Subscribe to AGB - One analysis of a good business every two weeks.

Bright Horizons Family Solutions

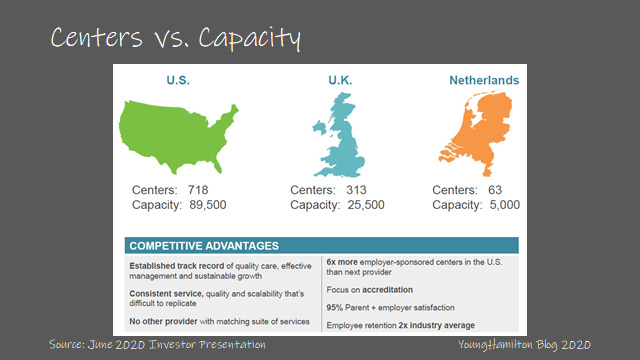

Bright Horizons is the largest employer sponsored provider of child care in the U.S. by a factor of 6x versus the next largest competitor. The company also operates centers in the U.K. and Netherlands. Bright Horizons has ancillary employer sponsored services such as (1) back-up care services in its centers and in homes, which has done well during the recent government mandated shutdowns and (2) education advisory services to the employees and relatives of the employer sponsors, which is mainly comprised of tuition assistance and college coaching.

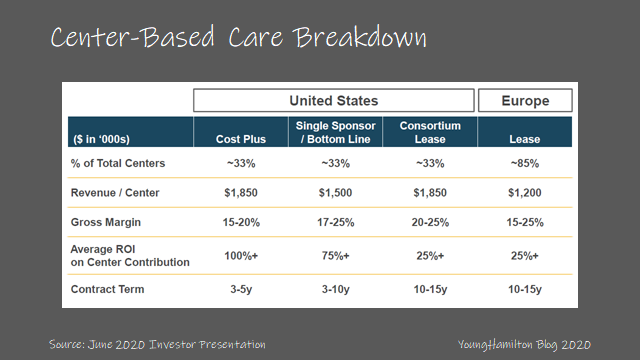

Bright Horizons provides services that are part of an employer’s benefits package to its employees, some of which is tax advantaged for the employer. Its center-based care business is 2/3 employer sponsored and 1/3 supported by a consortium of sponsors around a location. The better part of the business is the employer sponsored centers because the development capex and maintenance costs of the facility are paid for by the employer. Bright Horizons manages the center either at a cost plus model where the company earns a management fee from the employer sponsor or at a bottom line model where the company runs the facility for P&L. The returns on capital for the cost plus model are above 100% and greater than 75% for the bottom line model. In both cases, the employer typically provides a subsidy to its employees to encourage enrollment.

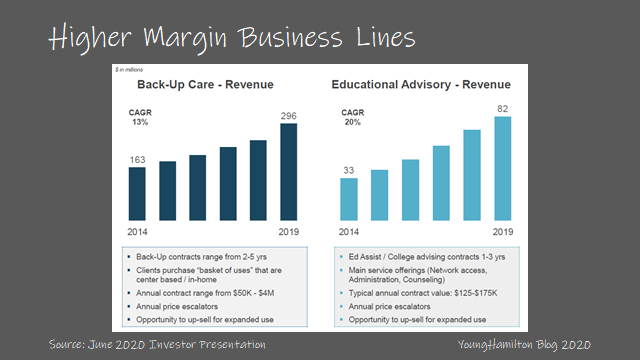

The two ancillary business segments, back-up care and educational advisory, are also employer sponsored. The back-up care business is meant for employees that have an emergency child care need and can either utilize a local center or opt for in-home care. This business is asset light because the centers are already built-out and in-home requires no capital spend. Bright Horizons can offer a better service than its competitors from its scale advantage because employees can elect back-up care at a different center from their primary location. Ed advisory is a low-touch, mostly online model, which scales very nicely. Ed advisory also takes advantage of the tax benefit for tuition reimbursement that employers can give to employees.

