Subscribe to AGB - One analysis of a good business every two weeks.

Waste Connections

“And that's why we define this as a commodity business, something that trades predominantly on price is a commodity business. I know, for example, Republic Services believed and articulated that they do not believe it is a commodity, but I would argue that when you're the size of Republic Services and when you change your price by more than 1% a year, you lose most of your business, that's a commodity.” – Ronald J. Mittelstaedt, Chairman and former Chief Executive Officer at the 2017 Analyst Day

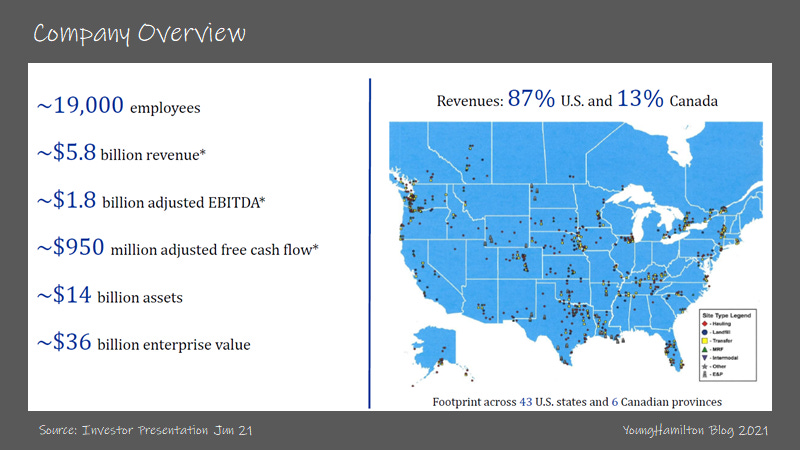

Waste Connections is the third largest solid waste services company in North America. The company services residential, commercial, municipal, industrial and E&P customers across 43 states and in Canada. Similar to other solid waste services companies, Waste Connections has grown through a series of acquisitions and organic growth (both price and volume). Waste collections services over 7M+ customers as of 2017 which is up from 3M in 2007.

Waste services is a predictable business because waste generation is largely driven by population growth. Municipal solid waste has increased by ~40% since the early 90s in the U.S. and the population of the U.S. has increased by 30% during that time period. If you look at how much volume is actually going into landfills, it’s actually been flat since the late ‘80s/early ‘90s as people are more aware of the environmental effects of waste disposal. There have been efforts to reduce the source of waste like reduction in package design, increased awareness of reusing items, and changes in industrial waste practices. And there have been increased efforts to divert waste to recycling, which as we’ll discuss later, has been met with mixed results.

There are broadly two sides to the waste services business, collection and disposal. Waste collection is a hyper local business with small, medium and large businesses competing largely based on price assuming that there is a minimum level of service quality. Collection services are very similar across competitors in general. Contracts are typically awarded to one of the many waste collection providers that service the local area and these contracts usually have annual price increases based on a predetermined formula (like indexed against CPI). Contracts that are up for renewal have fluid pricing terms and new companies can always bid for the business.

Waste disposal is also local and owning a landfill, transfer station or the materials recovery facility (for recycling) is required. The larger companies will typically own their own landfills so that they can capture the margin on their collected waste being disposed there (this is called internalization) but smaller companies will likely have to contract with the landfill owners to pay them for disposal rights (this is called tipping fees). There are also E&P waste specific landfills that only accept this type of waste and non-solid waste landfills that only accept construction and demolition industrial waste. Landfills require permitting, development and satisfying environmental safety measures. So it’s capital intensive.

For waste collection, Waste Connections owns and operates a fleet 9k+ of trucks and for waste disposal, the company owns and operates 90+ landfills in locations for their business operations. To put numbers to the different revenue lines, Waste Connections did almost $4B in collections revenues in FY20, of which was 41% commercial (a little lower than usual due to Covid), 38% residential and 21% industrial/construction. The company generated almost $2.3B for waste disposal in FY20, of which was 50% landfills, 35% transfer stations (sorting and moving of waste to other landfills), 4% recycling and 7% E&P.

