Subscribe to AGB - One analysis of a good business every two weeks.

Equinix

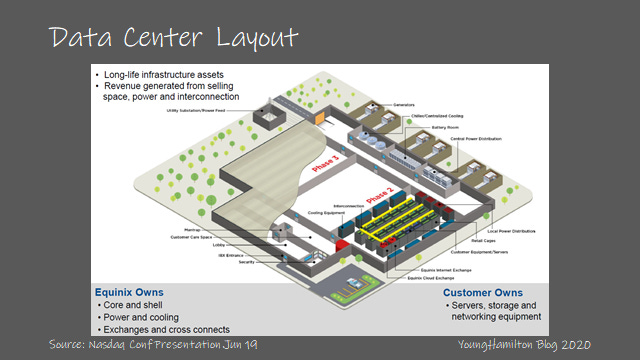

Equinix is the largest vendor neutral, multi-tenant data center company. That may seem like a lot to unpack but it’s not that complicated of a business model. Equinix constructs buildings (land leased or bought) in key real estate locations for third parties (network service providers, enterprises and cloud providers, etc.) to house some of their data center hardware in server cabinets. Equinix provides the building, power, cooling, and connections to the Internet. Customers provider their own compute, storage and networking hardware. This customer relationship is called colocation and it’s the bulk of Equinix (and other data center companies’) revenues.

An Equinix colocation customer typically rents space in the data center by the cabinet which costs between $1,500-$2,500/month depending on location (region is a large determinant of pricing), the number of cabinets rented and how many services are layered on top. Equinix data centers average ~1,500 cabinet capacity and have utilization rates in the 75%-85% range, lower than many of its competitors due to its growth in opening of new data centers. A data center at steady state has close to 90% utilization.

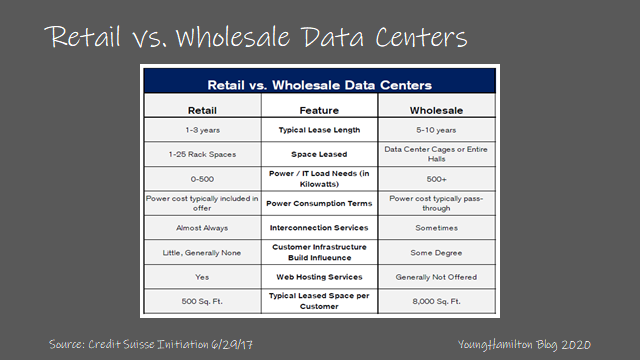

Within the colocation business model, there are two types of data centers. There is the Wholesale model and the Retail model – Equinix is mostly retail. The key difference is the amount of space that is leased to a single customer, the length of the lease and the terms for power/cooling, etc. The Wholesale model has fewer large customers that take up the majority of the cabinet space within the data center, which would imply more clarity around future cash flows and the return calculation for building a new data center location. However, the better model is the Retail model, which has many customers per data center at various sizes and offers a key differentiator for the data center company – interconnection.

Interconnection is a direct connection between the servers of different entities within the same data center location. This matters because Internet peering is so important for latency reduction. For example, if you watch Netflix as a Comcast Internet user in Philadelphia, having that feed broadcasted from a data center in Houston is not going to be a great experience. Instead, there are many data centers that have Netflix content on them and finding the closest server will usually result in the best user experience. Security is another important benefit from a direct connection (vs. connecting via the public internet).

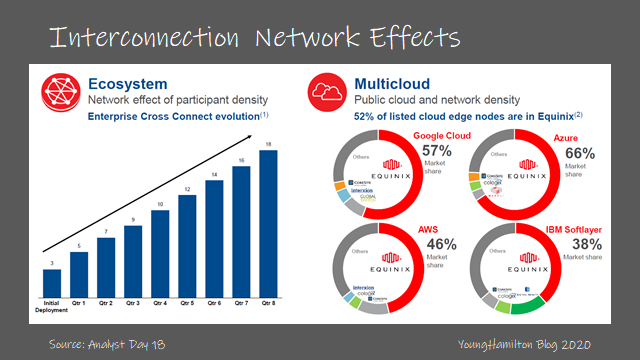

So what started as gaining access to network on ramps at different data centers around the world has evolved into many different entities wanting close and direct connection to other networks. For example, public cloud (AWS, Azure, Google Cloud) has grown so much so quickly that having an on-ramp to public cloud providers’ networks is also sought after by many customers. So the number of interconnections and cross connections continues to increase for each participant in the data center, and Equinix stands to benefit from this trend.

