The Update to this initial write-up was posted in April 2025. The financial model can be found near the end of the update post.

Domino’s Pizza

Domino’s has been one of the most impressive success stories since the great recession of ‘08/’09. The company increased its market share in the U.S. by 500+bps in the U.S. and outgrew the competition internationally by a wide margin. The company achieved this by transforming its pizza (particularly the dough), expanding its digital strategy, revamping its stores and improving its brand by focusing on quality execution, low everyday prices and empowering their franchisees.

There are three business models for QSR pizza: dine in, delivery and carryout. The first is in secular decline. Domino’s focuses on the last two with their small store formats, which have broad views of the kitchen and minimal seating space. The delivery model is the larger segment representing 65% of sales but delivery has lower margins due to its higher cost structure. Driver efficiency is key to profitability in this model, which largely depends on the geographical coverage of a restaurant and the pay/hour for the delivery driver. The increasing minimum wages across different states has a direct impact on the profitability of this segment.

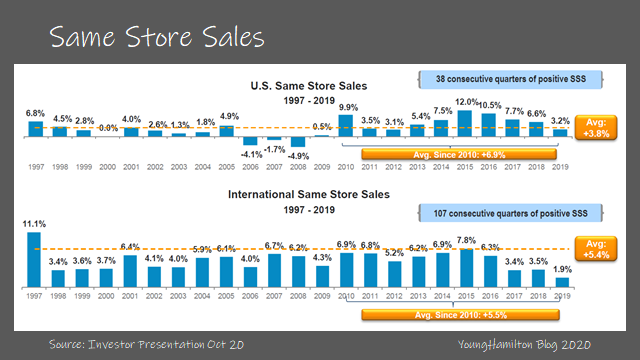

The smaller but faster growing segment (35% of revenues) is carryout, which has higher margins due to the customer’s handling of their own delivery. What’s interesting about the delivery vs. carryout model is that there is only a 15% overlap (per Domino’s research). Across all of QSR pizza, there are more than 2.5x the number of transactions in carryout vs. delivery in the U.S. Domino’s recognizes that carryout is the main growth opportunity and has been targeting this market over the past few years. (We’ll go over this more later). The result has been some pressure on same store sales growth since FY15/FY16 but as we can see from the graphic below, there’s been some room to spare.

The franchise model is key to Domino’s growth and has allowed the company to achieve significant returns on capital. Franchisees bear all of the startup costs to open new stores and pay a 5.5% royalty on sales in the U.S. and 3% Internationally in exchange for use of the Domino’s brand, food recipes and access to the company’s supply chain. Within the U.S., prospective franchisees are required to manage an existing Domino’s store before attending Domino’s Franchise Management School. A statistic that the company likes to give out on almost every earnings call is that 90% of franchise owners started out as delivery drivers. The average franchisee owns 7 stores and has operated Domino’s stores for over 18 years.

Domino’s owns and operates a small number of stores within the U.S., mainly as a means to testing technological innovation and operational improvements that can be applied to its franchisees as best practices. Training of new store managers and prospective franchisees also are often done at company owned stores. Domino’s has been selling off some of its stores every year to existing franchisees that have committed to growing within a region.

Internationally, Domino’s operates under a master franchisee model, where the mater franchisees are then tasked with either opening their own stores or recruiting sub-franchisees. That is why the royalty rates for the International stores are less than the U.S. stores. There are a few major publicly traded franchisees such as DMP:ASX and DOM:L that own many of the territories and respective stores internationally.

Domino’s largest competitors are Pizza Hut (owned by YUM), Papa Johns and Little Caesars. Pizza Hut is going through its own issues as dine in for QSR pizza is in secular decline. Low same store sales growth and profitability for its franchisees has resulted in stagnant store growth and high levels of closures. Papa Johns is undergoing a revamping of its brand since its CEO left the company (activists got involved and Shaquille O’Neil is a brand ambassador) and is seeing early signs of a turn around. But Papa John’s focus on “higher quality” QSR pizza has put their franchisees in a tough spot in terms of profitability. Little Caesar still leads the carryout category, but is experiencing share loss. Domino’s is now the largest pizza player within delivery with 3x the market share of the next largest player and the #2 player in carryout. Within the U.S., Domino’s has roughly 36% delivery market share and 16% carryout market share.

Domino’s success since the recession can also be attributed to its early rollout of its digital strategy. Domino’s was one of the first to adopt digital ordering and management within QSR. The company then developed a mobile app, introduced voice ordering, and allowed ordering on smartTV platforms and via text message. The company is actively investing and testing autonomous pizza delivery with Nuro in select cities and has recently introduced GPS delivery tracking in 2019.

Why is it a good business?

For a business that is heavily skewed towards the franchise model (98% of stores are owned and operated by franchisees), the financial health of these franchisees is the biggest driver to future growth and returns. Domino’s has done many things right since the great recession of ’08/’09 and it’s evidenced by the increasing profitability at its franchisees.

