Subscribe to AGB - One analysis of a good business every two weeks.

Alimentation Couche-Tard

Alimentation Couche-Tard is one of the largest convenience-store (C-store) operators. With over 14.2k stores (10k in North America, 2.7k in Europe, and 1.2k in Asia), Couche-Tard is the #2 player in the U.S., #1 in Canada and has a presence in many other major markets. The company operates just three brands - Couche-Tard, Circle K and Ingo - after unifying most of its smaller brands into Circle K starting in 2015.

Couche-Tard started as a single location in Quebec, Canada in 1980 and expanded throughout greater Canada via a series of acquisitions and new store buildouts. In 2001, the company entered the U.S. market through the acquisition of Bigfoot stores, which were located in the Midwest. Couche-Tard acquired Circle K just two years later, making it a formidable player within the U.S. market. By 2012, the company entered the European market though the acquisition of Statoil Fuel, which had locations in Norway, Sweden, Denmark, the Baltics and Russia. The company entered the Asia Market through various partnerships and licensing agreements for its Circle K brand.

A typical C-store is attached to a fuel station (with the exception of urban locations) and these two businesses contribute to the overall business model in different ways. The fuel business typically operates at lower margins (9%-12% gross margins for Couche-Tard), but drives traffic to the store, which sells merchandise for higher margins (33%-34% in the U.S. and Canada, 41-42% for Europe) due to the individual packaging and price mark-up for the convenience. Couche-Tard’s margins are consistently higher than the industry average due to its operational excellence and scale advantages. Gross margins for the fuel business tend to trend higher as a local market consolidates to one or few players as the sourcing and transportation of the fuel becomes more efficient and as pricing firms up with less competition, allowing for more dynamic pricing.

A C-store operator is selling convenience to its customers. With its small sq. ft. layout, C-stores represent the largest category (by store locations) of retail for many countries including the U.S. It’s estimated that 93% of consumers in the U.S. live 10 minutes away from a C-store and typically spend just 3-4 minutes per trip to a C-store. Consumers come for a quick fix of whatever it is that they’re looking for, usually at any time of day (most C-stores are open 24/7) and for many it’s age restricted products like cigarettes and alcohol. Over 90% of cigarettes, 97% of other tobacco products and 61% of all beer sales are through C-stores. Couche-Tard estimates that 85% of the items purchased at a C-store are consumed within one hour and 65% are immediately consumed.

As mentioned above, the store side of the business operates at higher margins, indicating that anything to increase traffic into the store is highly beneficial for operators. Currently for Couche-Tard, 25% of consumer trips to the store are for fuel only and 10%-15% of trips are for both in store and fuel. That implies 60%-65% of trips are for the store only, driven by the convenience factors laid out above.

Within the store, the highest margins products are ice, beverages, health and beauty products, prepared foods and snacks/candy. The age restricted products like cigarettes and beer have much lower margins between 15%-20%, but similar to fuel, these items drive traffic to the store. Cigarettes contribute to 40% of the store sales for Couche-Tard and the company has made efforts to increase traffic related to cigarette purchases. In 2018, the company introduced the Tobacco Club, which is a loyalty program that gives consumers special offers, and had 4M registered users in less than a year.

The C-store market is a highly fragmented in the U.S., dominated in Canada by Couche-Tard and a few major oil players, and is more mature in Europe and Asia. Couche-Tard has opportunities in most major markets due to its acquisition strategy and the scale of its balance sheet but the greatest opportunity still lies within the U.S. Couche-Tard’s market share is 5% in the U.S. and other large players like 7-Eleven (10% including the recent acquisition of Speedway), Casey’s (1.5%), EG America (1%) and Murphy (1%) are making strides to consolidate the market. Over 60% of the 155k C-store locations in the U.S. are owned by single store operators that usually have a partnership or licensing agreement with a major oil provider.