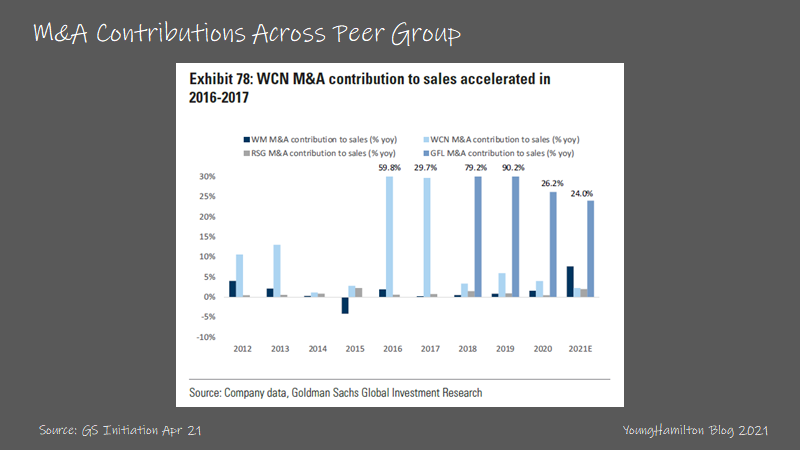

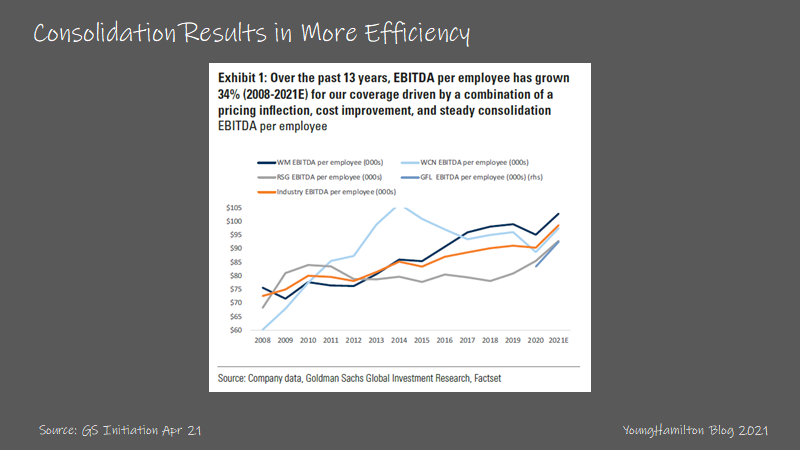

The market for solid waste services is over $65B annually and the top 4 public companies - Waste Management, Republic Services, Waste Connections and GFL Environmental - command over 50% market share. The smaller two companies, Waste Connections and GFL, have grown more through acquisitions in recent years, especially GFL. Consolidation in the industry and steady pricing/volume growth since the great recession of ’08 has led to improving EBITDA/employee for most companies.

There are two key differentiations that Waste Connections views set the company apart from its competition. The first is a culture that empowers employees to make key decisions for each local market. Waste Connections is operated in a decentralized structure, which allows decision making authority to be closer to the customer, which is important for a localized business. The district or site managers set sales goals and budgets for what’s need to achieve those goals. They also help identify key acquisition candidates and are responsible for integration post acquisition. This results in much lower employee turnover and incident rates vs. the industry.