Equinix has also recently decided to participate in the wholesale data center model specifically targeting the needs of the cloud vendors. The company is doing this through a JV with the Sovereign Wealth Fund of Singapore. Equinix benefits from being able to manage the data centers that service these cloud vendors while also being able to offer the company’s interconnection services. But the company doesn’t have to fully bear the cost burden of building out these lower returning wholesale data centers.

Equinix is the largest third party data center provider at almost 20% market share, followed by Digital Realty near 14% after its acquisition of Interxion. Here, size is the advantage, because at scale Equinix is able to choose to run most of their data centers in the Retail model. As a smaller player, new data center builds may be influenced by a large customer, but this reduces the potential for interconnection within the data centers, thereby reducing profitability.

Key geographical locations are vital to a data centers competitive position relative to others. Equinix acquired Verizon’s data centers for $3.6B in early 2017, or 15x EBITDA, which is on the expensive side. For the high price, Equinix acquired the 29 data centers and the corresponding colocation customers, but they also got key geographical points of presence in Miami, Florida (hub to Brazil and the rest of Latin America) and the Culpepper Data Center asset in Virginia (hub to many government agency customers).

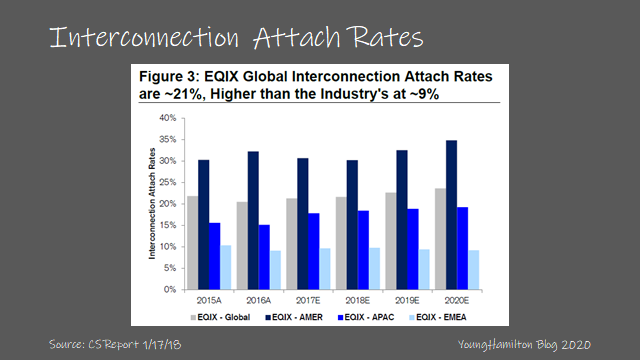

Over the near-term, the company expects to grow 8%-10% annually, outpacing the overall markets growth due to the higher attach rates for interconnection at its data centers. Equinix has also been offering software enabled services as well, something that may prove to be incremental at high margins. While Equinix hasn’t held its 2020 Analyst day due to Covid, the company gave out a target of >$7B revenues by 2022 at its 2018 Analyst day.

Why is it a good business?

For most REITs, the (small) advantage usually is with scale because the company can achieve better debt financing terms for its properties and/or can spread its fixed costs across many more units. However, Equinix benefits most from its network effects and its switching costs. This real estate company almost exhibits characteristics of a marketplace + subscription software company in one, which may be a bit of a stretch but indulge us.

It’s uncertain if the impact from interconnection was planned by the company or if it’s a nice byproduct of colocation, but it does provide network effects for the company. Customers want to be in Equinix data centers because they want the highest number of interconnection opportunities. Furthermore, they know that most of the largest service provider networks and cloud providers will want to be in Equinix data centers as well, so having a presence at an Equinix data center is almost necessary to future proof their networks. Interconnection revenues have high margins (90+% gross margin according to Credit Suisse) with lots of leverage, because the incremental cost of cabling is very low.

Equinix’s network effect also got a bit stronger recently with the introduction of its Cloud Exchange Fabric offering. This allows customers to access interconnections across multiple data centers through a virtual connection (through software), meaning customers aren’t limited by geography (as much). It’s uncertain how the performance of this virtual connection is relative to the physical connection, but the company has commented that the pricing makes sense to go physical once the bandwidth increases over a certain amount. Virtual net additions have been accelerating over the past few quarters (up to 26k connections vs. 386k total connections).

Equinix’s revenues are highly recurring (94% of total revs in FY19). Because a customer typically spends money on installation of the servers within a data center location and the monthly rental costs are not egregious, Equinix benefits from its customer’s switching costs. According to an InfoTech Research Group report, the cost to move a cabinet costs $10k, whereas the monthly colocation + interconnection charge ranges between $1,500-$2,500 per month. Even if a customer were to get a decent discount to Equinix’s monthly fees (10%-20%) the implied payback period would be multiple years. With Equinix’s increasing scale relative to its competition, switching becomes even more difficult in case a need for a specific interconnection manifests at an Equinix data center in the future.

