Subscribe to AGB - One analysis of a good business every two weeks.

American Tower

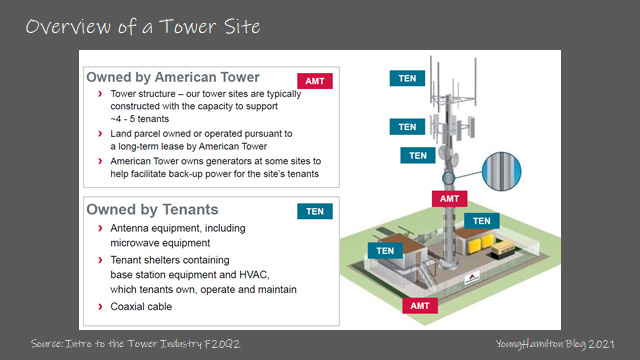

American Tower is the largest owner and operator of wireless towers and other communications real estate globally. The company mainly earns monthly recurring revenues by leasing space on its tower sites to wireless carriers (e.g. AT&T and Verizon in the U.S.). The carriers install and maintain their own radio equipment in leased vertical space on the towers and enter long-term agreements with American Tower with annual price escalators (3% in the U.S. and inflation protected in international markets). These contracts are typically 5-10 years in length with multiple renewals set in place and importantly, are non-cancellable. The company experiences low average net churn in the range of 1%-2% annually (though it’s been higher in recent years due to India carrier consolidation), which makes the business very predictable.

Tenancy is an important metric for tower operators because the business is a high fixed c…