The center-base child care market is fragmented with leading companies like KinderCare Education, Next 40 and Learning Care Group leading the way with 22%, 20% and 13% respective market shares. Bright Horizons has 16% but it is the only company at scale that focuses on employer sponsored center-based care. There are natural tailwinds for the industry such as the increasing labor force participation rate of women in the workforce.

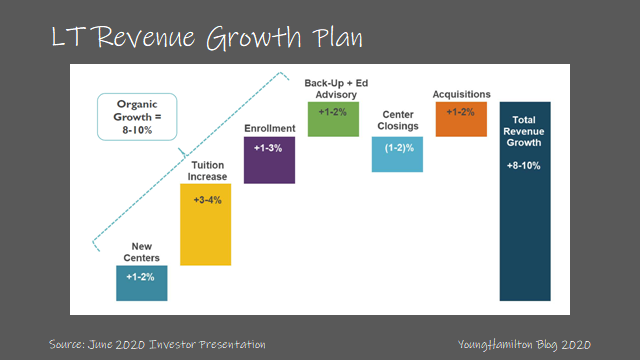

The LT revenue growth model for the company is 8%-10% annually comprised of:

1%-2% coming from new center openings,

1%-3% from enrollment increases (capacity is usually between 70%-80%),

1%-2% from back-up and ed advisory,

1%-2% from acquisitions,

3%-4% from tuition increases,

offset by 1%-2% from center closings.

At first glance, it may seem like the business has pricing power and perhaps to a certain extent it does because customers are reluctant to change providers based solely on cost if a child care arrangement is working for them, but Bright Horizons doesn’t actually benefit much from the increase. The 3%-4% covers the rising cost of labor and while wages are increasing, so will prices. As wage growth comes down from a softening economy, Bright Horizons may have difficulty keeping up with 3%-4% increases because enrollment may be soft as well. This is evidenced by the lack of operating leverage in the center-based care business.

Why is it a good business?

On average, center-based child care is not a good business. The cost to open a child care center is high (anywhere between $500k and $1M) and returns on investment are low due to thin margins (high labor costs) and high customer churn rates. Convenience, cost and safety/quality of care are most important to the customer. Normal life events such as moving, employment status of the primary care taker and changes in income can all impact enrollment.

As a business, there are few lasting competitive advantages for a center-based childcare company, even with scale. Operating leverage only occurs with overhead expenses, which is a small percentage of the overall cost structure. There are very few synergies with having site density around a city center or urban/suburban area other than brand recognition. Returns on capital are low, so self-funded expansion is hard to come by. The industry is fragmented for many reasons.

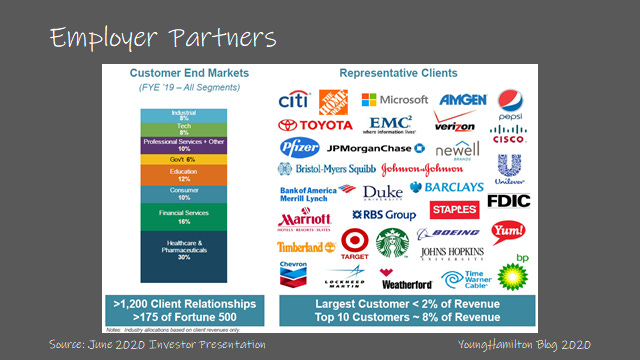

What makes Bright Horizons different from the rest of the industry is its employer sponsorships. Because employer sponsors want to provide the benefit of subsidized child care to their employees but don’t want to actually run a child care center, Bright Horizons fills a need. And with its strong reputation of building and running high quality child care centers, employers can have peace of mind with handing off this benefit to Bright Horizons. The company has over 1,200 client relationships in total and over 175 of the Fortune 500. And employer sponsors from all industries are represented, with Healthcare and Financial Services being the largest.

The employer sponsor relationship is a cornered resource and the highest returning use of capital for the business. The cost plus and bottom line models that are employer sponsored are more consistent in enrollment trends and have low capital requirements because the sponsor covers almost all of the cost. Employees typically get a subsidy for child care between 10%-40% and priority when signing up for care. While most employer sponsors will only require one or a few centers next to its largest employee hubs, the other two services that Bright Horizons offers is applicable to all employees of the sponsor.