However, the flipside to this argument is that monthly recurring revenues (MRR) has been flat from FY14 to FY19 (the earliest the company started reporting the number). Why is that the case when interconnection (1) is growing faster than colocation and (2) network effects should result in some level of pricing power? Well, there are two reasons that could explain the lack of MRR increase. First, the company is growing at an above average rate and new customers tend to have fewer interconnections per cabinet than older customers. If we could see cohort level MRR data, then we would be able to validate this theory. The second reason could be that Equinix has made a series of large acquisitions that either (1) had more wholesale than retail data center properties, or (2) had new customers to Equinix that have lower interconnection attach rates. Credit Suisse estimates that Equinix has interconnection attach rates close to 21%, while the industry average is near 9%.

These powers have allowed Equinix to sustain industry low churn rates, between 2.1%-2.6% over the past 10 quarters. This is an MRR based churn rate, which does include increases in MRR from existing customers that stay on as customers. As we know from studying some of the largest enterprise SaaS companies (Workday, Salesforce.com and Service Now), low churn can do wonders for your LTV/CAC ratio.

Returns on capital?

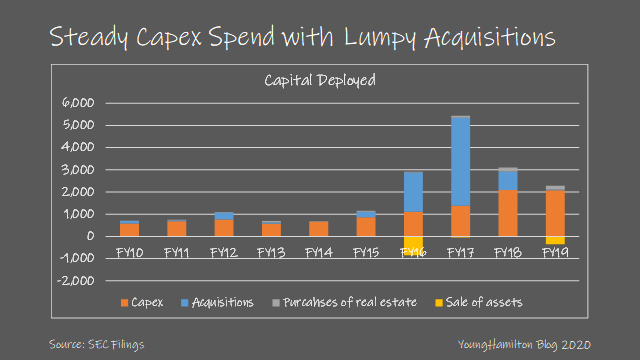

Over the past 10 years, Equinix has spent 62% of its capital on capex, 42% on acquisitions and 4% on real estate purchases, which was offset by -7% on sale of assets. Most of Equinix’s large acquisitions have come in the past 4 years, with the largest being Verizon ($3.6B) and Telecity ($2.9B). Both of these deals were expensive from a return on capital perspective at 15x EBITDA for Telecity and 11x EBITDA for Verizon. These two deals were the main reasons for the lower returns on capital for Equinix for FY18 and FY19.

As we mentioned previously, these deals were more important strategically than financially. Verizon gave Equinix a hub to expand in certain key geographies like Latin America and establish entry way within the energy vertical in Texas and the government vertical in Virginia/Washington D.C. Telecity allowed Equinix to shore up its market dominance in Europe (while keeping Interxion down) and was critical in establishing a stronger network within certain countries in the continent. Equinix maintains that its Telecity acquisition helped the company strengthen its interconnection business within Europe, but the company has yet to see improvement in its MRR figures.

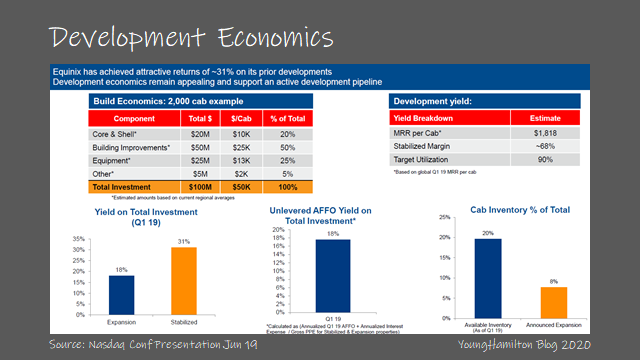

Aside from these large acquisitions, Equinix spends most of its capital on purchasing (or leasing) real estate and building out new data center facilities. The development economics for Equinix are quite compelling, leading to high average returns on capital for the company. For a 2,000 cabinet data center, the total cost is roughly $100M or $50k per cabinet. Here is the typical breakdown:

The shell or the building - $20M

Building improvements - $50M

Equipment - $25M

Other - $5M

In terms of timing, the buildout of a data center is usually done in multiple phases. This is because capacity isn’t filled on day one but planning needs to be done in advance so that future capacity can be expanded when the demand is reached. In the first phase of the buildout most of the heavy lifting is done, which includes the shell and core, power generation, back-up battery power, centralized cooling, front facing lobby and security. In the next phases, more cooling, interconnection equipment and cabinet space are built out, along with any Equinix specific hardware.