Store level EBITDA has increased from $49k in 2008 to $143k in 2019. With more money in the franchisees pockets, the company has been able to grow store count much faster than its competitors, taking over 560bps of market share from over the past decade, according to Credit Suisse. Its two largest competitors (Pizza Hut and Papa Johns) have seen stagnant growth as their franchisees are not in a similar cash flowing position. The closure rates for Domino’s have been very low at below 1%, while its competitors have ranged in the 2%-4% range.

With increasing scale, the company is able to offer the lowest prices in the industry. The company’s $5.99 delivery and $7.99 carryout offers are lower than its other large QSR competitors, sometimes by a wide margin when factoring delivery fees. While the company doesn’t have pricing power with its customers (quite the opposite – Domino’s has been offering the $5.99 two medium, two toppings pizza delivery option since 2009), it does make up for it with scale and volume.

The increase in store profitability was helped by the macro environment (recovery of wages, lower unemployment, etc.) but most of the recent increase has to do with an uptick in order volume at the higher margin carryout segment. Domino’s recognized early on that building out a denser network of stores would result in growth of the carryout business and improve the efficiency of the delivery business.

Domino’s calls this growth effort Fortressing. By splitting existing geographic coverage areas between more stores (increasing density), the franchisees as a whole are able grow their carryout business because proximity to the home is the most important factor for a carryout order. The company estimates that 90% of carryout orders from fortressing are incremental. Then on the delivery side, drivers are able to reach their destinations in much shorter times, thereby improving the profitability of each delivery order since franchisees foot the bill for driver labor costs. This effort does have a dampening effect on same store sales growth by 1%-1.5% annually due to some loss in the carryout business. However, the tradeoff is minor compared to the increase in profit dollars for the franchisees.

Fortressing can only be accomplished if its franchisees are in a healthy enough position to want to build out new stores. Given the increase in store level EBITDA, many of Domino’s franchisees have been able to grow their footprint. Another important factor is geographical zoning of territories. Franchisees only want to fortress within their own territories because it reduces the risk of losing that business to another franchisee. Domino’s has rightsized its franchisee base over the past 10 years, with the smaller franchisees selling or consolidating with larger franchisees.

Domino’s other competitive advantage is the brand. The company has revamped its image to close the gap on the quality perception with the other QSR players like Pizza Hut and Papa Johns while maintaining lower prices. A lot of that has to do with its new pizza formula and dough making at the supply chain centers (quality) and the company’s focus on the digital strategy (innovation). With the high brand association, Domino’s is able to leverage this to its International business, where unit growth has outpaced its domestic operation by over 700bps in the past 7 years.

Returns on capital?

Domino’s has spent all of its capital over the past 10 years on capex. Investments include building out distribution/supply chain centers, expanding its technology offerings (recent innovations include GPS tracking for its delivery drivers and its new POS system Pulse) and building out and upgrading company owned stores. Domino’s has systematically sold off some of its company owned stores to franchisees over the past 10 years at an average rate of 18 stores per year.

To understand the high returns on capital for the overall business, we must first try to unpack returns at the store level. An average store costs $350k to build and the average annual revenue per store is between $1.2M-$1.3M. It’s difficult to estimate what the average EBITDA or after-tax earnings are per store given that the high-margin franchise royalty segment skews the company margins higher. But, Domino’s does give out its estimate of average store level EBITDA in the U.S., which was $143k in FY19. This reconciles with the company’s statements about payback period if you define it as start up costs/EBITDA at being close to 2.5x in the U.S. and 3x Internationally.

At a payback period of 2.5x, the implied returns are close to 40% in terms of EBITDA, but of course that’s before taxes. At 2.5x it’s one of the best returns found across franchise concepts, according to Goldman Sachs. The average payback period for many franchise concepts is closer to 6-7 years, which would imply much lower returns at 15%. If we compare this return to Starbucks (AGB Issue #1), which has a payback period is 1.5 years, it is still one of the best in the industry.

Another significant advantage for a Domino’s franchisee is the low cost to open new locations vs. other franchise concepts. At $350k, it’s much lower than what it costs to open a Starbucks ($680k) and significantly less that what it costs to open a Taco Bell ($1.3M). Furthermore, with the low start-up costs, existing franchisees are more easily able to expand their 2nd and 3rd locations with the cash flows generated from their first store.

We estimate that the company has generated between 60%-80% returns on capital over the past 5 years. This number is very high for two reasons. First, the capex spent on company owned stores has very high returns, even better than that of its franchisees. Even after tax, we estimate that company owned stores return above 50%, given there is no franchise fee. However, this is before taking into consideration the supply chain costs and returns, which would bring this number down.

