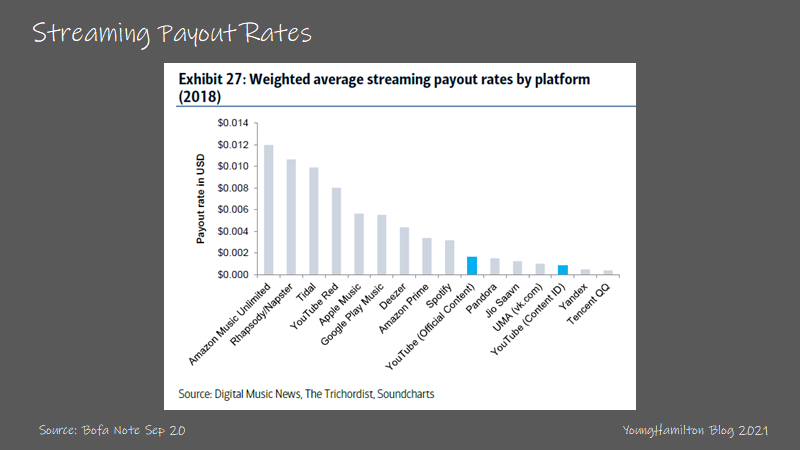

He may be right though, since Spotify pays one of the lowest rates for recorded music across the competition. As of 2018, the weighted average streaming payout for Spotify is ~$0.03, whereas Amazon pays ~$0.12 and Apple pays ~$0.05. We do have to remember than both Amazon and Apple don’t offer an ad-supported streaming service.

As for network effects, the company has few networks, each with different levels of strength. First, the more artists and creators put their content on the platform, the more users will likely join and engage on the platform and vice versa. The company has stated that some artists leverage the listening data from Spotify to customize their concert set lists for each region during their tours.

As the company gets larger, more user data is generated on the platform and Spotify is able to leverage that data to offer additional services to artists and labels. The music labels spend a large percentage of their revenues on Artist & Repertoire (A&R), which is comprised of finding new talent, overseeing and producing the recording process, and marketing and promoting the record. As of 2018, the labels spent 23.8% of its revenues on A&R, not including marketing and Spotify can help the labels use that capital more effectively.

Second, there is a network effect between users (and the data that they generate through playlists, preferences and usage statistics) and the number of advertisers that utilize the platform. It’s arguable that the first is a stronger network for now, given where the company is in the growth cycle, but network between advertiser and users will likely end up generating much higher margin dollars in the future.

And specifically on the financial side, Spotify has been able to grow while remaining free cash flow positive due to its negative cash conversion cycle. For the premium subscription segment, Spotify takes in revenues upfront and then pays the labels for the music rights in arears. The company generally remits payments monthly after all the streaming data is collected and analyzed. As a result, Spotify has been free cash flow positive since FY16 and didn’t need to raise capital at its IPO, hence the company’s decision to go with a direct listing.

Returns on incremental capital?

Over the past 6 years, Spotify has spent 70% of its capital on R&D, followed by 19% on acquisitions and 11% on capex. The acquisitions have mostly occurred in the past two fiscal years, with the notable acquisitions being Anchor, Gimlet, Bill Simmons Media Group and Megaphone. Each of these deals have been podcast content or technology related.