Assuming that the new data center reaches stabilization at 68% margins and 90% utilization, and using the average MRR per cabinet in FY19, which was $1,867, we can arrive at the gross margins of a data center to be $30.5M per year ($1867 x 12 x 68% x 2000), which implies an unlevered return of 30.5% on an a data center buildout. We have to keep in mind that this is before corporate expenses, taxes and interest. Of course this assumes the utilization rate reaches 90% so that gross margins can reach 68%. And it also assumes that there were successful phase 2 and phase 3 expansions of capacity at these data centers.

The company does breakout maintenance capex vs. build capex, but knowing that most of the company’s capex is actually for new data center builds (almost 97%-98%), it goes to show that a stabilized data center is a very high returning asset with attractive incremental margins. That is why the assumption of 90% gross margins on interconnections is a reasonable assumption to make.

We estimate that the company has returned an average of 13% on all of its capital invested over the past 4 years. Analyzing the incremental returns over a longer period would show that the returns got much better in FY15 and FY16 when interconnection became more meaningful and when the company transitioned over to a REIT structure. But looking at the last two years, we recognize that the large acquisitions of Verizon and Telecity have hurt total returns given the high multiples paid.

Reinvestment potential?

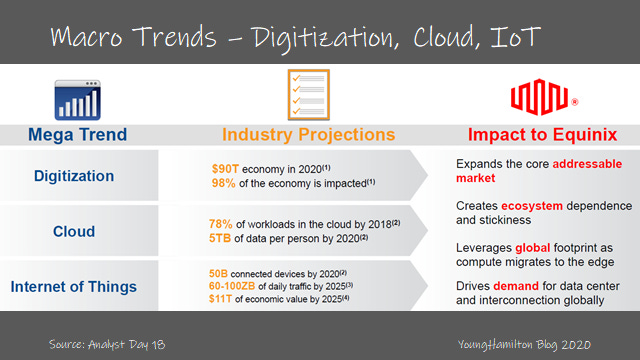

There are many tailwinds for the third party datacenter industry including Equinix. First, the growth in cloud workloads mean the data center becomes that much more important as enterprises and network service providers want a low latency on ramp to these cloud providers. The growth in digitization and the Internet of Things means that more data is created and shared across the world, and the third party data centers become these crucial network hubs.

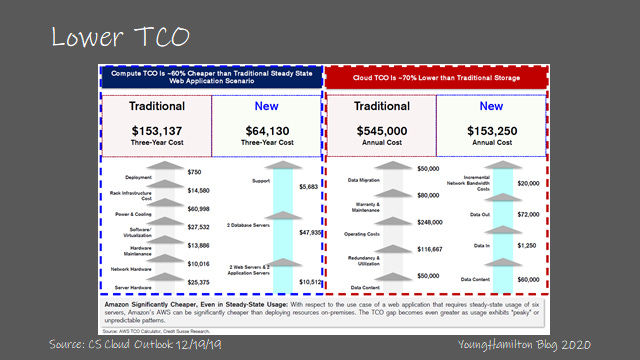

Furthermore, from an enterprise standpoint, using third party data centers has become much more compelling on costs. It’s estimated that total cost of ownership for compute is 60% lower and for storage is 70% lower in the cloud vs. in the traditional enterprise data center model. This is especially true if the usage needs are peaky such as for online retail during the holiday season.

The enterprise is shifting to the hybrid cloud model, which means utilizing public clouds and hosting their own private clouds. And it makes sense that having a point of presence in the data centers with the largest number of potential interconnections is very important. Furthermore, a hybrid cloud structure means better delivery of data and content for the end user. According to Credit Suisse, there is a 42% benefit to latency using a multi-colocation architecture vs. using the traditional hub and spoke data center model.