Let’s take FY19 as an example. The average company owned store generated $1.24M and had operating income of $293k. Apply a tax rate of 35% and you still arrive at an after tax income of $190k. On a $350k investment, the returns are very high at 54%. Even attributing the average G&A expenses per store, which would mean $22.5k in extra attributed costs, the after tax returns would be close to 50%.

The second reason the returns look very high is that franchise fees are 100% margin and there is no capital investment associated with that other than the investments into its digital platform and supply chain centers. While the company doesn’t break these out by category, the total capex investment is relatively small (2%-3% of revenues) because most of the capital investments are done by the franchisees at the store level. As we’ve mentioned before, the health of the franchisees is what drives the model.

Reinvestment potential?

In 2019, the global pizza industry was a $141B market and is expected to grow at low single digits in the U.S. and 3%-6% Internationally. Of the total market, the QSR pizza market is $88B or 62%. Domino’s has been a share gainer over the recent years, mostly from Pizza Hut and Papa Johns.

Domino’s estimates that there is potential for the company to reach 8,000 stores in the U.S. and 25,000 stores globally. At the end of FY19, the company had over 6,100 stores in the U.S. and almost 10,900 Internationally. At similar growth rates going forward to that of the past 4 years, the company could reach its store count target by FY25.

In the company’s recent investor presentation, Domino’s estimated that there is a potential for 5,200+ shares in the top 15 international markets. As we mentioned before, International market growth is dependent on the financial health of the master franchisees, some of which are public. Due to the success of fortressing effort internationally, there are markets were competition has gotten easier for Domino’s like in India. Domino’s believes that the growth opportunity in China has attractive economics. The company has invested in Dash Brands (master franchisee in China, Hong Kong and Macau).

We estimate that the company has reinvested between 15%-20% of its capital back into the business over the past 4 years. With returns between 60%-80%, we estimate that intrinsic value of the company grows between 11%-13%. We must keep in mind that this calculation is at the company level and it’s much different at the stock level. Due to the low capital requirements of the franchise model, there is excess capital that the management team can effectively allocate to improve shareholder returns.

The company has recognized this and has historically kept its cash balance low. Over the past 10 years, Domino’s has generated $2.7B in operating cash flow. During this time period, the company has paid $700M in dividends and $3.8B in buybacks mainly funded from a series of recapitalization transactions. The company has increased its debt balance by $2.7B (from $1.45 to $4.1B) to fund its share repurchases, the majority of which have been completed after FY14.

Up until the company’s Analyst Day in FY19, the Long-term growth targets were 6%-8% global units and 3%-6% same store sales growth. Starting in F19Q3, the company revised its target to a 2-3 year target of 2%-5% US SSS, 1%-4% international SSS, and 6%-8% unit growth.

What else is important?

Third party delivery apps

As many investors that have looked at Domino’s over the past two years know, the rise of third party delivery apps like Uber Eats, DoorDash, Grubhub and Postmates has had a negative impact on the company’s same store sales growth (and that of the other QSR Pizza companies). This is because Pizza has always been available via delivery. The third party apps leveled the playing field somewhat, though there are extra costs and quality issues.

The third party apps have been giving out aggressive subsidies to consumers because these companies are in land grab mode. The influx of VC funding has allowed these companies to operate at losses for longer, though some companies like DoorDash have decent unit economics.

Due to these subsidies, consumers don’t see all the extra costs to having restaurant food delivered to their homes. And while quality of the food and short delivery times matter, consumers are willing to be lenient due to the convenience and low cost (for now). Credit Suisse estimates that the third delivery party apps were a 5% headwind to SSS for FY19.

Domino’s started seeing the impact in the middle of FY19 and it hurt the stock. However, starting in FY19Q4, the company started to see an easing of the heavy promotional activity that they saw earlier in the year. Covid may have had something to do with this since consumer demand for delivery was high, even without the promotional advertising. It’s worth noting that as DoorDash goes public and Uber Eats continues to be an are of focus, the pressure from the third party delivery apps may continue.

Covid trends

Since the beginning of F20Q2, Domino’s stores in the U.S. saw a big pick up in same store sales. Comps increased to 15%-20% from mid March to June and remained high in 3Q at 17.5%. Demand for delivery orders was higher than carryout due to health implications. The company adapted to the distancing rules, including curbside delivery.

Optionality

The Domino’s story is pretty straight forward. Management executes at a high level and has set reasonable growth targets, given the financial strength of its franchisees. The international franchisees are only getting larger and the brand continues to grow across the globe.

After the store growth targets are met by FY25, there may be limited ways for the company to grow. One reasonable way for the company to continue to grow would be a new franchise concept either acquired or grown in house. Domino’s has a best in class operating model and could leverage that expertise to grow new concepts, similar to Yum Brands.

If you made it this far, I hope you received some value from reading our analysis. Please subscribe to the free newsletter and share with anyone that would find it valuable. Thank you for your support!