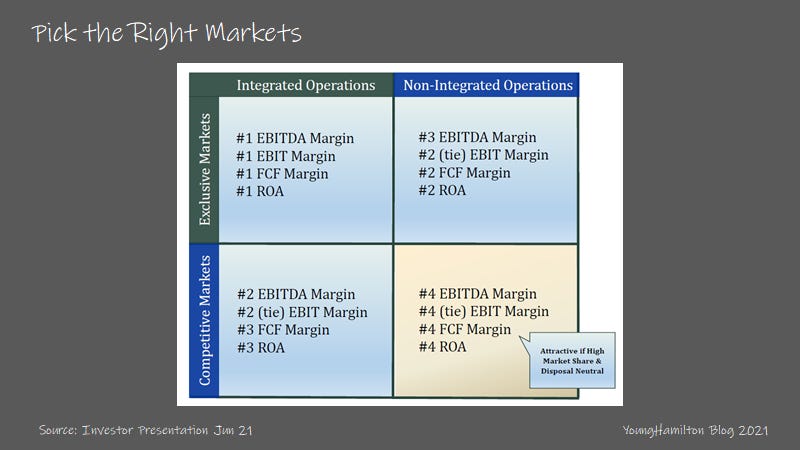

The second is targeting secondary or rural markets that have the potential for higher returns on capital. These markets are less competitive than large urban markets, which usually results in Waste Connections having high local market share. The company also targets franchise markets, which are long-term exclusive contracts that can last up to 15 years and grants Waste Connections the right to service all residential and commercial customers in that market. Exclusivity leads to much higher returns on capital even if the price/ton of waste collected is lower because route density (usually 33% more stops on a route) allows the trucks to have higher and more efficient utilization. Customer churn is also lower due to the long-term nature of the contracts and price increases are usually tied to CPI growth.

For competitive or urban markets, owning the landfill is quite important, not only for the internalization advantages but also because owners can charge the competition tipping fees, which could put pressure on how long these smaller players stay in the market. However, landfills require a lot of invested capital and the costs to operate a landfill are moving higher from environmental regulations that require plastic linings, leachate collection systems and methane recovery. Landfills have also become more scarce, with many smaller landfills closing down since the ‘80s. For a franchise market, oftentimes the municipality owns the landfills and offers the disposal fees at low enough cost where it doesn’t make sense to own the landfill.

Waste Connections roughly has 40% of its revenues come from franchise markets, 50% in secondary markets and 10% in competitive urban markets. Republic Services, the #2 player in North America, is skewed more towards urban with a 33%/33%/33% split.

Why is it a good business?

The solid waste services business is competitive at the local level, but it gets somewhat easier with scale. Small operators have a fleet of trucks that are typically not being fully utilized, unless they own an exclusive agreement in a market. These smaller operators usually don’t own their own landfills and as we’ve discussed before, it’s very important to own a landfill in a competitive market.

Goldman recently estimated that the top two players in a market controlled 77% market share within a 50 mile radius and typically owned the landfill in that local market. Trucking costs range between $0.15-$0.25 per tonmile, which would indicate a 50 mile trip adding $7.5-$12.5 per ton to the disposal cost to get the waste to a landfill outside of the region. (This also doesn’t account for the trip back). This compares to the average cost of $30 per ton for disposal costs if you don’t own the landfill. So for a smaller player, paying the local landfill owner tipping fees or transporting the waste to a landfill you own outside of the region are both a large hit to profitability.

But let’s say a small operator has an exclusive contract and there is no financial need to own the local landfill (i.e. it’s owned by the local municipality). The company will do very well on margins and returns on capital but how does that small company grow? The company can enter an adjacent region and enter a competitive market without access to its own landfill or the company can put up capital to acquire an existing business in adjacent regions. If the acquired company has an exclusive or franchise agreement in place, that would transfer over to the company.

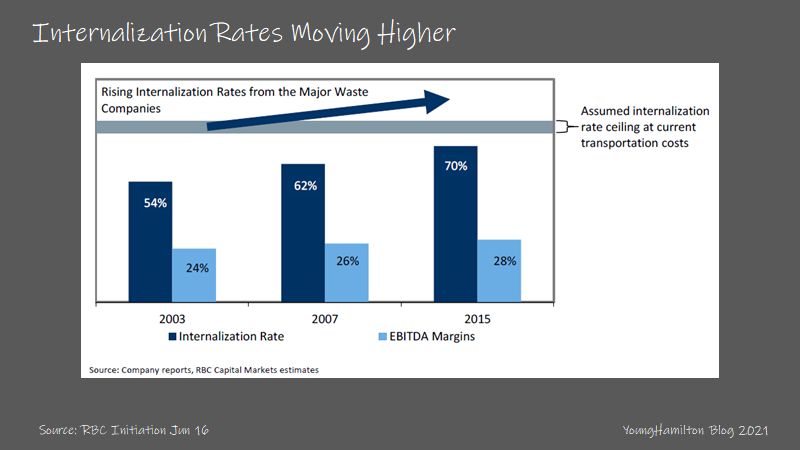

Larger operators benefit from typical scale advantages like purchasing power when negotiating for new trucks, back office and rising compliance costs spread across more regions, and being able to bid for certain municipal contracts that may require bonding (capital). But the biggest benefit may be access to capital to acquire landfills in certain competitive markets. Whether it’s through M&A or being able to construct from the ground up, landfills require lots of capital and the benefits to higher internalization rates usually mean margin improvement.