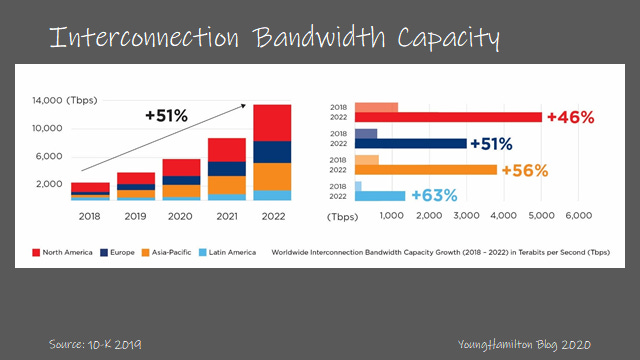

Equinix anticipates that the amount of Interconnection bandwidth capacity will grow between 46%-63% annually on a global basis from 2018 to 2022, reaching 14,000 terabits per second of bandwidth capacity. Equinix will have to continue to build out more data centers in key geographic locations to maintain its interconnection lead during this time.

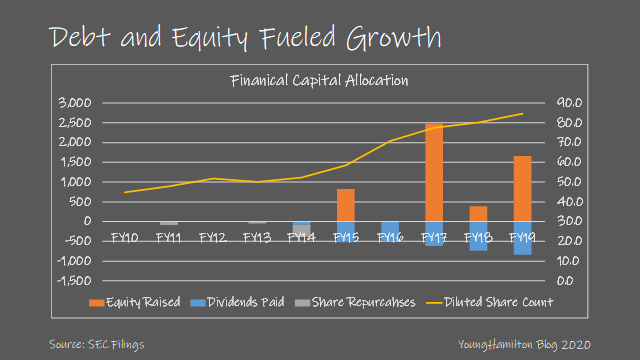

We estimate that the reinvestment rate for the company has averaged between 110%-150% over the past 4 years, with peak reinvestment coming in FY16 and FY17 with the acquisitions of Verizon and Telecity. With that type of reinvestment (the highest that we’ve analyzed so far in AGB), we estimate that the company has increased intrinsic value by 15%-20% annually during this time period. As we have done so in a few of these recent issues, we do note that this is at the company level. At the per share level it’s much different, given that the company has raised $5.4B in equity in the past 5 years while also increasing its net debt level by $6.4 during the same time period.

What else is important?

Share offerings and capital allocation

Equinix changed into a REIT structure in 2015, which has changed the capital allocation framework of the company. Prior to the conversion, the company made a few share repurchases and didn’t payout a dividend, but rather reinvested most of the capital back into the business in the form of capex. Growth was slower, but Equinix’s relative size vs. its competition wasn’t as wide as it is now.

Subsequent to the REIT conversion, Equinix initiated a dividend. This makes sense considering that Equinix gets preferential tax treatment for being a REIT for many of its data center structures. However, the company has always had a lower dividend yield vs. many other REITs and perhaps that was mainly to do with the outperformance in the share price performance. Equinix also made a few large acquisitions (Verizon and Telecity) subsequent to the REIT conversion that required capital.

It’s interesting to note that Equinix’s philosophy of share issuances has changed. The company has issued $5.4B in equity and shares outstanding have increased from 58.5M in FY15 to 84.7M in FY19 or an increase of 9.7% per year. That’s more than some SaaS companies! It’s something to consider when looking at the equity.

Interest rates

REITs (like Utilities and other long duration/yield based equities) are very sensitive to interest rates. These sectors have benefited this decade from declining interest rates. So while growth rates may still be impressive at Equinix and a few other REITs, it’s something to consider when analyzing the stock. It goes without saying that it’s important to remember that owning an asset like this is at least a partial bet on the movement of interest rates, more so than other equities.

Optionality

Network Edge is a service that has been recently introduced by Equinix to service a wider set of customers whose servers are not collocated at an Equinix data center. This would be a virtual connection to create a presence within an Equinix data center and so the customer would be able to benefit from interconnection capabilities this way. It’s yet to be seen if performance of this connection is good enough for these customers and at the very least it’s interesting to see that Equinix is trying to monetize customers outside of their core colocation customer base.

Also, potentially acquiring tower real estate assets is something that could be interesting. Equinix has mentioned that towers could be a complementary asset worth owning at some point in the future. There could be synergies with data center assets as 5G wireless densification occurs over the next decade. The retail data center opportunity remains large enough for Equinix to continue to stay in its lane, but it’s interesting to think about wireless as an extension of the growth strategy at some point.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!