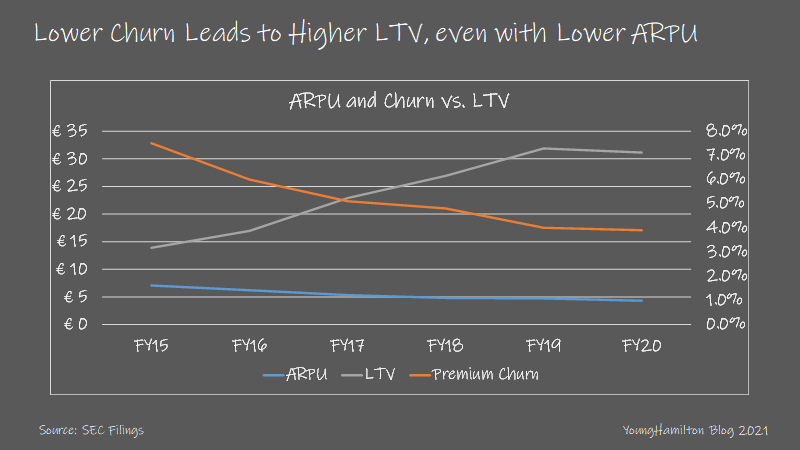

The unit economics for the company can be broken out into two buckets, premium subscriber and ad-supported. The company discloses average revenue per user (ARPU) and churn for the premium subscriber segment. With those two data points, we can calculate LTV of a premium subscriber over time. Since ARPU has been disclosed starting with data from FY15, the number has come down every year from €7.06 to €4.31 in FY20.

Most of the ARPU pressure has been from the company’s launches of new subscription plans (the company estimated that it accounted for 80% of the decline in FY19). The Family plan was introduced in 2014 and was changed in 2016 to allow more members at a lower price point. The Student plan was also introduced in 2014 and the Duo plan was introduced in 2020. The remainder of the ARPU pressure is from expansion into international markets. However, the ARPU declines may subside soon as Spotify has been implementing price increases in the US, UK and parts of Europe in FY20 and FY21.

But even with declining ARPU, because the platform is getting larger and the service is getting better each year, monthly churn has steadily declined since FY15 from 7.5% to 3.9% in FY20. Family and Duo plans have also had a positive impact on churn, so the ARPU pressure was well worth it.

With the ARPU and churn numbers, we can easily calculate LTV. The formula is:

LTV = 1/churn x ARPU x premium subscription gross margins

So even though ARPU has declined, LTV has increased from €14 in FY15 to €31 in FY20.

Spotify has commented that its LTV/SAC ratio was 2.7x at IPO and above 3.1x by FY19Q2. We weren’t able to calculate SAC because we would need to know (1) the percentage of marketing expenses that is attributed to acquiring a premium sub and (2) the subscriber gross additions for each period (we only get net additions). If we use the company’s calculation, the LTV/SAC ratio implies very good returns on capital, similar to many SaaS companies.

For the ad-supported segment, it’s difficult to calculate LTV because we don’t know what churn is for the ad-supported segment. We do know that the ad-supported segment has lower gross margins than the premium subscriber segment (between 10%-30% since FY15). So we can assume that the ad-supported segment has a lower LTV, but as mentioned previously, the ad-supported segment is the marketing funnel for the higher margin premium subscriber segment.

Luckily the ad-supported segment is just 10% of revenues so we don’t need to fret too much about unit economics there. And ad-supported MAUs have been roughly 1.2x the size of the premium subscriber MAUs for the past three years. This implies that the company is doing well to convert the ad-supported MAUs to premium subscribers.

For acquisitions and the licensing deals related to podcasts, the return calculations become a little fuzzy. In total, Spotify has spent €722M over the 5 large acquisitions in FY19 and FY20. And the company has signed high profile licensing deals that add up to hundred million dollars over many years.

So far the commentary around podcasting and how the segment increases conversion, retention and engagement have all been positive. Here are some quotes from the company over time:

“For music listeners who do engage in podcasts, we are seeing increased engagement and increased conversion from Ad-Supported to Premium. Some of the increases are extraordinary, almost too good to be true. We're working to clean up the data to prove causality, not just correlation. Still, our intuition is the data is more right than wrong, and that we're onto something special.” - F19Q3 Shareholder Letter

“We have a growing body of evidence showing that there are significant benefits to engagement, retention, and conversion of users from Ad-Supported to Premium stemming from consumption of Podcast content. We have seen benefits to retention on the order of several hundred basis points, which is a material change on a retention curve, for users that engage with spoken word content relative to those that haven’t, and early data indicates that these users are more likely to convert to Premium over time.” - F19Q4 Shareholder Letter

“We've done a lot of testing and we're starting to believe that we cannot prove out causality that having podcasts and having users engaged with podcasts actually increases our LTV. And so that's what we're getting to. So we still have more work to do to prove that out and prove out the magnitude of how impactful that can be. But we feel good about the impact it's having on the business overall.” - Chief Financial Officer, Paul Vogel, at the Morgan Stanley Tech Conference in March 2021

We estimate that Spotify has achieved returns on its incremental capital invested between 15%-75% over the past 4 years (limited data means the numbers are lumpy). The company achieved high returns on capital in FY17 and FY18 because of the label negotiations that resulted in a big step up in gross margins for both the premium subscription and ad-supported segments. It is likely that the returns on capital will more similar to FY19-F20 going forward. Since the ad-supported segment was hindered by Covid in FY20 and the exclusive podcast licensing deals really begin in FY21, we should be able to know whether podcasts have had a material positive impact on returns after the next two fiscal years.