The key to this business being a low to mid-teens compounder is growth of the sponsor model and the attachment rates for its other two services. As mentioned before, the back-up care segment is asset light and has very high returns on capital due the situational nature of the need for care. Results from this segment for F20Q2 showcases this. Revenue growth for the back-up care segment was 94% y/y and operating margins were 55%! However, the situational need for this benefit means that the overall size of this market is much smaller than the center-based care business, but the returns and growth should outpace it for some time.

Bright Horizons also benefits from scale economies for all three business segments. For the center-based business, the fixed overhead can be spread across a larger base of centers. Furthermore, the company can pass some of that scale benefit to its employees, thereby reducing employee churn at the centers. The company has half the industry turnover for its child care employees at 25%, but there is still room for improvement. But the largest benefit from achieving scale in a certain geography is the ability to offer back-up care services and to push its ed advisory business, which has the highest incremental margins due to the online nature of the product.

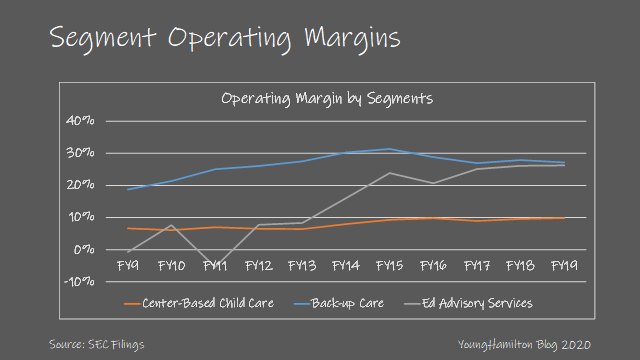

This is evidenced in the company’s segment operating margins. The center-base child care segment has achieved steady margins between 8%-10% over the past decade while back up care was much higher between 20%-30% and ed advisory exhibited increasing profit margins from 0% in FY09 to 25% in FY19. The overall EBITDA margins of the company have improved as the two ancillary business have grown faster than the core center-based business. EBITDA margins have increased from 14% in FY10 to over 18% in FY19.

Returns on capital?

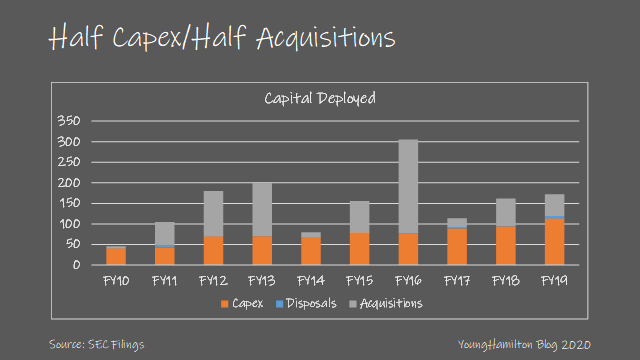

Since FY10, Bright Horizons has spent approximately half of its capital on capex and the other half on acquisitions. The returns on total capex have returned between 18%-23% on average. While the company doesn’t disclose the breakdown between maintenance and new center capex (unlike Vail Resorts, which has a nice breakdown in every Form 10-K), we can estimate that maintenance is a large portion of annual capex. This is because the capex growth has high correlation to revenue growth and it doesn’t fluctuate much year to year. Furthermore, because more than half of the company’s child care centers are sponsored, opening and maintenance of these locations are paid for by the employers.

A cost plus model center has high returns on capital because almost no capital is required to build or maintain the center. Instead, Bright Horizons gets a management fee from the sponsor, while the sponsor covers all costs including labor. Similarly, a bottom line model center also has high returns since there is no capital required. The only difference is that Bright Horizons runs the center for profit and covers most costs, which includes labor. A consortium center has much lower returns on capital, because of the capital required and the lower consistency of enrollment and cash flow margins.