The solid waste services business has been good to the large operators over the past decade. More consolidation in the space has led to better price rationalization. Among the three largest publicly traded waste companies (Waste Management, Republic Services and Waste Connections), all of them have beaten the S&P500 on a 10 year basis and the performance dispersion among the three is small.

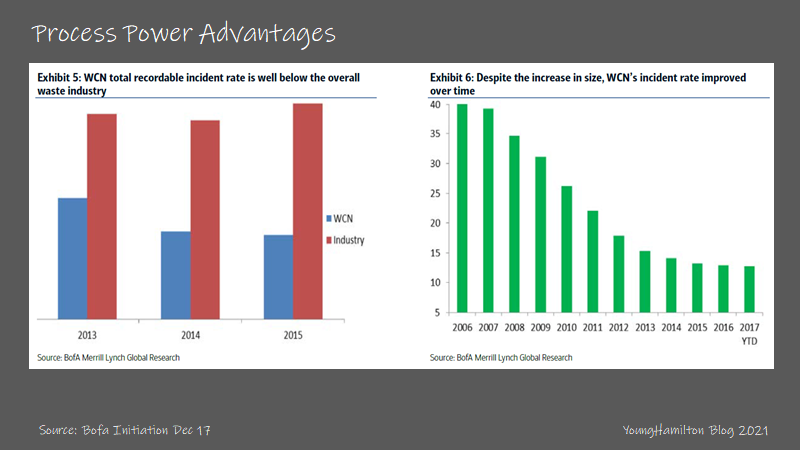

Specific to Waste Connections, the company benefits from process power. Waste services is the 5th most hazardous industry in America according the Bureau of Labor Statistics. In 2016, there were 34.1 fatal injuries per 100,000 workers for waste services and more than 6,000 injuries were nonfatal. Whether it’s the way the company empowers local managers to do make decisions, the low turnover rate, the safety training programs in place or the way key employees are incented, Waste Connection has a much lower incident rate vs. the rest of the industry.

At the company’s Analyst Day in 2017, there was an example given by Rob Nielsen, Regional VP of the Southern Region about a route that was voluntarily canceled by the company due to the danger for the driver during the collection process. The driver had to back the truck into an enclosure and climb out of the window to service the customer. The customer refused to change the enclosure so the company pulled out of that contract. That may be just one example, but it shows that the company values safety vs. revenues.

Returns on incremental capital?

Over the past 10 years, Waste Connections spent 44% of its capital on capex and 56% on acquisitions. If you include the merger with Progressive Waste in 2016, which was an all-stock deal valued at $2.67B, acquisitions make up 67% of the capital spent. Capex is typically spent on acquiring new trucks + maintenance of existing trucks and acquiring and expanding existing landfills and materials recovery facilities.

Average deal multiples were roughly 10x EBITDA in the years prior the great recession, but got pushed down to 7x-7.5x in the years after. In recent years, the multiples have moved back to 10x EBITDA. That’s the average multiple paid for high quality, large targets that typically have attractive franchise agreements or are vertically integrated. Smaller regional players usually go for 6x-8x EBITDA and tuckins go for 4x-6x EBITDA. Waste Connections has commented that the company is passing on 80%-85% of the deals they see because of the competitive bidding process. The company has stated that private equity usually wins those competitive auctions. Waste Connections tries to focus on sole sourced deals where they are the natural buyer.