Reinvestment potential?

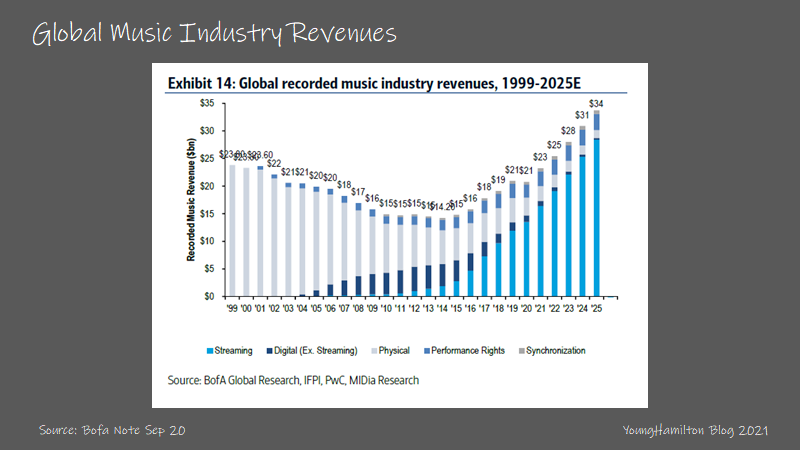

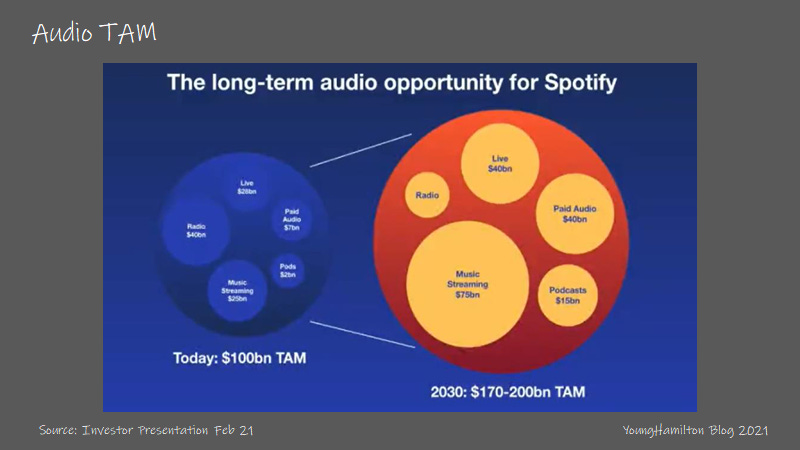

Spotify recently announced at its Analyst Day that the current TAM is roughly $100B and is expected to expand to $170B-$200B by 2030. Of the $100B, music streaming is $25B, radio is $40B, live is $28B and podcasts is $2B. The company expects those numbers to increase to $75B (+12% CAGR) for music streaming, $40B (+4% CAGR) for live and $15B (+22% CAGR) for podcasts while radio advertising shrinks over time.

Spotify mainly competes in two of those markets today, music streaming and podcasts. The company’s expectation is that it will continue to gain market share on the music streaming side and that is evidenced by the market share gains vs. the other streaming providers.

For podcasting, the company expects to continue to invest in exclusive owned and operated content as well as licensing deals. Long-term the company expects that its share of podcasting will be similar to that of music streaming, around 40%. Spotify’s CEO, Daniel Ek, has stated that 20% of listening hours can be in the form of podcasting, which would make the revenues from subscriptions, advertising and the services layered on top to be very meaningful.