Acquisitions have been less accretive but the capital returns are decent, nonetheless, because of the attractive multiple paid. Most existing child care centers are not growing and suffer from low margins due to lack of scale. Bright Horizons has been able to acquire centers in the 5x-7x EBITDA range, or 14%-20% returns. Acquired businesses (even those at scale) don’t have the infrastructure or the sponsor relationships for back-up care or ed advisory businesses, so they are typically dilutive to Bright Horizons’ margins.

The business as a whole returns roughly 18%-23% on average, with acquisitions being dilutive to returns. So why does that company do any M&A, especially when the typical acquisition target doesn’t have an employer sponsor relationship attached? The answer is that acquisitions are used to achieve scale or density within certain geographies. The company can then leverage the newly acquired scale to one day get employer sponsor relationships and eventually sell its back-up care and ed advisory services. The higher margin businesses don’t come into play unless there is an established network of child care centers in place.

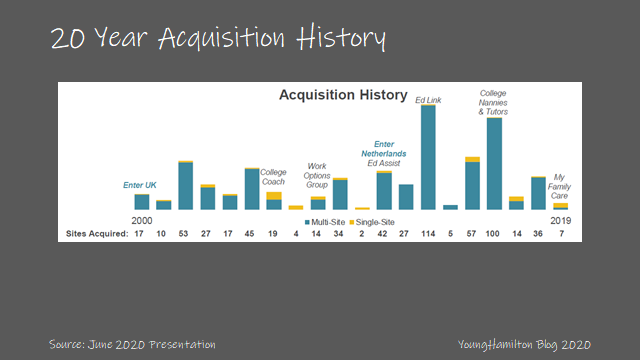

If you look internationally, 85% of the centers are under the lease based model. These are typically smaller centers in urban or dense population areas that contribute dilutive gross margins and returns. However, this is the way that Bright Horizons has initially expanded internationally. Both in the U.K. and the Netherlands, the company acquired an established player to build its brand and add on ancillary services. So far, the ed advisory business doesn’t exist internationally. There is an opportunity to offer this benefit to employees in the future once Bright Horizons establishes more sponsor relationships in those regions.

Reinvestment potential?

Bright Horizons has a large runway for growth, but the challenge is to find the highest returning capital investments. Employer sponsorships should be the first priority for the company as these new relationships provide an opportunity for all three business segments to grow with little capital required from the company. Of the 13,000 employers that employ over 1,000 workers in the U.S. and the U.K., Bright Horizons has 1,200 relationships or 9.2%.

The second priority should be to expand into back-up care and ed advisory services once the employer sponsor relationships have been established. While both business segments have grown nicely throughout the past decade, only 25% of Bright Horizon’s partners subscribe to more than one of the company’s offerings. That means there are over 900 relationships that can add back-up care or ed advisory to their benefits packages to its employees. Studies have shown that offerings such as child care, back-up and tuition assistance improve employee retention and these subsidies are tax advantaged for the employer.

The third priority should be growing the ed advisory business internationally. Through its online platform, Bright Horizons should be able to achieve significant margin improvement at scale. Starting in FY10, the operating margins of this business segment was 0% and has improved to over 26% in FY19. Employers in the U.S. spend $18 billion per year on tuition assistance and more of that can be managed by Bright Horizons. The segment is currently a ~$85 million revenue business and the next largest competitor is doing $10 million in revenue.

The last priority should be expanding its lease based centers (organically and through acquisitions) if it gives the company a larger strategic footprint in a certain geography. From a TAM perspective, Bright Horzions operates almost 1,100 centers within the U.S., U.K. and the Netherlands. Capacity in those geographies is estimated to be 120,000 centers, which implies Bright Horizons has less than 1% of the TAM. However, we will note that not all child care centers are worth operating.

The company reinvests an average of 65%-80% of its capital each year into the business. Some years can be acquisition heavy years, so this is lumpy. With capital returns between 18%-23% on average, we estimate that intrinsic value of the company compounds between 12%-15% per year. The key to the higher returns in recent years is from the lower tax rate from the Tax Cut and Jobs Act and the growth of the back-up and ed advisory businesses.

What else is important?

How does Bright Horizons perform during recessions?