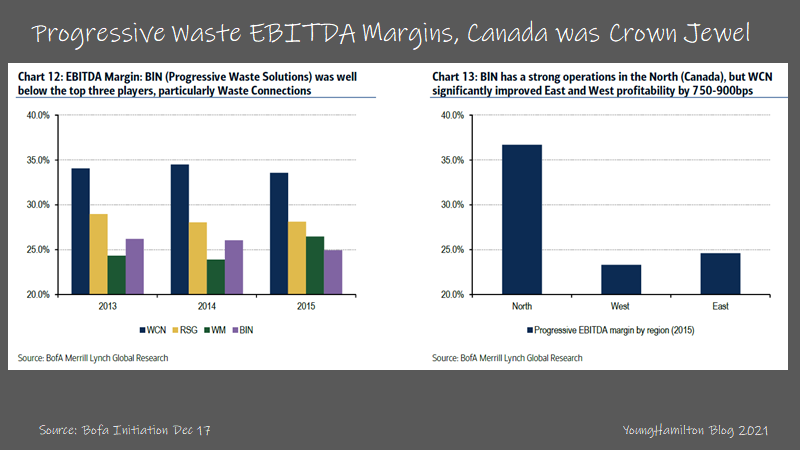

While Waste Connections acquires many companies every year (over 20 for the each of the past 3 years), the merger with Progressive Waste is probably the best indicator of whether the company is good at acquiring waste services assets. The deal was an all-stock transaction with a 70%/30% ownership split for Waste Connections/Progressive shareholders. Waste Connections was clearly the better run company, with higher margins and growth and lower employee turnover and incident rates.

At the time of the deal, the two companies were similar in terms of revenues, employees, vehicles and customers. However, Waste Connections had much better margins, lower landfill sites (due to not needing them in many franchise markets) and more exposure to E&P collection and disposal. Progressive had also underpriced many of its markets leaving many markets at low margins. Progressive had a much larger exposure to urban markets than Waste Connections.

The Progressive assets weren’t all poorly run. The Canada market was the crown jewel of the acquisition. EBITDA margins in Canada were 36%, much higher than Progressive’s other two regions at 23% for West and 25% for East. Furthermore, Waste Connections saw ample opportunity to improve efficiency and operations at Progressive post the deal close.

Waste Connections planned on rationalizing (through a series of divestitures and/or swaps with other waste service companies) about $225M in annual revenues (11% of Progressive) but still expected EBITDA to increase. This is because Progressive was running routes in certain markets that were operating at a loss. The company was also looking to lower incident rates and employee turnover while improving pricing. Waste Connections found that the initial changes were effective (incident rates decreased by 45%, employee turnover by 40% and margins increased 750bps) and that fewer markets needed to be rationalized than the original estimate. Ultimately $100M-$110M of revenues were rationalized and EBTIDA was increased by $15M.

We estimate that Waste Connections has achieved returns on incremental capital between 15%-19% over the last 5 years not including FY20. With the R360 acquisition in FY12 and the Progressive acquisition in FY16, the reinvestment rate has been elevated for Waste Connections for some time.

Reinvestment potential?

Waste Connections continues to reinvest in capex for new trucks and landfills. We would estimate that a good portion of this capex goes towards maintenance of the fleet + replacement of older trucks. Because solid waste volume does move higher with population growth, the fleet should get larger over time. The company would also require new fleet if a deal for a new region was won.

Capex needs to be invested for existing and new landfill assets as airspace gets consumed. Additional capacity is carefully estimated and permitted. As we mentioned before, the extra costs related to environmental concerns can be a burden. The company estimates the remaining useful lives of its landfills and even though the average years remaining may seem very high, we have to remember that landfills are only useful at the local level. This means that each region has to have landfills with plenty of useful life left for the company to retain its profitability in those regions.

The rest of the reinvestment opportunity will go towards future acquisitions. Waste Connections has very specific characteristics in mind when considering an acquisition target. The company would ideally aim to acquire franchise or exclusive market operators for a reasonable multiple. Waste Connections will pay more for an integrated company in a non-exclusive market because the landfill has strategic value. The company has been good about acquiring new revenue in the tune of 3%-4% annually (they’ve actually acquired ahead of this target recently).

Prior to the Progressive acquisition, Waste Connections estimated that there was $2B-$2.5B of revenues that the company can acquire from private companies. After the Progressive deal, that number moved up to $4B due to the larger footprint (especially Canada). If the company is acquiring 3%-4% annually, that is roughly $160M-$220M from FY20 revenues. Using the higher 4% estimate, the company should have 18 years of acquisition opportunity ahead of them.