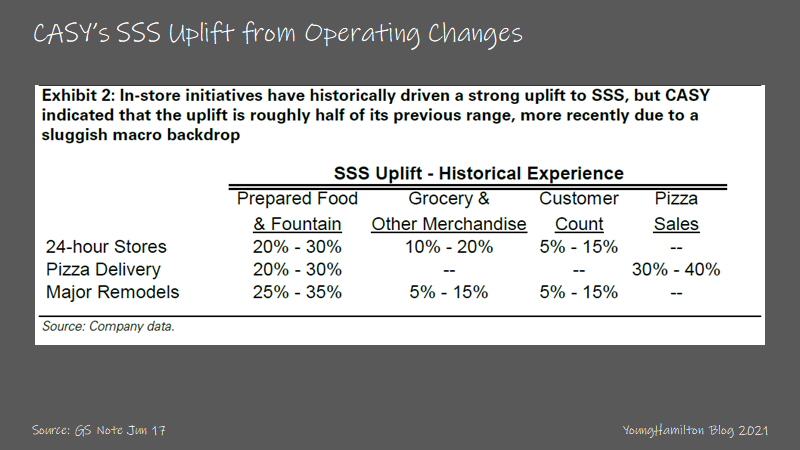

Operators in the U.S. have many opportunities to improve the consumer experience. Relative to C-stores in the Europe and Asia, the U.S. still lags behind in prepared food offerings and ancillary services. Couch-Tard is making the effort to improve this through its Fresh Foods Initiative (FFI). This means offering prepared foods usually through a partnership with a third party vendor with foods prepared specific for the region the store operates in. Operationally, it means the company turns over food much more quickly, taking delivery much more frequently, has to invest in new equipment ($75k-$100k per store), and has to train employees to deal with spoilage and general food safety. For stores that haven’t undergone FFI, food contributes to less than 18% of revenues. For stores that have undergone FFI, food contributes more than 25% of revenues. Couche-Tard wants to increase this percentage meaningfully over the next 5 years. Casey’s has a much larger fresh food operation with one of the largest pizza operations in the U.S. (5th in terms of market share).

Over the past 10 years, 70% of Couch-Tard’s growth has come from acquisitions and 30% from organic sales growth and new store builds. Same store sales growth for its merchandise revenues have averaged 2.5%-3% across geographies and just 0.5%-1.7% for its fuel revenues. This implies that while there have been great efforts to improving the operational performance and efficiency of the store business, growth really does come from new units, whether they are acquired or built organically.

The company has a 5-year goal of doubling EBITDA from FY18 to FY23 and is aiming to have a balance between acquisitions and organic sales growth. The path to growth is by taking market share in the U.S., expanding opportunistically in Europe and Asia and cutting costs in Europe. The EBITDA target is achievable, but it’s highly dependent on whether Couche-Tard can continue to acquire large operators at reasonable prices and avoid regulatory scrutiny. 7-Eleven’s recently closed acquisition of Speedway did get increased scrutiny from the FTC, which could imply that future large acquisitions in the U.S. are less likely to materialize anytime soon.

Why is it a good business?

For a single store operator, C-stores are not great businesses. On the fuel side of the business, margins are thin and growth is very low. There is also the overhang of more EV adoption every year which would imply fewer ICE cars to make trips to C-stores for fuel. Furthermore, as a single store operator, negotiating leverage when sourcing fuel is minimal. The store side of the business is much better, but still operates at lower margins than a QSR restaurant or other retail franchise concepts. The saving grace is that the cost to acquire a c-store operation is much lower, so the ROIC is reasonable.

The C-store business gets much better with scale. The fuel side of the business naturally becomes more profitable as a local market consolidates. The C-store operators have much more leverage when negating for fuel sources and it becomes easier to firm up on pricing. As for the store business, larger C-store operators can invest to offer more higher margin products like fresh food and beverages as well as offer loyalty programs to increase brand equity with its customers. Large operators can also offer private label products, which tend to have higher margins. Couche-Tard’s private label business started in 2015 and quickly became more than 5% of revenues by 2017.

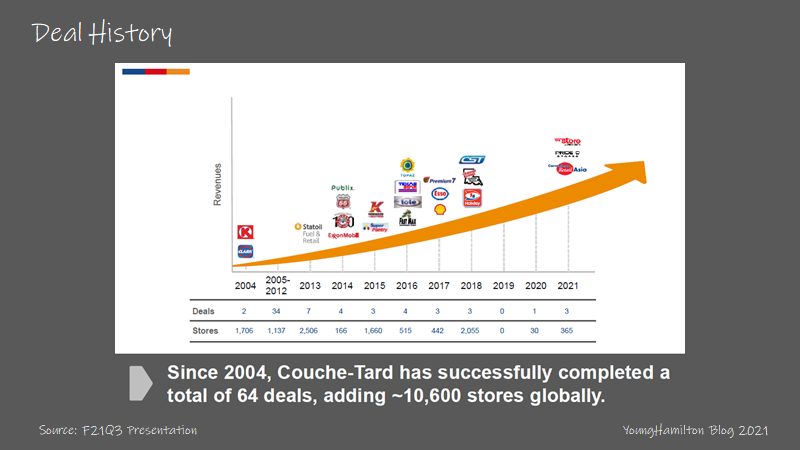

Specific to Couche-Tard, the company benefits from its acquisition engine, decentralized organization, culture of iterative improvement. From FY11 to FY20, the company has acquired over 7,500 locations globally from the efforts of its inhouse acquisition team. The company rarely uses outside bankers to evaluate deals and upper management personally spends time at locations to determine what to improve and what to copy from an acquisition target. (The company calls this reverse synergies). Case in point, when Couche-Tard acquired Circle K and Holiday, the management team toured most of the stores prior to closing. This is part of the reason that synergy goals usually make up more than 25% of the target company’s EBITDA.