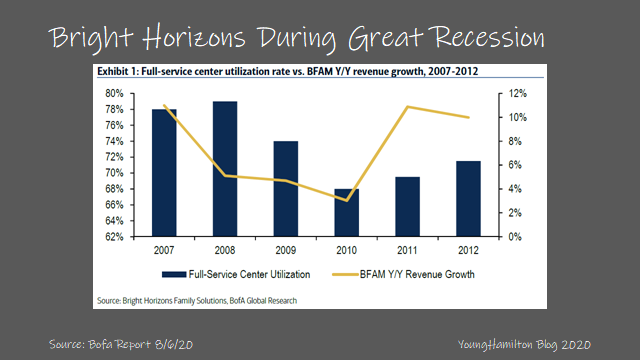

While the company wasn’t public during the great recession, we have a sense of how the company performed. Utilization rates at its centers dropped from 79% in FY08 to a low of 68% in FY10. Utilization rates have improved since FY10 back to the 70-80% range prior to the recent Covid related shut downs.

Revenues still grew nicely through the recession from ‘08/’09 due to the sponsor model providing a cushion during downturns (because employees still need child care and the monthly subsidies are a large benefit) and the company was still able to raise prices. While the employment market was soft during the recession, the company chose to still raise pay during the down turn to maintain consistency for its care providers. As we mentioned before, the business has some pricing power, but most of benefit goes to the employees in the form of raises.

Covid impact

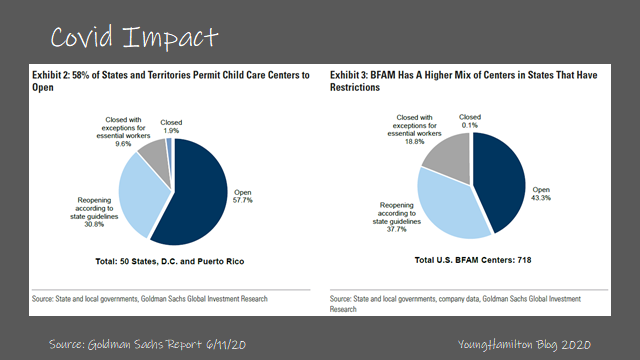

Government mandated shutdowns have resulted in Bright Horizons closing many of its locations. While child care centers were considered to be essential by many states in the U.S., employers that shut down offices and implemented work from home policies chose to temporarily close the onsite locations. The sponsored locations that remained open were near healthcare centers, which allowed many parents in the healthcare field provide care for Covid infected patients. Bright Horizons was able to keep margins healthy even during the shutdown due the high variable cost nature of its operating model.

Since the initial wave in March, many states have reopened for business and Bright Horizons expects to have 3/4 of its locations reopened by the end of 3Q. The back-up care business had very strong results during the shutdowns as child care services were still needed in-home. Bright Horizons’ large network of care providers (even though most centers were closed) allowed them to grow this segment by 94%. To showcase the scalable nature of this business segment, operating margins were 55% in 2Q, the highest ever for the segment. Ed advisory also had a great quarter, still growing 5.8% with 23.5% operating margins.

Optionality

Geographic expansion is the largest call option for the company. Regions such as Singapore, Hong Kong, France, Germany and Australia have been mentioned to either have a tax advantage for employer sponsored child-care or some sort of subsidy directly from the government. We have to remember that a typical acquisition will not come with employer sponsored centers, so Bright Horizons has to establish those relationships after entering the market. So far, Bright Horizons has been able to establish a few partnerships but over 85% of their International centers are under the lease model. The next step would be then to offer back-up care and ed advisory to its newly established employer sponsor partners, which is much more scalable and margin accretive.

Other acquisitions like Sitter City also have option value. Sitter City is an online marketplace that brings child care providers and families together. The site does its best to verify and vet child care providers to ensure quality of product. But the business is small and doesn’t add a material amount to earnings. Acquisitions likes these can provide new avenues for revenue and earnings growth if they can successfully leverage the footprint and employer partnerships that the company has already established.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter (if you haven’t already) and share with anyone that would find it valuable. Thank you for your support!