With a reinvestment rate between 90%-100% and a return on incremental capital of 15%-19%, we estimate that Waste Connections has increased its intrinsic value 15%-17% over the past 5 years, excluding FY20.

What else is important?

Recycling opportunity

As awareness around the environmental concerns related to waste disposal has increased, recycling rates have also increased in the U.S. In 1960, just 6% of households recycled and that number has increased to 35% by 2017.

Recycling, in theory, should be profitable for waste companies as collections are done on the same route as municipal solid waste. However, in practice, profitability of recycling is heavily reliant on the price and sale of the recycled product. This is in contrast to solid waste disposal for which the landfill owner receives payment based on a pre-determined price for the volume of waste.

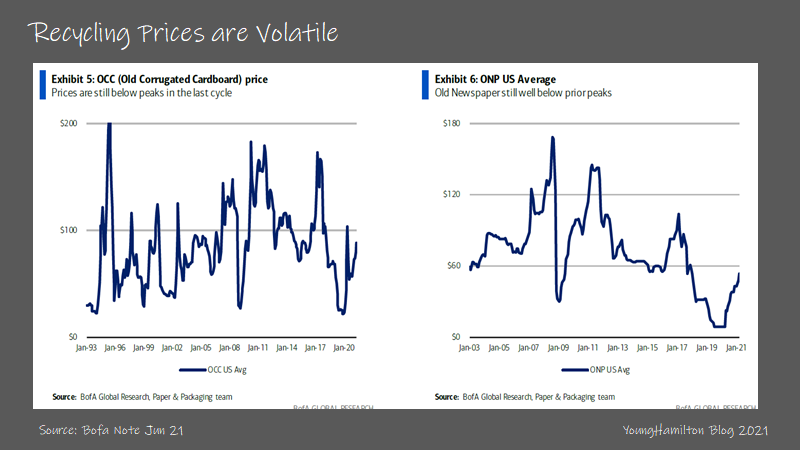

Most of the recyclables that are processed for resale are paper products and these products are shipped to customers mostly based in Asia. Over 55% of recycled paper is shipped to Asia and most of that is China. OCC (Old Corrugated Cardboard) and ONP (Old Newspaper) pricing is very volatile and so the profitability and returns on capital of recycling is also in turn volatile.

A materials recovery facility can have better returns than a landfill if the pricing of the recycled commodity is at a reasonable level. When pricing is good, the owners of the facilities can even pay other companies that collect recyclables and turn a profit. In the past, these facilities would pay $30/ton for recycled materials and spend another $60/ton to process the materials but would be able to turn a profit when OCC and ONP pricing were higher. Furthermore the capital required for a facility is much lower than a landfill. However, as prices have come down, many companies are now charging tipping fees to accept recycled materials.

Waste Connections views the economics of recycling unappealing (due to the volatility) and looks to limit exposure to this part of the market as much as possible. Of the big three waste companies, Waste Connections has the smallest exposure to recycling at just 1.6% of revenues.

Methane gas collection

Waste Connections and the other waste companies have begun to explore building out more methane gas collection plants for their landfills. Landfills generate the greenhouse gas which can be converted into a source of energy. The company already has recovery systems in 51 of their landfills to collect methane (and the largest plant in North America), which at current prices, generates high returns on capital.

Waste Connections is beginning construction on two plants that’s already gone through the approval process. Due to supply chain shortages for certain components, the completion of these plants may be delayed. The company expects them to be up and running by 2023 and in full utilization by 2024.

As an illustrative example of returns, we can analyze the economics of these two plants. They collectively will cost between $100M-$125M to build and generate between $75M-$100M in revenues with EBITDA margins of 70%, implying EBITDA of $52.5M-$70M. This results in a payback period of less than two years (or returns on capital of 55% at the midpoint). This is better than what the company has seen in the past, which is payback periods of less than three years.

Optionality

Acquisitions are always going to move the needle the most for the waste companies. The smaller of the large public companies, Waste Connections and GFL, have the largest upside opportunity in this regard because there will be less regulatory scrutiny over large deals.

As Waste Connections gets larger, the deals have to get larger to meet the 3%-4% revenue target and it may be difficult to find an acquisition that fits their criteria of franchise/exclusive + secondary markets or integrated operations in a competitive market.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!