The company’s decentralized organization allows business units to have a higher level of autonomy than at other companies. There are 29 distinct business units within Couche-Tard that are responsible for their own P&L, which incents managers to maintain Couche-Tard’s cost-conscious and ROI driven culture. Furthermore, when the company acquires a large target, different business units can help with the integration process, allowing for quicker realization of synergies.

Couche-Tard is consistently improving its store layouts and offerings to optimize for each market. As mentioned earlier, the Fresh Food initiative is likely the most impactful in the near-term. As the company grows its food sales, margins should follow suit and move higher. Within Europe, the company already generates a higher mix of its revenues from food and merchandise margins in Europe are 8%-9% higher than that of the U.S. stores.

Couche-Tard is also expanding its omni-channel offering by partnering with delivery operators like DoorDash and UberEats. The company also rebranded many of its smaller brands like Statoil, Mac’s, Kangaroo Express, Corner Store, On the Run and Topaz under the Circle K brand in 2015. This allowed the company to more effectively run national advertising campaigns, increase private label penetration and grow brand awareness.

Returns on capital?

Over the past 10 years, Couche-Tard has spent 66% of its capital on acquisitions and 45% on capex, offset by 12% of sales of assets and businesses. From a location perspective, over 7.6k units have been acquired, 2k units built out and over 3.7k units sold or closed during this time period. The company also converted almost 450 stores from license to company owned. Including the conversions, Couche-Tard has averaged adding 636 stores annually since starting FY10 with 5.4k stores.

Couche-Tard regularly looks to acquire and sell locations, optimizing its portfolio of assets for ROI and competitive positioning. Concentration in local markets can improve margins meaningfully. The company’s licensing effort in international markets as helped them gain a beachhead in many markets that have established competitors (like in Asia where 7-Eleven and Family Mart have much larger networks of stores). Couche-Tard has been acquiring the stores of its license affiliates at the average rate of 45/year and has recently acquired the Circle K stores from Li & Fung in Hong Kong.

While the ROIC for new store builds are not well disclosed, we do know that management’s hurdle rate is 15% return on capital. The build vs. buy calculation is interesting because there is still ample opportunity to consolidate the U.S. C-store market. Just as a reference point, from the Susser Holdings (acquired by Energy Transfer Partners in 2014) presentation from 2011, Susser’s unlevered ROI for new store openings ranged between 18%-24%.

Similar to Boyd Services Group’s roll-up of the U.S. collision repair shops (you can read our write-up on Boyd here), the ROI for single store acquisitions should be higher than acquiring operators of many regional stores. That’s because single store operators likely have (1) less leverage in M&A negotiations, (2) lower margins both in store and for fuel, and (3) opportunities to increase penetration in food services, private label and loyalty programs. The likely higher return profile is offset by having to do many deals to reach scale within a market. Acquiring a large operator would provide that benefit with one deal.

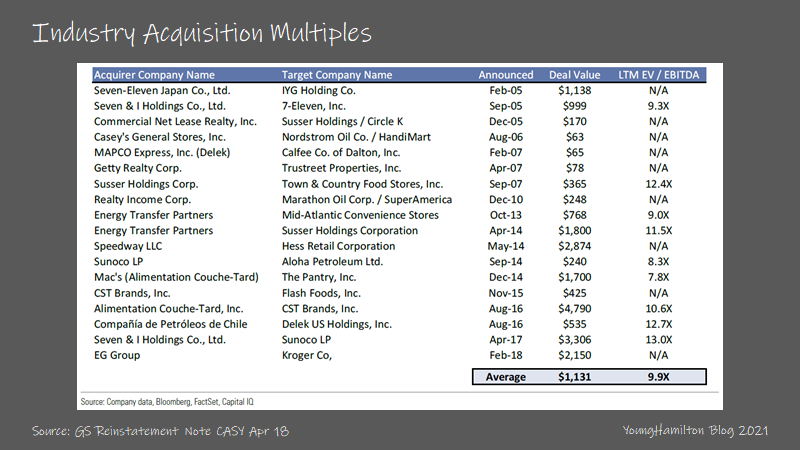

The industry average M&A transaction multiple for the larger C-store operators are not unreasonable at 10x EBITDA before incorporating any synergies. The multiple for Couch-Tard’s acquisition for CST Brands was 10.4x trailing EBITDA, but the multiple was much lower after incorporating synergies. With over $215M in synergies, the implied multiple paid was 7.6x, implying a return of 13%.