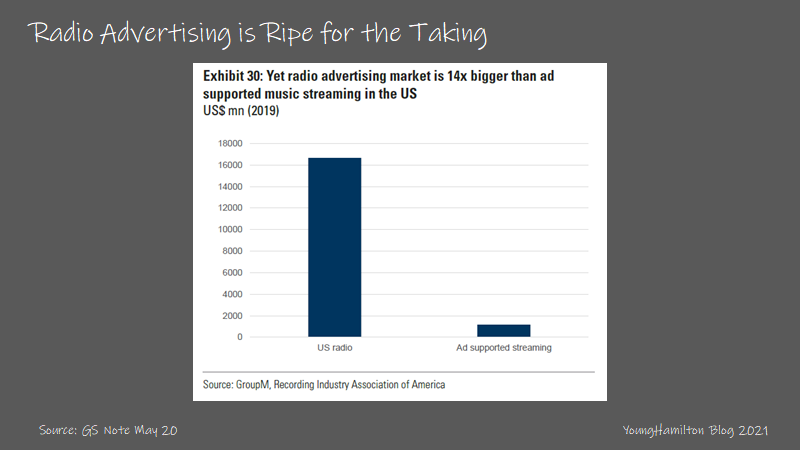

Podcasting still under monetized vs. other forms of audio for the time spent on listening. It’s estimated that podcasting represents almost 4% of all audio time spent in 2018 (according to Triton Digital and Edison Research’s – Share of Ear 2019) and only commands 1.5% share of the audio advertising market (according to PWC Global Media Outlook), which is a ratio less than 40%. Over time, the expectation is for podcast advertising to increase as traditional radio advertising decreases.

Spotify is well underway in improving its ad tech for podcasting. The company has introduced Streaming Ad Insertion (SAI) capabilities to Anchor creators and eventually to all podcast creators on the Spotify platform. The Spotify Audience Network, which allows advertisers to buy ads for podcasts like a marketplace, is also well underway growing +110% y/y (off of a small base) in FY21Q2.

With a reinvestment rate between 30%-75% and a return on incremental capital of 15%-75%, we estimate that Spotify has increased its intrinsic value 12%-25% over the past 4 years. The investments into podcasting has brought the reinvestment rate higher in recent years, but we’ll have to wait to see if those investments generate sufficient returns for the company to sustain its high intrinsic value growth.

What else is important?

High profile podcast licensing deals

Spotify signed many exclusive licensing deals for its podcast segment in the back-half of FY20 and so far into FY21. Joe Rogan was reported to sign for over $100M to be exclusive on Spotify. Other high profile signings were Kim Kardashian, DC Universe, Michelle and Barack Obama, Call Her Daddy ($60M over 3 years) and Armchair Expert. However, only time will tell if those deals were worth the investment.

One thing to consider is that negative sentiment may come around (as opposed to the highly positive sentiment resulting from these signings from mid to late FY20) if any of these deals don’t get renewed in the future. In 2020, Joe Budden didn’t renew his contract with Spotify when his exclusive licensing deal came up for renewal. The Verge wrote about it last year.

There is the issue of big name podcasters losing popularity by going exclusive. The Verge recently wrote about Joe Rogan losing his star power since moving over to Spotify late last year. That and the controversy around Spotify removing some of his past interviews off the platform could pose a risk of his leaving the platform when his contract is up for renewal.

If you’re interested, Liberty has been covering this topic for some time now. If you want his take from the perspectives of the users and creators on Spotify’s push into podcast exclusives, you can read them in issues #18 and #171.

Gross margins

Margins are a key indicator of the health of the company. Barring another favorable negotiation with the labels, we know premium subscription margins are likely to stay around 27%-28%. This can move slightly higher as the company continues to scale and many minimums are met in different regions.

The real margin improvement opportunity is on the ad-supported (including podcasting) and services side of the business. As discussed before, the ad-supported side has a better opportunity see improved margins due to the leverage of the fixed costs in the segment, especially on the owned and operated podcast portion. Pandora as a comparison had over 40% gross margins for its ad-supported segment, but this was mainly because the company’s subscribers were based in the U.S. where the ad market is more developed.

Optionality

Currently it seems like the company has a lot to execute on before making anymore bold moves. But optionality will likely come from M&A, whether it’s on the content or ad tech side.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!