Couche-Tard aims to achieve synergies of at least 25% of the target’s EBITDA prior to doing a deal. This has allowed the company to be very effective in M&A, usually paying down debt quickly from the cash generated by the acquisition target. Historically, the company has outperformed its original synergy targets for many of its large deals:

Holiday Stations: original target $50M-$60M, on track for >$60M

CST Brands: original target $150M-$200M, achieved $215M

The Pantry: original target $85M, achieved $125M

Statoil Fuel: original target $150M-$200M, achieved >$200M

We estimate that Couche-Tard generated between 12%-18% returns on incremental capital over the past 5 fiscal years. Remember that the company operates on an April fiscal year, so FY20 included less than one quarter of the economic impact from Covid.

Reinvestment potential?

For Couche-Tard, the most impactful reinvestment opportunities are the consolidation effort in the U.S. and opportunistic M&A in Europe and Asia. If the regulatory bodies don’t impede future medium sized acquisitions for the C-store consolidators, the company can make good progress towards its growth target of doubling EBITDA from $3B in FY18 to $6B by FY23.

The company has stated that it plans to even out its growth between organic and acquisitions (vs. prior 30%/70% split), but it may be difficult to achieve its 5-year growth target if that were the case. New store buildouts are difficult to manage with scale. Couche-Tard has historically opened an average 200 stores per year and if the company were to continue at that pace for the next 2 years, they would come up short of their EBITDA target (assuming it’s a 50%/50% split between organic and acquisitions).

On the M&A side, there are opportunities to consolidate the smaller operators, but the company has to be judicious about price. Within the U.S., single store operators make up 62% (2019 data from NACS), 2-10 store operators 3%, 100-500 store operators 5% and 500+ store operators 20% of the market.

With a reinvestment rate between 65%-85%, we estimate that Couche-Tard’s intrinsic value had increased 10%-12% annually over the past 5 years.

What else is important?

Norway Laboratory

One of the largest overhangs for the C-store operators is the eventual impact of EV adoption. Consumers that drive EVs have the option to charge at home or at stations located at various types of commercial establishments (office building, mall, hotel, strip mall, single location retail, etc.). This would imply that fuel margins would be negatively impacted from lower volumes and traffic to C-stores would come down as well.

In preparation for this potential outcome, Couche-Tard is experimenting with EV charging stations in Norway. Norway is the leading country for EV adoption over 50% of new cars sold are EVs due to high subsidies. The company has a partnership with IONITY (JV of BMW, Daimler, Ford and Volkswagen) and others to set up charging stations for Couche-Tard locations. The company currently has over 500 chargers installed.

So far the data trends are somewhat positive. Customers are visiting the store more frequently during a charging session vs. when getting fuel and staying longer for each trip (20-25 minutes). We’ll have to see if store visits related to charging changes as the charging technology gets better and times spent is reduced over time.

Carrefour acquisition

In early January 2021, it was reported that Couche-Tard was in talks to acquire Carrefour, a leading grocery and C-store operator in France and Latin America. Carrefour has almost 13k locations of which 60% are C-stores, generally without a fuel business on site.

The market soured on this deal (stock was down 10% on the day), because the implied purchase price was quite large ($20B) and grocery tends to be a much more competitive market with thin margins. The supply chain and operational knowhow required to run grocery stores is much different from running a regional collection of C-stores. The company viewed the differences in business model to be an opportunity to strengthen Couche-Tard’s capabilities in procurement, supply chain, e-commerce and private label.

Just a few days later, the acquisition talks ended without a deal because the French government was opposed to it. However, the two companies did reach an agreement to examine opportunities for operational partnerships in the future.

The attempted transaction showed that the company was willing to take calculated risks outside its core business of C-stores, something that could be viewed as style drift. It’s something to monitor going forward.

Optionality

Expansion into QSR

Couche-Tard has alluded to the fact that it is willing to expand into other retail categories in a meaningful way if an acquisition opportunity arises. Quick Service Restaurants are likely the area that the company is looking at the most. QSR brands that are run well tend to operate at high margins and the brand loyalty (and resulting foot traffic) is strong.

The company already operates 300 quick service restaurants units. Subway at 250 locations is the largest branded QSR units the company operates, but there is no room for expansion there. The brand density is too high (meaning any new store will cannibalize an existing store meaningfully) and the brand is lagging behind other growing QSR concepts.

As an extension of its Fresh Foods initiative, the company may look to incubate new QSR brands inside of the Circle K banner and spin out stand alone locations if there is enough traction from customers. This provides the upside for additional reinvestment opportunities without much upfront costs or risks taken by the company.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!

Wonderful write up. As with all of your write ups it is not only informative about the company covered, but provides great education of the market segment itself. Thank you!!